The Big Difference Between Renter and Homeowner Net Worth

Some Highlights

- If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership.

- Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s.

- Connect with an agent if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

What’s Motivating Homeowners To Move Right Now

### Ready to Move? Here’s Why Many Homeowners Are Deciding to Sell

Over the past few years, many homeowners in Greater Cincinnati, Northern Kentucky, and Southeast Indiana have hesitated to sell their homes. Why? They’re reluctant to take on a higher mortgage rate when purchasing their next home. If you’re in this situation, you’re not alone—this challenge has contributed to the low inventory of **homes for sale** across the real estate market.

However, a growing number of homeowners are realizing they can’t wait any longer. Personal or lifestyle changes often make it necessary to move, despite market conditions. As Redfin explains:

*”Some homeowners are opting to bite the bullet and give up their low rate in order to move. Many are selling because of a major life event like a job change, or divorce . . .”*

If you’re considering selling your house, here are some common reasons why others are making the move. These might resonate with you, too.

—

### Top Reasons Homeowners Are Choosing to Sell

#### 1. **It’s Time for a Change**

Life changes—such as a new job in a different city, a desire to be closer to family, or simply seeking a fresh start—often prompt homeowners to list their homes.

If you’ve landed a great job offer in another area, selling your home and relocating may be the next logical step.

#### 2. **Your Current Home No Longer Fits**

When your lifestyle changes, your home might not meet your needs anymore. Whether it’s a growing family, the need for a home office, or more space for entertaining, upgrading to a larger home might be the best move.

For instance, if you’re living in a condo and expecting a baby, it could be time to find a home with more space.

#### 3. **Retirement or Downsizing**

Some homeowners in Greater Cincinnati, Northern Kentucky, and Southeast Indiana are ready to downsize. Whether it’s due to retirement, empty-nest living, or the desire for less maintenance, selling your current home can free up time and resources for this exciting new chapter.

#### 4. **Changes in Relationship Status**

Life events like marriage, divorce, or separation often necessitate a move. Selling your home can help both parties start fresh with new living arrangements that better fit their needs.

#### 5. **Health and Mobility Concerns**

As health or mobility needs change, some homes may no longer be practical. Selling and moving to a more accessible home—or using proceeds to transition to assisted living—can significantly enhance your quality of life.

—

### What’s Your Next Step?

Selling a home isn’t just about **real estate market conditions** or mortgage rates. It’s about making a decision that aligns with your personal goals and lifestyle needs. As Bankrate puts it:

*”Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based . . . Your future plans and goals should be a significant part of the equation.”*

—

If a major life change is prompting you to consider selling, now may be the right time to act. Whether you’re in **Greater Cincinnati**, **Northern Kentucky**, or **Southeast Indiana**, work with a trusted real estate professional who can guide you through the process and help you achieve your goals.

Let’s discuss how we can navigate your next steps—whether you’re looking to **sell your house** or find the perfect **home for sale** for your next chapter.

