If you’re looking to break into homeownership in Cincinnati or Northern Kentucky but the cost of single-family homes has you second-guessing, consider exploring the option of a condominium (condo) or townhome. These types of properties often offer a lower barrier to entry, making it easier to start building equity and enjoy the benefits of owning real estate sooner.

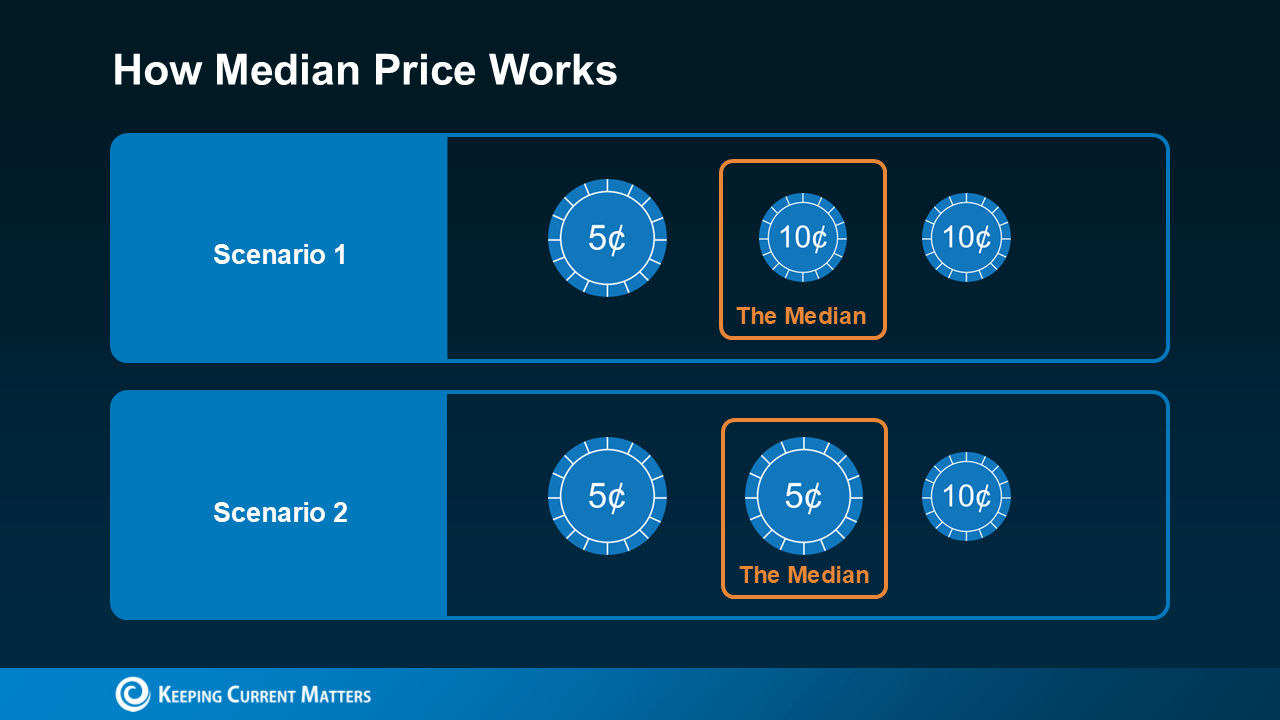

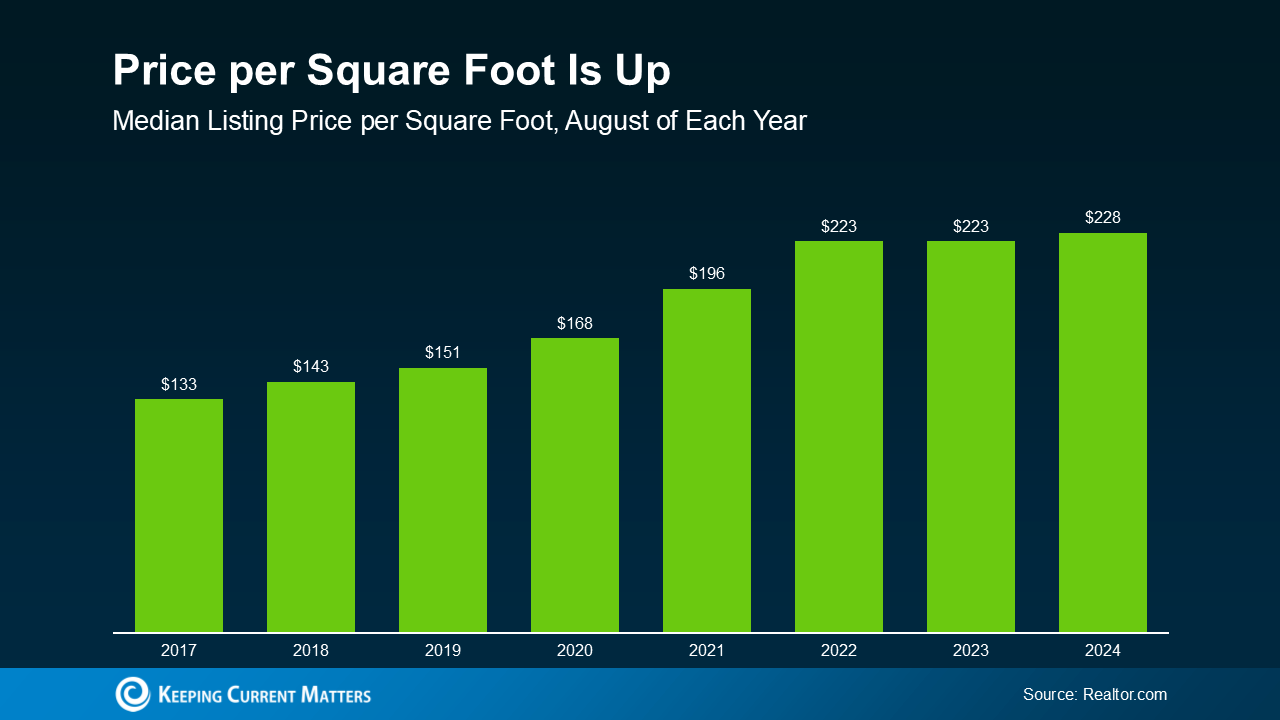

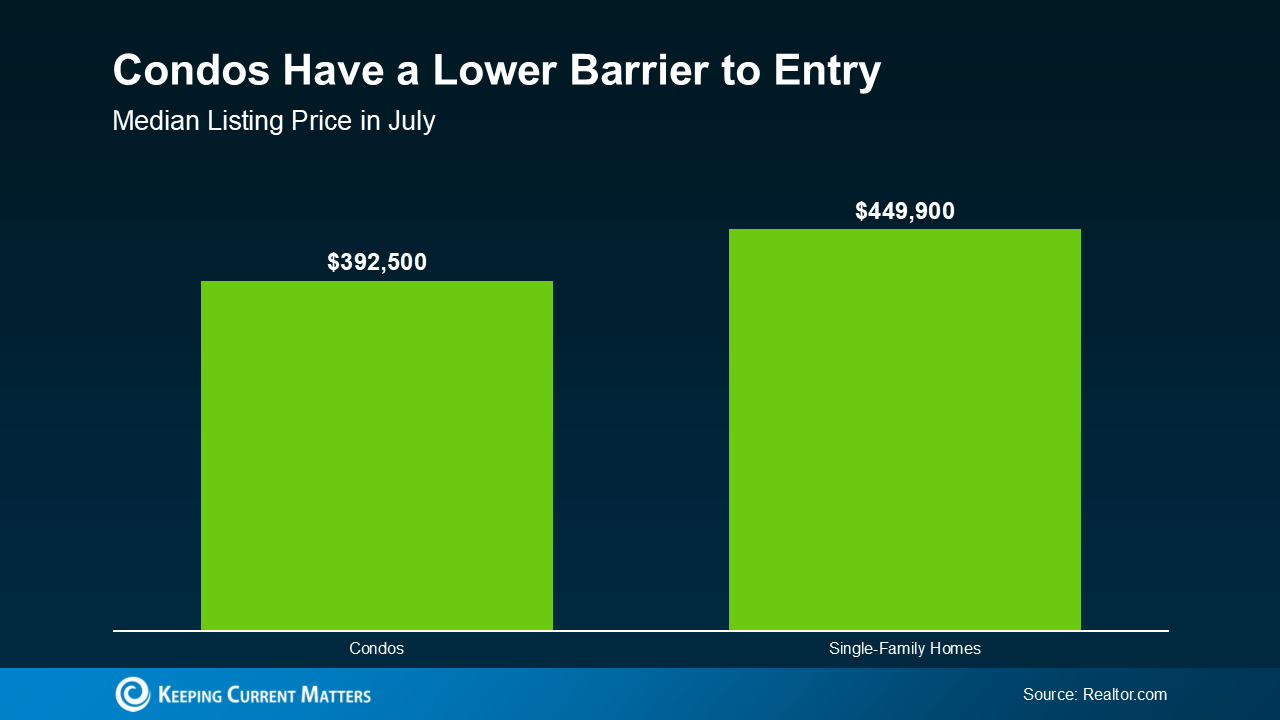

Since condos and townhomes are typically smaller than single-family homes, they can be more affordable, which is great for first-time buyers in Cincinnati and Northern Kentucky. Smaller square footage usually means a lower price tag, and according to recent data from Realtor.com, condos often have a more competitive asking price than single-family homes (see graph below):

Good news: builders are placing more emphasis on constructing townhomes. According to the National Association of Home Builders (NAHB), townhomes are experiencing a construction boom:

“The share of townhomes being built is at an all-time high.”

