Control the Controllables If You’re Worried About Mortgage Rates

Chances are you’re hearing a lot about mortgage rates right now, and all you really want to hear is that they’re coming back down. And if you’ve seen headlines about the early November Federal Funds Rate cut by the Federal Reserve (The Fed), maybe you got hopeful mortgage rates would start to decline right away. Although some media sources may lead you to believe that the Fed’s actions determine mortgage rates, in reality, they don’t.

The truth is, the Fed, the job market, inflation, geopolitical changes, and a whole list of other economic factors influence mortgage rates, too. So, while recent actions from the Fed set the stage for mortgage rates to come down over time — it’s going to be a gradual and, likely bumpy, process.

Here’s the best advice anyone can give you right now. While you may be tempted to wait for rates to fall, it’s really hard to try and time the market — there’s just too much that can have an impact. Instead, set yourself up for homebuying success by focusing on the factors you can control. Here’s what to prioritize if you’re looking to put your best foot forward.

Your Credit Score

Credit scores can play a big role in your mortgage rate. And the difference of just a few points can make a significant impact on your monthly payment. As an article from Bankrate explains:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

With rates where they are today, maintaining a good credit score is one of the keys to getting the best rate possible. To find out where your credit score stands and what you can do to give it a boost, reach out to a trusted loan officer.

Your Loan Type

There are many types of loans, and each one offers different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Work with your team of real estate professionals to see which loan types you may qualify for and figure out what will work best for you financially.

Your Loan Term

Just like with loan types, you have options when it comes to terms, or the length of your loan. As Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Lenders typically offer mortgages in 15, 20, and 30-year terms. And which term you go with has a direct impact on your rate. Talk to your lender about which one is right for your situation.

Bottom Line

Remember, you can’t control what happens in the broader economy or when mortgage rates will come down. But there are actions you can take that could help you set yourself up for success.

Connect with a local real estate agent and lender to go over what you can do now that’ll make a difference when you’re ready to move.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

Why We’re Not Heading Toward a Foreclosure Crisis

The real estate market in Greater Cincinnati, Northern Kentucky, and Southeast Indiana is thriving, with strong fundamentals that set it apart from the 2008 housing crisis. One major factor is the unprecedented level of equity homeowners have today. Unlike the last housing bubble, when many owed more on their homes than they were worth, today’s homeowners enjoy significantly more equity than debt.

Equity Levels Are a Game-Changer

Even though mortgage debt is at an all-time high, it’s not a concern. As housing analyst Bill McBride of Calculated Risk explains:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Let’s dive deeper to see why today’s market is different and how this affects homes for sale and homeowners looking to sell their house.