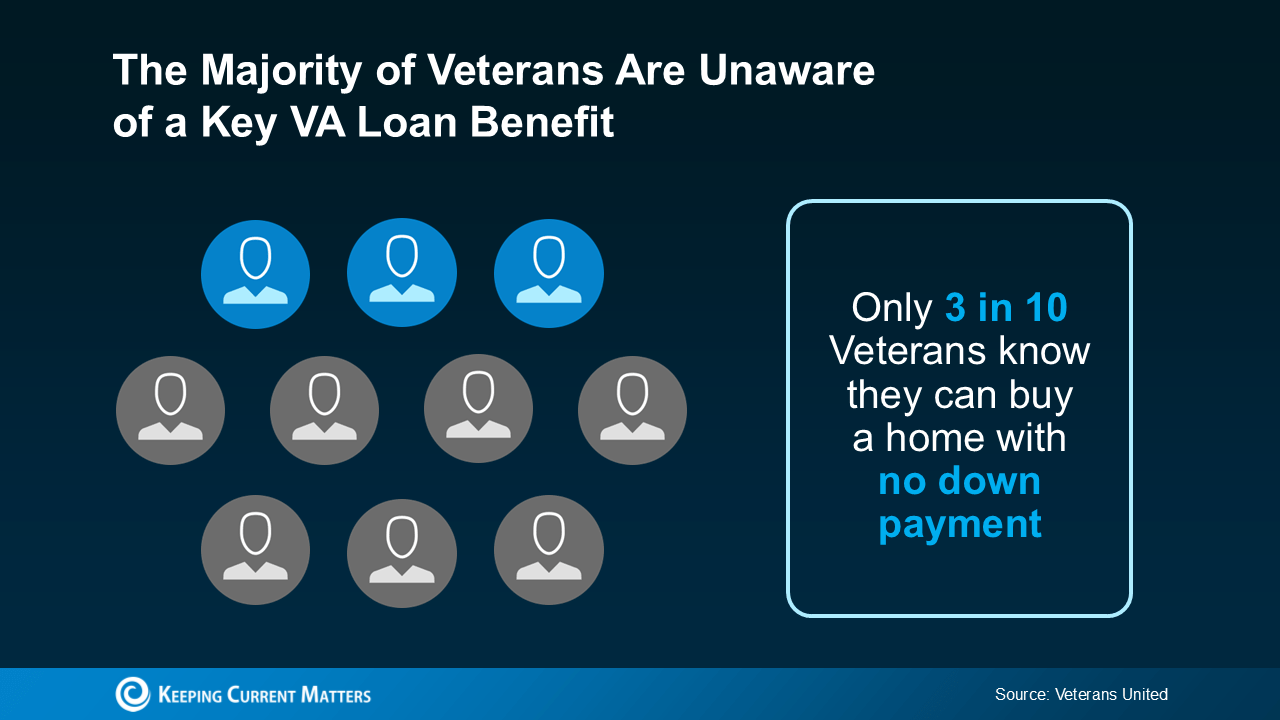

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

### VA Home Loans: Helping Veterans Achieve the Dream of Homeownership

For over 79 years, **Veterans Affairs (VA) home loans** have empowered countless Veterans to own homes across **Greater Cincinnati, Northern Kentucky, and Southeast Indiana**. However, according to Veterans United, only 3 in 10 Veterans realize they may be eligible to purchase a home with no down payment (see visual below):

This highlights the importance of spreading awareness about this valuable program. Whether you’re a Veteran or someone who knows and supports one, understanding the resources available can make buying a home easier and prevent life-changing plans from being delayed. Veterans United explains:

> “The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

### Why VA Home Loans Stand Out

VA home loans are designed to make the dream of homeownership a reality for those who have served our country. These loans offer significant benefits for **buying homes for sale in Greater Cincinnati, Northern Kentucky, and Southeast Indiana**, including:

– **Options for No Down Payment**

Many Veterans can purchase a home without a down payment, streamlining the homebuying process.

– **Limited Closing Costs**

VA loans limit the types of closing costs Veterans must cover, keeping more money in your pocket when you close the deal.

– **No Private Mortgage Insurance (PMI)**

Unlike other loan types, VA loans don’t require PMI—even with lower down payments. This means reduced monthly payments and significant long-term savings.

### Partnering with Real Estate Experts

When buying or selling homes in **Greater Cincinnati**, **Northern Kentucky**, or **Southeast Indiana**, your local team of expert real estate professionals, including a trusted lender, can help you navigate the process. They’ll ensure you understand all the benefits and options available to make confident, informed decisions.

### Bottom Line

Owning a home is a vital part of the American Dream. For Veterans, VA home loans are a game-changing benefit, helping make that dream a reality. Whether you’re looking to explore **homes for sale** or need guidance on how to **sell your house**, connect with a real estate professional today to ensure a smooth and successful journey in the housing market.

Why You Need an Agent To Set the Right Asking Price

Some Highlights

- The #1 task sellers struggle with is setting the right asking price for their house.

- Without an agent’s help, you may set a price that turns away buyers and takes a long time to sell.

- To make sure your house is priced right, connect with a local agent. Because if the price isn’t compelling, it’s not selling.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

**Navigating the Current Real Estate Market in Greater Cincinnati, Northern Kentucky, and Southeast Indiana**

If you’re thinking about buying or selling a home, you’ve probably noticed that the housing market feels a bit unpredictable. From home prices to mortgage rates, the market is experiencing some volatility, and it’s crucial to understand the driving forces behind these shifts.