This means a greater selection of condos and townhomes may be available in your search. Expanding your home search to include these options could present opportunities that better fit your budget and lifestyle in the Cincinnati and Northern Kentucky real estate markets.

### The Perks of Condo Living

Condos offer several benefits, especially for first-time homebuyers in areas like Cincinnati and Northern Kentucky. Here are some reasons why condo living is appealing:

1. **Build Equity**: Owning a condo or townhome allows you to start building home equity and growing your net worth as you pay down your mortgage and your property value appreciates.

2. **Low Maintenance**: If you want to own property but prefer not to handle tasks like lawn care, snow removal, or roof repairs, a condo could be ideal. A real estate agent can explain any homeowner association (HOA) fees or maintenance details.

3. **Access to Amenities**: Many condo communities offer amenities like pools, dog parks, and parking spaces, without the responsibility of maintaining them. This adds to the convenience and appeal of condo living.

4. **Community Feel**: Condos often foster a sense of community, with shared spaces and opportunities to connect with neighbors. Many condo complexes host social events, helping create a close-knit environment.

### A Smart First Step in Cincinnati and Northern Kentucky Real Estate

Remember, your first home in Cincinnati or Northern Kentucky doesn’t have to be your forever home. The key is to get your foot in the door, start building equity, and take that important first step into homeownership. As your needs and preferences change, the equity you build can help you move up to a different type of property in the future.

Ultimately, choosing to live in a condo or townhome is a lifestyle decision. To explore whether it’s the right fit for your goals, speak with a local real estate agent familiar with the Cincinnati and Northern Kentucky markets. They can guide you through the options available in these regions.

### Bottom Line

Looking to find a home that meets your needs and budget? A condo or townhome might be the perfect fit for your first real estate purchase in Cincinnati or Northern Kentucky. Reach out to a local real estate agent today to begin your home search.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link