More Equity, Less Foreclosure Risk

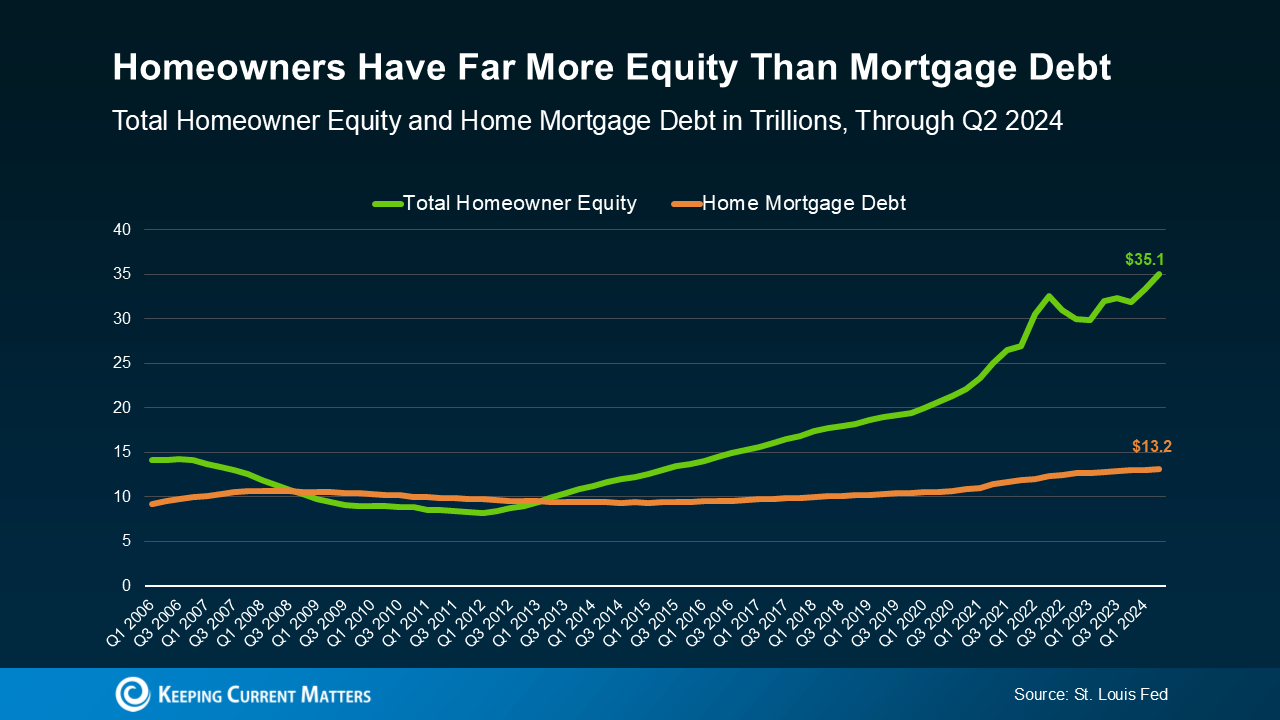

Data from the St. Louis Fed shows that homeowner equity today is nearly triple the total mortgage debt. (See graph below.)

This high equity reduces foreclosure risks. If a homeowner struggles to make payments, they often have the option to sell their house and still come out ahead, thanks to their accumulated equity. This is a stark contrast to 2008, when many homeowners were underwater with no options.

Even if home values were to dip, most homeowners would remain in a strong position due to their equity cushion.

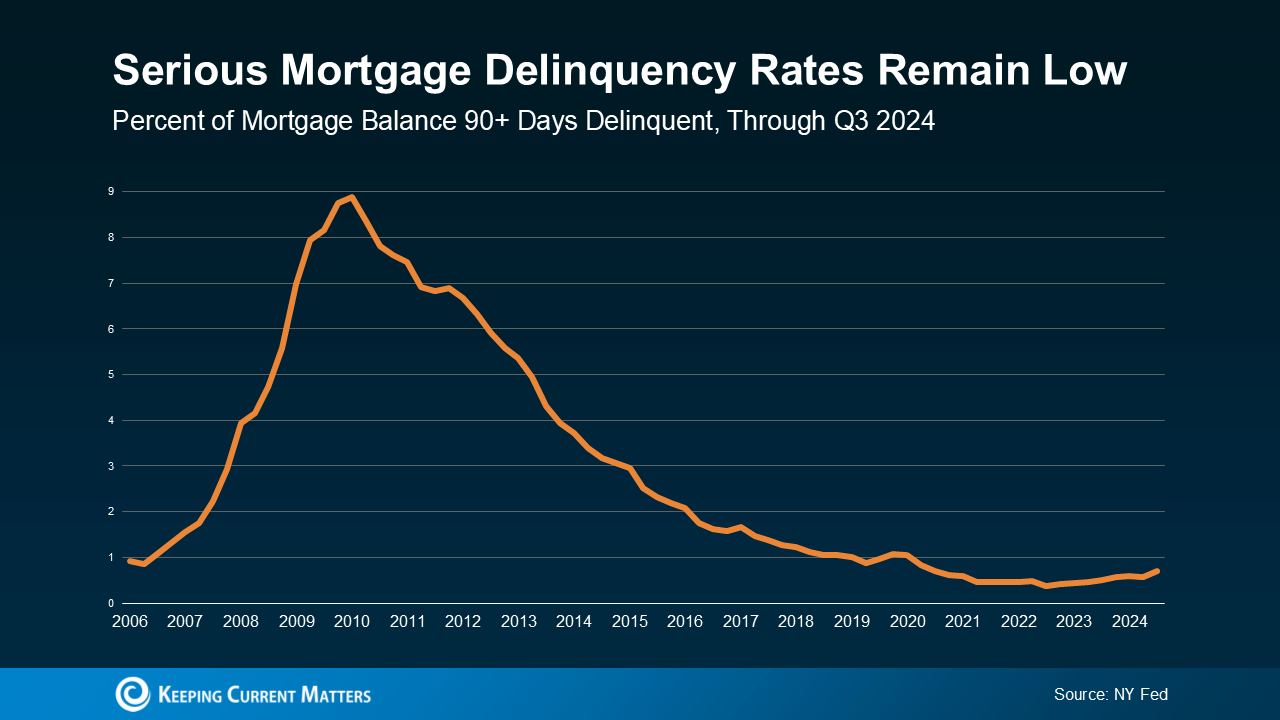

Delinquency Rates Are Historically Low

Mortgage delinquency rates are another sign of market health. According to the NY Fed, mortgage payments that are over 90 days late remain near historic lows.