Let’s break down what’s happening and how you can successfully navigate today’s market—whether you’re searching for *homes for sale* or looking to *sell your house*.

—

### **What’s Causing Market Volatility?**

Several key factors are contributing to the uncertainty in the real estate market:

– **Economic data**

– **Unemployment rates**

– **Federal Reserve decisions**

– **Geopolitical events**

– **The upcoming presidential election**

These elements create uncertainty, which directly impacts market conditions, especially mortgage rates. Each new economic report, employment update, or inflation release can lead to sudden shifts in interest rates.

Mortgage rates, while projected to trend downward over the long term, have been anything but steady. As **Greg McBride, CFA**, Chief Financial Analyst at Bankrate, explains:

> “After steadily declining throughout the summer months, I expect more ups and downs to mortgage rates. Job market data will be closely watched, as well as any clues from the Fed about the extent of upcoming interest rate cuts.”

**Hannah Jones, Senior Economic Research Analyst at Realtor.com,** agrees:

> “Rates have shown considerable volatility lately and may continue to do so . . . Overall, we still expect a downward long-term mortgage rate trend.”

This fluctuating landscape also affects *home prices* and *inventory*. Whether you’re buying or selling in Greater Cincinnati, Northern Kentucky, or Southeast Indiana, conditions can vary dramatically between neighborhoods. Some areas have rising prices and limited inventory, while others offer more homes for sale with moderate pricing trends.

—

### **The Key to Success: Partnering with a Real Estate Professional**

When navigating these unpredictable shifts, having the guidance of an experienced *real estate agent* is invaluable. A professional can:

– Keep you informed about market updates in Greater Cincinnati, Northern Kentucky, and Southeast Indiana.

– Explain how mortgage rate changes impact your purchasing power or selling strategy.

– Provide hyper-local insights, such as neighborhood-specific pricing trends and inventory levels.

For example, even small changes in mortgage rates can significantly affect monthly payments. Your agent and a trusted lender will ensure you understand these nuances and help you make smart financial decisions.

Whether you’re buying a home or listing your property, an agent’s expertise will help you adapt to changes in competition, pricing, and inventory.

—

### **Bottom Line**

The housing market may be unpredictable, but that doesn’t mean you need to pause your plans. With an experienced *real estate agent* by your side, you’ll have the tools to navigate market shifts and take advantage of opportunities in *Greater Cincinnati, Northern Kentucky, and Southeast Indiana*.

Whether you’re looking for *homes for sale* or need help to *sell your house*, reach out today to discuss your real estate goals!

