If you remember the housing crash back in 2008, you may recall just how popular adjustable-rate mortgages (ARMs) were back then. And after years of being virtually nonexistent, more people are once again using ARMs when buying a home. Let’s break down why that’s happening and why this isn’t cause for concern.

Why ARMs Have Gained Popularity More Recently

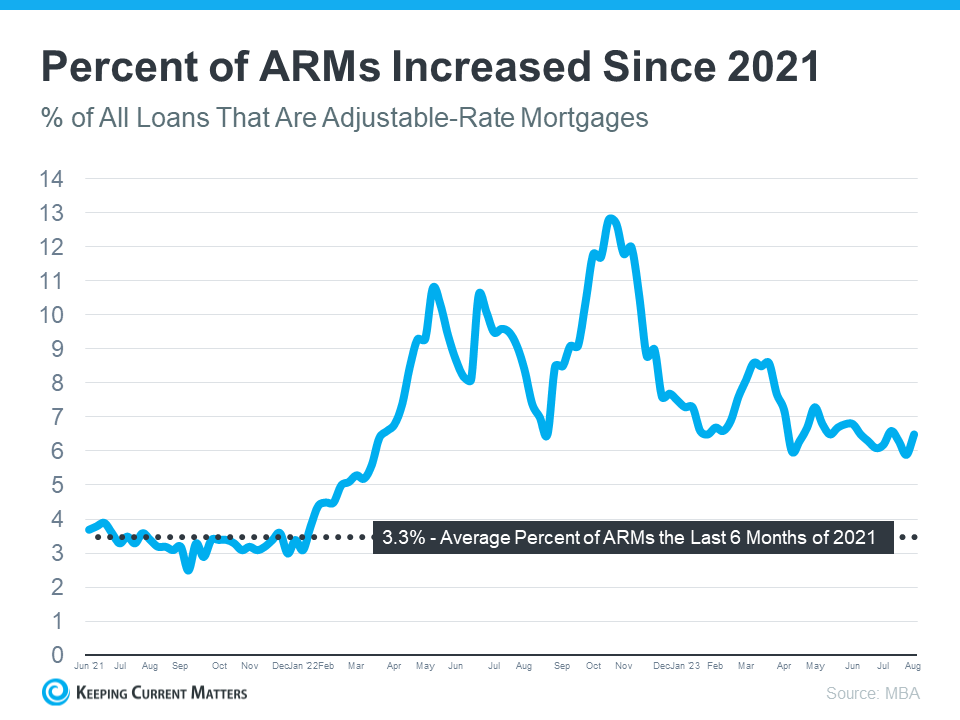

This graph uses data from the Mortgage Bankers Association (MBA) to show how the percentage of adjustable-rate mortgages has increased over the past few years:

As the graph conveys, after hovering around 3% of all mortgages in 2021, many more homeowners turned to adjustable-rate mortgages again last year. There’s a simple explanation for that increase. Last year is when mortgage rates climbed dramatically. With higher borrowing costs, some homeowners decided to take out this type of loan because traditional borrowing costs were high, and an ARM gave them a lower rate.

Why Today’s ARMs Aren’t Like the Ones in 2008

To put things into perspective, let’s remember these aren’t like the ARMs that became popular leading up to 2008. Part of what caused the housing crash was loose lending standards. Back then, when a buyer got an ARM, banks and lenders didn’t require proof of their employment, assets, income, etc. Basically, people were getting loans that they shouldn’t have been awarded. This set many homeowners up for trouble because they couldn’t pay back the loans that they never had to qualify for in the first place.

This time around, lending standards are different. Banks and lenders learned from the crash, and now they verify income, assets, employment, and more. This means today’s buyers actually have to qualify for their loans and show they’ll be able to repay them.

Archana Pradhan, Economist at CoreLogic, explains the difference between then and now:

“Around 60% of Adjustable-Rate Mortgages (ARM) that were originated in 2007 were low- or no-documentation loans . . . Similarly, in 2005, 29% of ARM borrowers had credit scores below 640 . . . Currently, almost all conventional loans, including both ARMs and Fixed-Rate Mortgages, require full documentation, are amortized, and are made to borrowers with credit scores above 640.”

In simple terms, Laurie Goodman at Urban Institute helps drive this point home by saying:

“Today’s Adjustable-Rate Mortgages are no riskier than other mortgage products and their lower monthly payments could increase access to homeownership for more potential buyers.”

Bottom Line

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

And, if you’re a first-time homebuyer and you’d like to learn more about lending options that could help you overcome today’s affordability challenges, reach out to a trusted lender.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link