This trend is supported by programs that assist homeowners during financial hardships. Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association, emphasizes:

“. . . servicers are helping at-risk homeowners avoid foreclosures through loan workout options that can mitigate temporary distress.”

Stable Employment Supports Housing Market

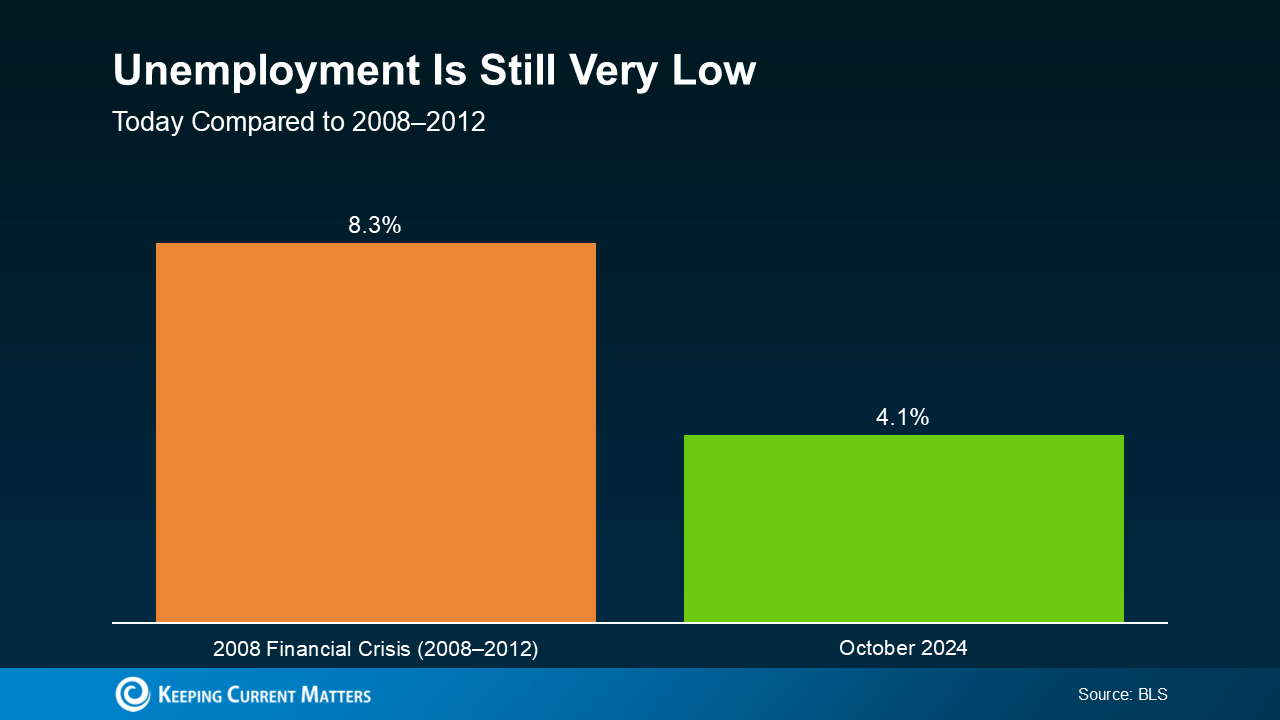

Low unemployment is another critical factor keeping the real estate market in Greater Cincinnati, Northern Kentucky, and Southeast Indiana stable. More people with steady jobs mean fewer missed mortgage payments. Archana Pradhan, Principal Economist at CoreLogic, explains:

“Low unemployment numbers have helped reduce the overall delinquency rate . . .”

During the last housing crisis, high unemployment drove a wave of foreclosures. Today, low unemployment and affordable, low-interest mortgages are helping homeowners stay current on payments.

Bottom Line

The housing market isn’t heading toward a foreclosure crisis. With strong equity, historically low delinquency rates, and a stable employment environment, today’s market is fundamentally different from 2008.

If you’re thinking of selling your house or exploring homes for sale in Greater Cincinnati, Northern Kentucky, or Southeast Indiana, now is the time. Connect with a local real estate expert to discuss your options and stay ahead of the market.