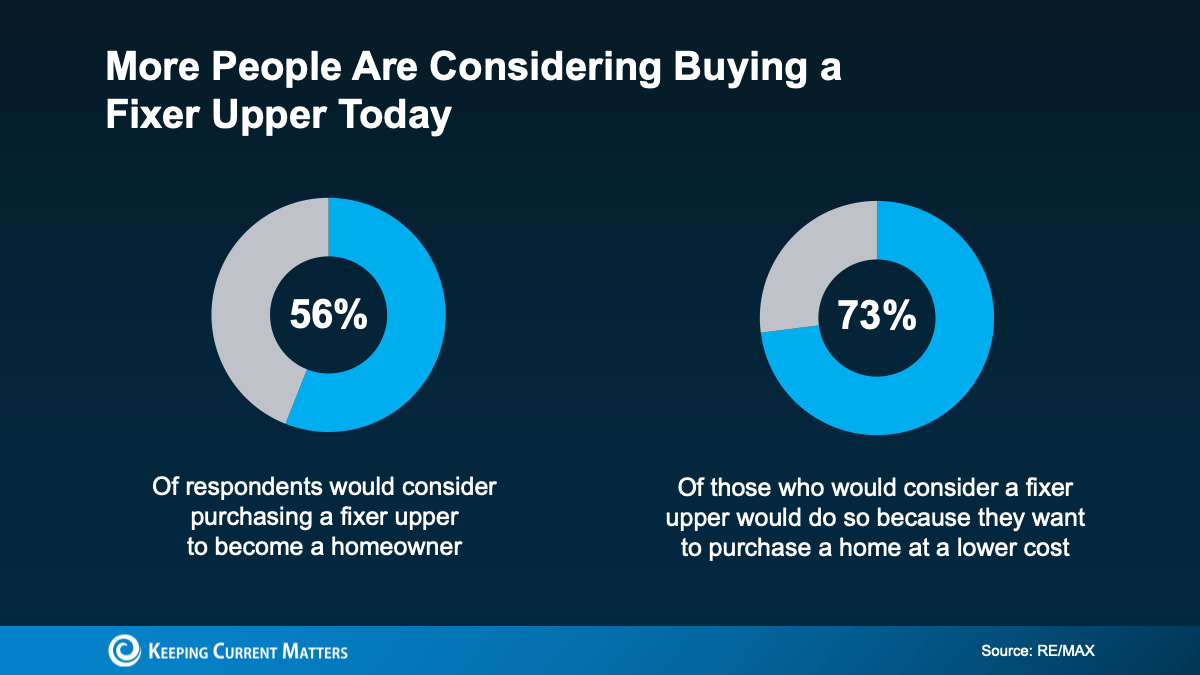

Is a Fixer Upper Right for You?

**Homes for Sale: Why a Fixer Upper Might Be Your Best Bet**

Looking to buy a home in **Greater Cincinnati, Northern Kentucky, or Southeast Indiana**, but feeling like most options are out of reach? The good news is, there’s still a way to become a homeowner—even when affordability feels like a major challenge. The solution might be a fixer-upper! Let’s explore how buying a fixer-upper could be the key to achieving homeownership and how to make it work for you.

—

### **What Is a Fixer Upper?**

A fixer-upper is a home that’s livable but needs some work. The extent of repairs varies—some homes may only need cosmetic updates, like fresh paint and new flooring, while others might require more significant improvements, such as roof replacement or plumbing upgrades.

Because these homes require some effort, they’re often priced lower than move-in-ready properties. According to a **StorageCafe** survey, fixer-uppers typically cost about **29% less** than comparable homes that are ready to move into. That’s why more buyers are considering homes that need a little extra attention right now.

If you’re willing to roll up your sleeves and invest some time, a house with untapped potential might be your best option to break into the market.

—

### **Tips for Buying a Fixer Upper in Greater Cincinnati, Northern Kentucky, and Southeast Indiana**

#### 1. **Location is Key**

You can change almost anything about a house—except where it’s located. Look for homes in neighborhoods with rising property values and convenient amenities. Whether you’re buying in **Northern Kentucky**, **Southeast Indiana**, or **Greater Cincinnati**, a good location ensures that your investment pays off over time.

#### 2. **Budget for the Unexpected**

Renovations often take longer and cost more than anticipated. Be sure to set aside extra funds for unforeseen repairs or delays during the process.

#### 3. **Get a Professional Inspection**

Before making an offer, hire a home inspector. They’ll identify critical repairs and help you avoid surprises that could strain your budget.

#### 4. **Set Priorities for Renovations**

Think of your renovation plan in three stages:

– **Must-Haves:** Address essential repairs (e.g., structural issues or outdated wiring).

– **Nice-to-Haves:** Add features that improve convenience (e.g., new appliances or upgraded bathrooms).

– **Dream Features:** Save luxuries like outdoor kitchens or spa-like bathrooms for later.

—

### **Why Fixer-Uppers Are a Smart Choice**

Buying a fixer-upper allows you to customize your home while saving money on the purchase price. With careful planning and strategic renovations, you can transform a house into your dream home over time.

Plus, partnering with a knowledgeable **real estate agent** is key. An agent who understands the **Greater Cincinnati, Northern Kentucky, and Southeast Indiana real estate markets** can help you find homes for sale that offer maximum potential. They’ll guide you toward properties where your upgrades will add real value, ensuring your investment is worthwhile.

—

### **Bottom Line**

In today’s competitive housing market, finding a move-in-ready home that fits your budget can feel daunting. But if you’re open to putting in a little work, a fixer-upper might be the perfect solution. With the right guidance and a vision for what’s possible, you can turn a house that needs some love into the home of your dreams.

Whether you’re looking to **buy a home** or want to **sell your house**, a trusted local **real estate agent** can help you navigate the market in **Greater Cincinnati, Northern Kentucky, and Southeast Indiana**. Don’t hesitate to reach out to start your journey today!

Q&A: How Do Presidential Elections Impact the Housing Market?

Some Highlights

- Even if you’re not looking to move right away, you may have questions about how the election will impact the housing market.

- When we look at historical trends, combined with what’s happening right now, we can find your answers. Based on historical data, mortgage rates decrease in the months before and home prices and sales increase the year after the election.

- The facts show Presidential elections only have a small and temporary impact on the housing market.

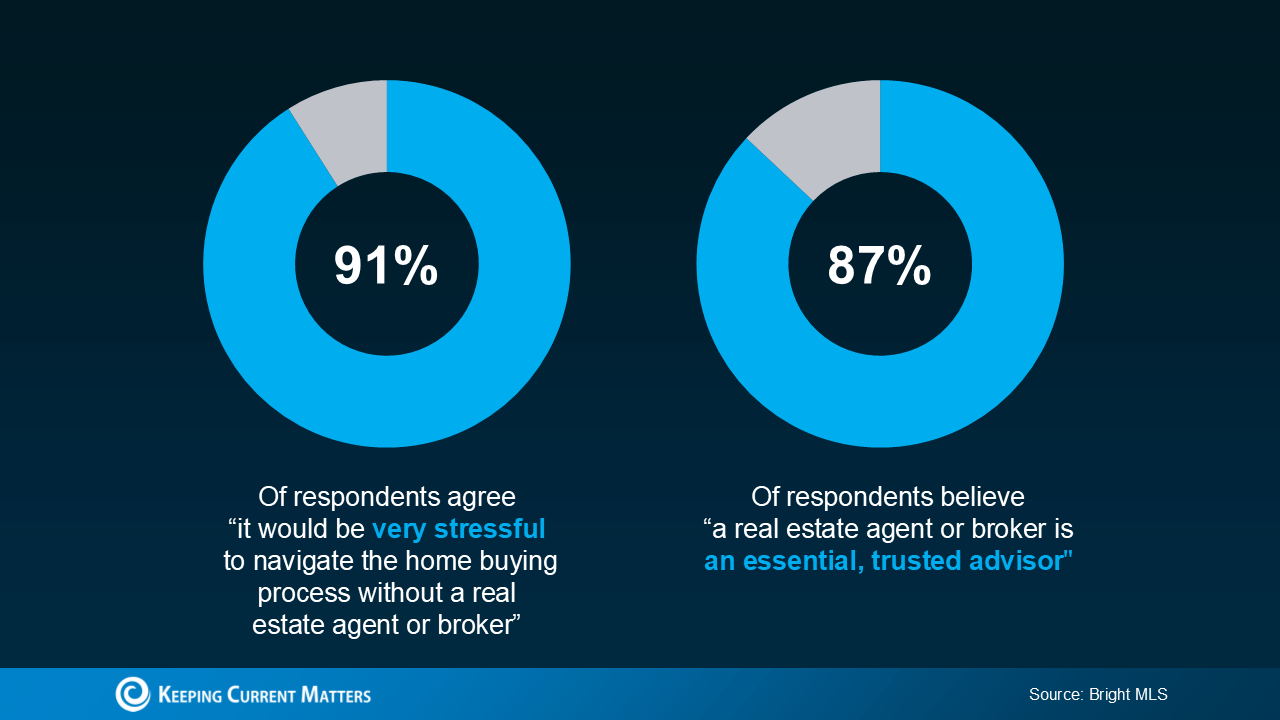

How Real Estate Agents Take the Fear Out of Moving

Feeling uncertain or even fearful about moving right now with so much happening in the world? Moving shouldn’t be scary; it should be an exciting new chapter! To turn that fear into confidence, work with a seasoned real estate professional.