How To Get Your House Ready To Sell in 2025

Some Highlights

- If you’re planning to list your house in 2025, it’s already time to start working on any repairs. But where do you start?

- Your local agent will be able to help you prioritize projects that will help you get the best return on your investment and appeal to what today’s buyers really want.

- If your goal is to sell your house next year, connect with an agent so you know what to start working on now.

Don’t Miss Out on the Growing Number of Down Payment Assistance Programs

Discover Your Path to Homeownership in Greater Cincinnati, Northern Kentucky, and Southeast Indiana

With rising home prices and fluctuating mortgage rates, it’s crucial to explore every resource available to make buying a home possible. One valuable resource to consider is the growing number of down payment assistance (DPA) programs designed to help buyers like you.

Take a look at the graph below, highlighting the surge in new programs added in the past year, based on data from Down Payment Resource:

More Programs, More Opportunities for You

This growth in DPA programs means more opportunities for homebuyers in Greater Cincinnati, Northern Kentucky, and Southeast Indiana. With more options available, there’s a higher chance you’ll find a program that aligns with your homeownership goals.

These programs can offer significant financial support. As Rob Chrane, Founder and CEO of Down Payment Resource, explains:

“We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford. Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine qualifying for $17,000 toward your down payment. That level of assistance could make a huge difference, especially if you’re buying your first home in this competitive real estate market.

Opportunities Beyond First-Time Buyers

The expanded DPA options don’t just benefit first-time and first-generation buyers. Many of the new programs are designed to support affordable housing initiatives, including manufactured and multi-family homes. This widens the pool of eligible homebuyers and home types, offering even more pathways to success.

Find the Right Program with Expert Guidance

Navigating these opportunities can feel overwhelming, but you don’t have to do it alone. Your real estate agent and loan officer are your best resources for finding the right DPA programs. As noted by The Mortgage Reports:

“The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

When selling or buying a home in Greater Cincinnati, Northern Kentucky, or Southeast Indiana, partnering with an experienced real estate professional ensures you’ll access the resources and guidance you need.

Bottom Line

If you’re looking for homes for sale or thinking, “How can I sell my house?” in Greater Cincinnati, Northern Kentucky, or Southeast Indiana, now is the time to explore the benefits of down payment assistance programs. Connect with a trusted real estate expert to uncover the opportunities available to help you achieve your goals. Whether you’re a first-time buyer or looking to transition, these programs could be the key to unlocking your next chapter.

What’s Behind Today’s Mortgage Rate Volatility?

What’s Behind the Roller Coaster of Mortgage Rates? Insights for Greater Cincinnati, Northern Kentucky, and Southeast Indiana

If you’ve been following mortgage rates recently, it probably feels like a roller coaster ride. One day rates are climbing, and the next they dip slightly. So, what’s causing all this movement? Let’s explore some major factors driving these fluctuations and how they could impact your decisions when buying or selling a home in Greater Cincinnati, Northern Kentucky, or Southeast Indiana.

Election Season and Mortgage Rate Volatility

One major driver of mortgage rate changes is the market’s reaction to political events, particularly elections. Uncertainty surrounding election outcomes and policies often impacts financial markets. The National Association of Home Builders (NAHB) explains:

“. . . the primary reason interest rates have been on the rise pertains to the uncertainty surrounding the presidential election. Although the election is now complete, there continue to be growing concerns over budget deficits.”

This uncertainty has led to fluctuations, with mortgage rates ticking upward as markets adjust. Other influences, such as international tensions, supply chain challenges, and trade policies, also sway investor sentiment. When uncertainty looms, investors often turn to safer assets like bonds, indirectly affecting mortgage rates.

The Federal Reserve and Economic Indicators

Inflation and employment levels are two key economic factors impacting mortgage rates. The Federal Reserve (Fed) has been actively working to control inflation while monitoring employment. When inflation moderates and the job market stabilizes, the Fed may reduce the Federal Funds Rate, which indirectly influences mortgage rates.

For example, during the Fed’s November 6-7 meeting, they implemented another rate cut, leading to a slight dip in mortgage rates. While the Fed doesn’t directly set mortgage rates, their policies heavily influence market trends.

Looking Ahead: What This Means for You

As we move forward, expect mortgage rates to remain responsive to the Fed’s policies and broader economic developments. Political transitions and ongoing economic uncertainty add an unpredictable element to the equation. As The Mortgage Reports notes:

“Today’s economic indicators come with mixed pressures on mortgage rates, and we’re likely to be in for a good amount of volatility as markets adjust and respond to the election . . .”