Real estate agents are more than transaction facilitators—they’re trusted guides who help you navigate the housing market’s complexities with ease and assurance. A great agent transforms what can feel overwhelming into a smooth, enjoyable experience.

In fact, a recent Bright MLS survey revealed that people who work with agents report less stress and more peace of mind. Here are a few reasons why partnering with a pro can make all the difference, whether you’re looking at homes for sale in Greater Cincinnati, Northern Kentucky, Southeast Indiana, or are preparing to sell your own home.

**1. Explaining the Current Market**

You may see alarming headlines about a potential market crash or falling prices, and it’s easy to get caught up in the noise. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, explains, “In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

An agent offers clarity, debunking the fear-driven headlines with a grounded understanding of local trends, home values, and inventory levels. This expertise helps buyers and sellers in Greater Cincinnati, Northern Kentucky, and Southeast Indiana make confident decisions.

**2. Walking You Through the Process Step-by-Step**

Is this your first experience buying or selling a home? Or has it been a while? Either way, your agent will guide you through each step, from the initial conversation to closing day. As NerdWallet states, “If it’s your first time buying—or selling—you’re likely to come across terms you don’t recognize.” Your agent will explain every term and process in a way that makes sense, giving you a seamless experience as you look at homes for sale or plan to sell your house.

**3. Advocating for Your Best Interests**

Negotiations can be intimidating, especially if you’re not familiar with the process. Thankfully, your agent is a trained negotiator dedicated to achieving your goals. They’ll secure the best terms for you, whether it’s finding a great deal as a buyer or negotiating a higher price as a seller in the competitive Greater Cincinnati, Northern Kentucky, or Southeast Indiana markets.

**4. Solving Unexpected Problems Quickly**

If the unexpected arises, know that your agent has it covered. Real estate agents are skilled problem-solvers, anticipating potential issues and proactively addressing them to keep the transaction on track. They’re equipped with the experience and resources to resolve any hurdles, so you don’t have to worry about disruptions.

**Bottom Line**

Don’t let fear or uncertainty keep you from reaching your goals in real estate. With an expert agent by your side, you can confidently explore homes for sale or prepare to sell your house, knowing your best interests are always protected.

Avoid These Top Homebuyer Mistakes in Today’s Market

Avoiding costly mistakes in your home-buying journey is essential, especially with so much at stake. Here’s a quick look at the most common mistakes buyers are making in today’s Greater Cincinnati, Northern Kentucky, and Southeast Indiana markets—and how an experienced agent can help you sidestep each one.

**Trying to Time the Market**

In hopes of getting the best deal, some buyers wait for home prices or mortgage rates to drop, aiming to time the market. This strategy can be risky due to unpredictable factors influencing the housing market. Elijah de la Campa, Senior Economist at Redfin, advises:

> “My advice for buyers is don’t try to time the market. There are a lot of swing factors, like the upcoming jobs report and the presidential election, that could cause the housing market to take unexpected twists and turns. If you find a house you love and can afford to buy it, now’s not a bad time.”

A knowledgeable real estate agent can guide you through this uncertainty, helping you focus on what matters most for your home-buying goals.

**Buying More House Than You Can Afford**

It’s easy to feel tempted to stretch your budget, but buying a home should align with your financial comfort. Rising costs like property taxes and insurance mean it’s important not to overextend. Bankrate offers wise advice:

> “Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations.”

**Missing Out on Assistance Programs**

Saving for closing costs, down payments, and other upfront expenses takes planning. Many buyers overlook assistance programs that could help ease these costs, especially first-time buyers. Realtor.com highlights that nearly 80% of first-time buyers qualify for down payment assistance, but only 13% take advantage of these opportunities. Consult a lender and your agent to explore available programs.

**Not Leaning on Expert Guidance**

This may be the most important point of all. Working with a seasoned real estate agent helps you avoid pitfalls and make confident, informed decisions as you explore homes for sale in Greater Cincinnati, Northern Kentucky, or Southeast Indiana.

**Bottom Line**

With the right real estate agent, you’ll have a pro on your side to help you avoid costly mistakes and make your home-buying journey as smooth as possible. Whether you’re looking to buy or sell a house, connecting with a trusted real estate expert in your area will help you navigate each step with confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link