For homeowners in Greater Cincinnati, Northern Kentucky, and Southeast Indiana, this could mean opportunities to refinance, sell your house, or explore homes for sale in a competitive real estate market.

Why You Need a Trusted Real Estate Professional

Navigating mortgage rate volatility and the housing market can feel overwhelming. That’s where having an experienced team by your side makes all the difference. Whether you’re asking, “How do I sell my house?” or exploring homes for sale in the area, partnering with real estate professionals ensures you make informed decisions.

Bottom Line

Mortgage rate fluctuations will continue to reflect economic shifts and political developments. If you’re buying or selling real estate in Greater Cincinnati, Northern Kentucky, or Southeast Indiana, now is the time to lean on experienced professionals. A trusted real estate agent and mortgage expert can guide you through the complexities, helping you achieve your goals in today’s dynamic market.

Don’t Let These Two Concerns Hold You Back from Selling Your House

### Ready to Sell Your Home? Here’s What You Need to Know

If you’re considering selling your home in **Greater Cincinnati, Northern Kentucky, or Southeast Indiana**, you might feel uncertain about whether now is the right time. Questions like, *”Is moving a good idea in today’s market?”* or *”Will I find a home I love?”* can weigh heavily on your decision-making process. Let’s tackle these concerns head-on and provide clarity.

—

### **Is It a Good Idea to Move Right Now?**

If you already own a home, you might hesitate to sell because of rising mortgage rates. However, your decision to move could be more achievable than you think, thanks to your **home equity**.

Equity is the difference between your home’s current market value and what you owe on your mortgage. Over the past few years, home prices have appreciated significantly, boosting your equity. How much are we talking about? Dr. Selma Hepp, Chief Economist at CoreLogic, shares:

> *“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.”*

Here’s why this matters:

– Your equity can provide a substantial down payment on your next home.

– It may reduce the amount you need to finance, even at today’s rates.

– In some cases, you might even purchase your next home in cash, avoiding mortgage rates altogether.

**Bottom Line:** Your equity could be the key to confidently moving forward.

—

### **Will I Be Able to Find a Home I Love?**

If you’re worried about finding a home you like, it’s likely because you remember the tight inventory of the past few years. But today, the landscape is shifting.

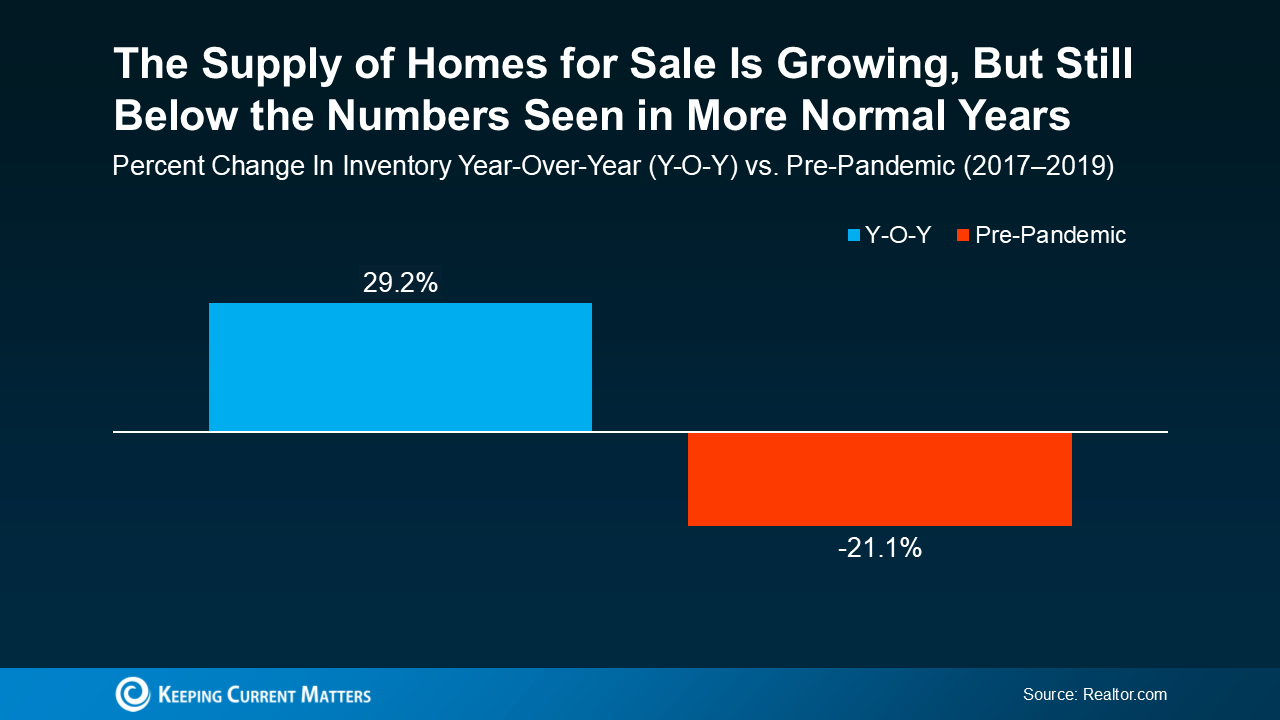

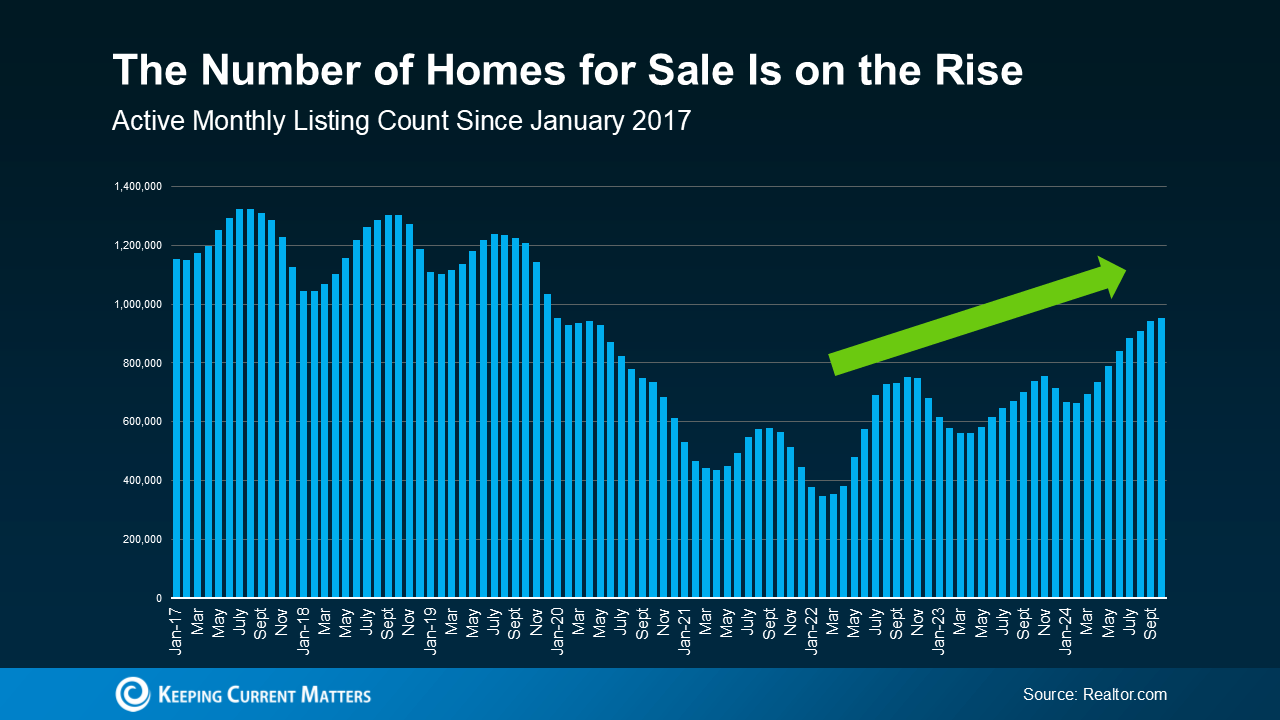

The number of **homes for sale** has grown, giving you more options. According to data from Realtor.com, inventory has increased nearly 30% year-over-year. While inventory is still below pre-pandemic levels, it’s higher than it’s been in recent years, creating a sweet spot for both buyers and sellers.

That said, local market conditions vary. For the best insights, work with a trusted real estate agent who understands trends in **Greater Cincinnati, Northern Kentucky, and Southeast Indiana**.

Don’t Let These Two Concerns Hold You Back from Selling Your House—

### **Why Work With a Local Real Estate Agent?**

Navigating the real estate market—whether you’re buying or selling—requires up-to-date data and personalized insights. A local agent can provide:

– Market trends specific to your area.

– Guidance on pricing your home to stand out.

– Strategies to find the right home for your needs.

—

**Thinking of selling your home or searching for homes for sale?** Don’t let uncertainty hold you back. Contact a local real estate expert today to turn your goals into reality.

Should You Sell Your House or Rent It Out?

**What Should You Do with Your Home? Sell or Rent?**

When you’re ready to move, deciding what to do with your current home is a critical decision. Increasingly, homeowners in **Greater Cincinnati**, **Northern Kentucky**, and **Southeast Indiana** are considering renting out their properties instead of selling.

According to recent data from Zillow, about two-thirds (66%) of sellers thought about renting their homes before listing them, with nearly a third (28%) seriously considering it. This trend has grown significantly since 2021 when less than half (47%) of homeowners considered renting before selling.

So, should you sell your house and use the proceeds toward your next home, or keep it as a rental property to build long-term wealth? Let’s explore some key considerations to help you determine the best path for your financial and lifestyle goals.

### Is Your House a Good Fit for Renting?

Before choosing to rent or sell, evaluate if your property is suitable as a rental. Key considerations include:

– **Location:** Is your neighborhood ideal for rental properties?

– **Condition:** Does the house require significant repairs before it’s tenant-ready?

– **Logistics:** If you’re moving far away, managing maintenance remotely could be challenging.

If your home isn’t ideal for renting, listing it as one of the many **homes for sale** in **Greater Cincinnati**, **Northern Kentucky**, or **Southeast Indiana** may be a more practical option.

### Are You Prepared to Be a Landlord?

Becoming a landlord involves more than collecting monthly rent. It can be time-consuming and demanding.

– **Maintenance:** Landlords must handle repairs like broken pipes, HVAC issues, and structural damage promptly.

– **Tenant Issues:** There’s always the risk of late payments, lease violations, or even property damage.

– **Financial Reserves:** As Redfin notes, unexpected repairs can cost thousands. If you’re not prepared financially, renting might not be the best option.

### Do You Understand the Costs?

If you’re renting out your home primarily for passive income, be sure to account for additional expenses, including:

– **Mortgage and Property Taxes:** These remain your responsibility, even if rent doesn’t cover all costs.

– **Insurance:** Landlord insurance costs about 25% more than standard home insurance.

– **Maintenance and Repairs:** Budget at least 1% of the home’s value annually for upkeep, potentially more for older homes.

– **Tenant Search Costs:** Advertising and background checks require time and money.

– **Vacancies:** Empty periods between tenants can lead to income loss while you still cover the mortgage.

– **Property Management Fees:** A property manager typically charges about 10% of monthly rent.

### Bottom Line

Choosing whether to **sell your house** or rent it out is a deeply personal decision. Weigh the pros and cons carefully, and don’t hesitate to consult with real estate professionals.

A knowledgeable agent specializing in **homes for sale** and the local real estate markets of **Greater Cincinnati**, **Northern Kentucky**, and **Southeast Indiana** can guide you through your options. Whether you’re looking to **sell your house** or explore the rental market, professional advice ensures you make a well-informed decision that aligns with your goals.

More Homes, Slower Price Growth – What It Means for You as a Buyer

**More Homes for Sale: What This Means for You in Greater Cincinnati, Northern Kentucky, and Southeast Indiana**

If you’re considering buying or selling real estate, now might be the perfect time. The number of *homes for sale* has risen significantly, offering unique opportunities for buyers and sellers alike. Let’s explore two key reasons why this is a game changer for the housing market in *Greater Cincinnati, Northern Kentucky, and Southeast Indiana*.

—

### **1. More Options to Choose From**

An article from Realtor.com highlights just how much the inventory of homes has grown:

> “There were 29.2% more homes actively for sale on a typical day in October compared with the same time in 2023, marking the twelfth consecutive month of annual inventory growth and the highest count since December 2019.”

While inventory hasn’t fully returned to pre-pandemic levels, the increase in available homes is significant (see graph below).

As Hannah Jones, Senior Economic Research Analyst at Realtor.com, puts it:

> “Though still lower than pre-pandemic, burgeoning home supply means buyers have more options . . .”

For buyers, this translates to a better chance of finding a house that meets your needs without feeling rushed. With more options and less competition, it’s an excellent time to explore *homes for sale*.

—

### **2. Slowing Home Price Growth**

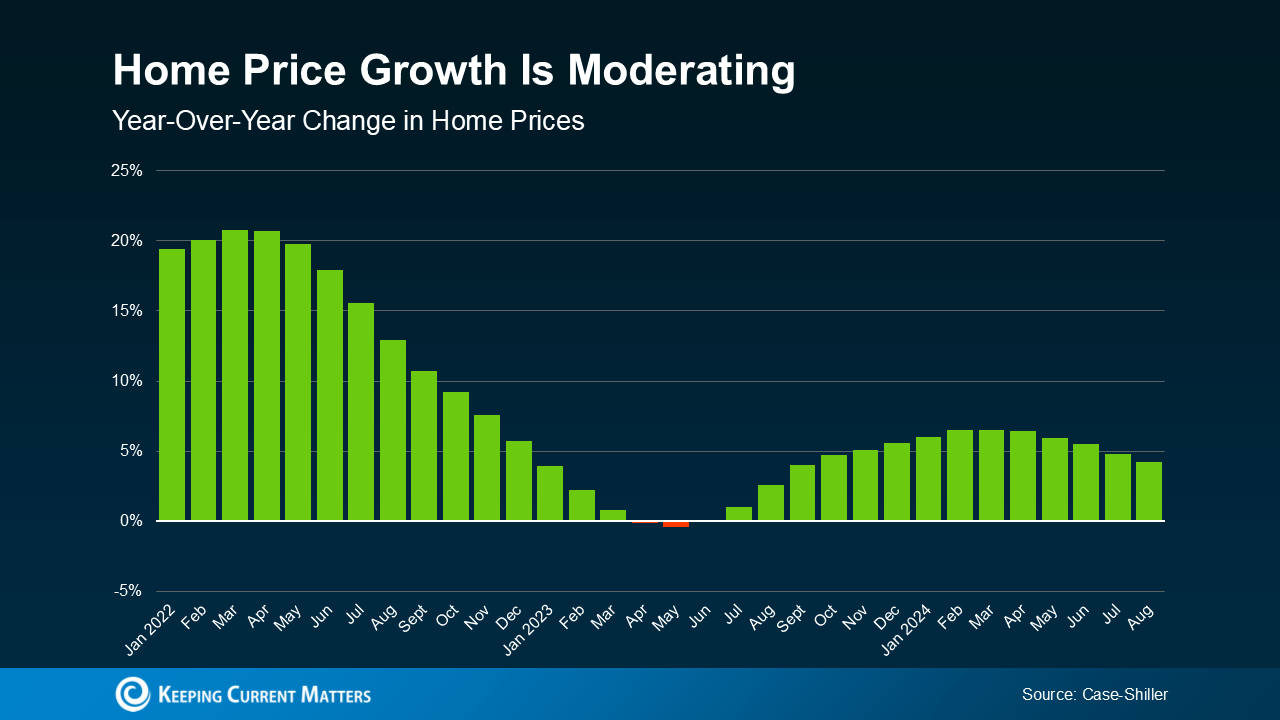

Fewer bidding wars and increasing inventory are helping to slow the rapid rise in home prices. A larger selection of properties means buyers are no longer forced to compete as fiercely, which has a cooling effect on prices (see graph below).

In some areas, inventory levels have not only rebounded to pre-pandemic numbers but have even exceeded them. In these markets, home price growth has softened or, in some cases, stalled altogether. Lance Lambert, Co-Founder of ResiClub, notes:

> “Generally speaking, housing markets where active inventory has returned to pre-pandemic 2019 levels have seen home price growth soften or even decline outright from their 2022 peak.”

This slower growth creates opportunities for buyers to find a home that fits their budget. Dr. Anju Vajja, Deputy Director at the Federal Housing Finance Agency (FHFA), adds:

> “For the third consecutive month, U.S. house prices showed little movement . . . relatively flat house prices may improve housing affordability.”

—

### **Why Work With a Local Real Estate Expert?**

While these trends are promising, inventory levels and prices can vary significantly by market. Having a local real estate agent who understands the nuances of the *Greater Cincinnati, Northern Kentucky, and Southeast Indiana* markets is essential. They can provide personalized guidance to help you navigate this dynamic market, whether you’re looking to buy your dream home or wondering, “How can I *sell my house* quickly and efficiently?”

—

### **Bottom Line**

The growing number of *homes for sale* and slower price growth offer exciting possibilities for both buyers and sellers. If you’re ready to make a move, contact a trusted real estate professional to discuss your options. Whether you’re in *Greater Cincinnati, Northern Kentucky, or Southeast Indiana*, now’s the time to take advantage of this evolving market.

**Let’s make your real estate journey a success!**

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link