Are you wondering if you’re on track to retire someday?

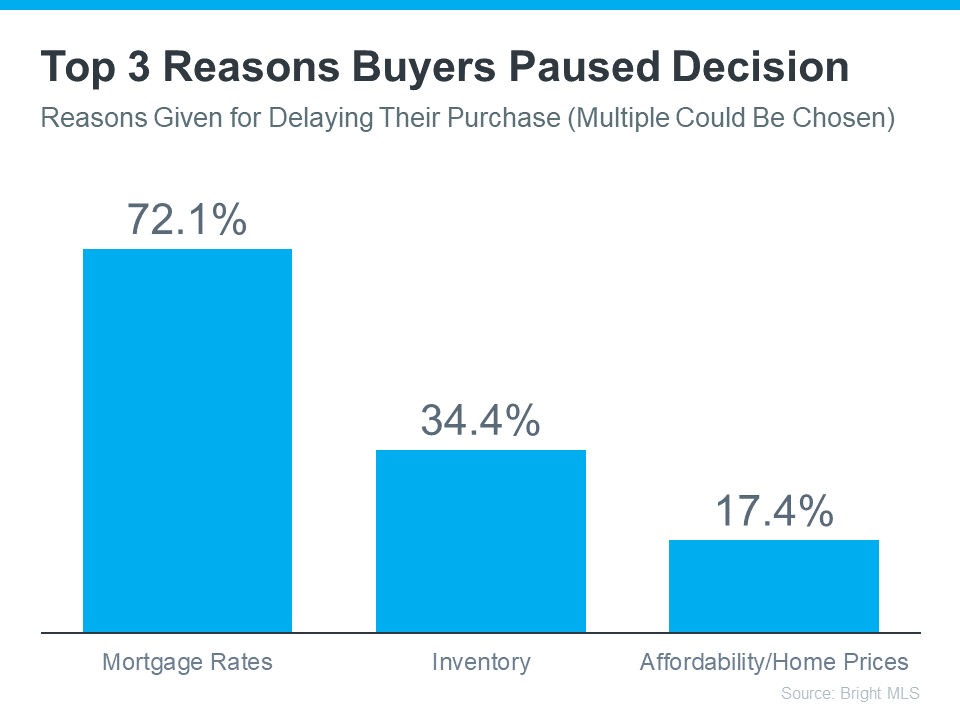

According to Intuit, 69% of people say today’s financial environment makes it tough to plan for the future, and 68% aren’t sure they’ll ever be able to retire. That’s why many people are exploring new ways to build stability and long-term income.

And that’s where real estate comes in.

Why Real Estate? Here’s What It Can Do for You

If you’re able to make the numbers work, buying a second home can be a powerful tool for your future retirement. It could help you:

- Build wealth over time: As home prices rise through the years, your second home should grow in value and increase your net worth.

- Generate extra income: Renting the home could bring in some extra income you can add to your existing retirement savings. Just remember, some of the rent coming in will need to be used to pay that mortgage and maintain that house.

- Profit in the future: You may decide to sell the second home down the road and use the profit from that sale to give your retirement funds a boost.

- Diversify your financial assets: Real estate offers a tangible asset that can help reduce your dependence on just stocks or savings, making your overall financial picture more stable.

Most Second Homeowners Aren’t Big Investors

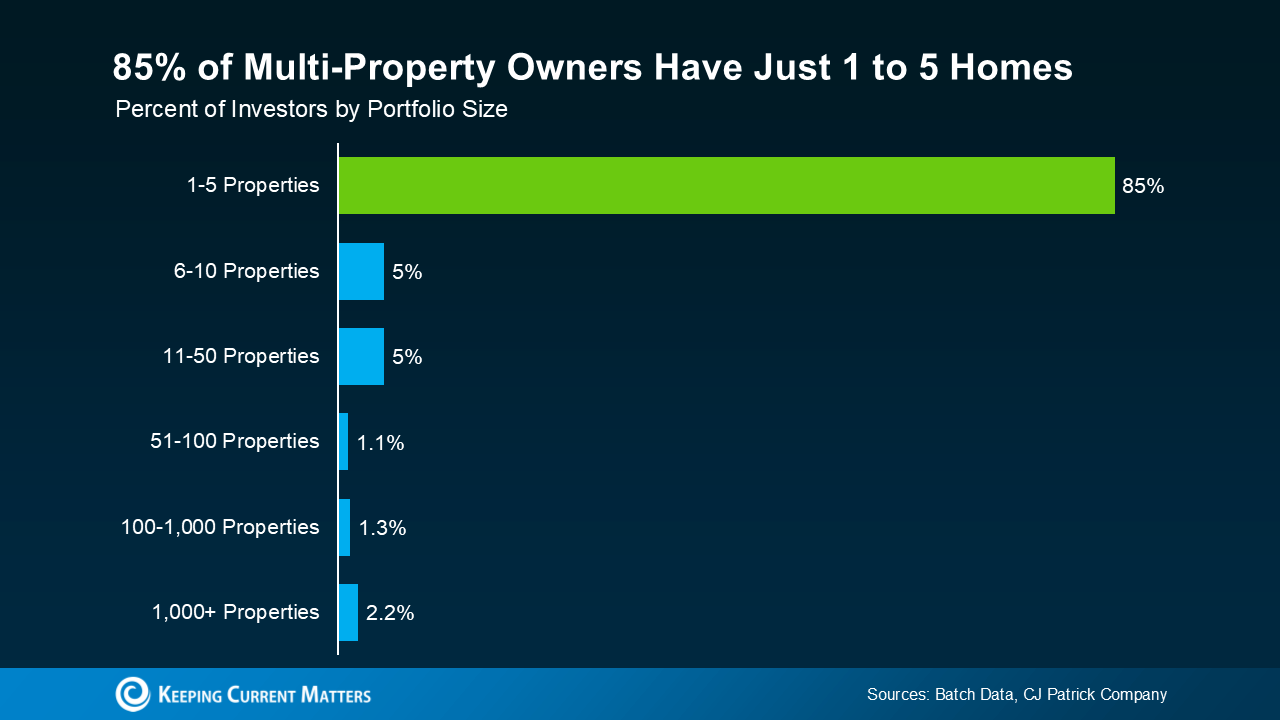

And if you’re thinking: wait, owning multiple homes is only for big investors – data shows that’s not necessarily true. Many homeowners who buy an additional property aren’t the big investors you hear so much about. They’re people like your neighbors.

In fact, data from BatchData and CJ Patrick Company shows 85% of people who own more than one property have just 1 to 5 homes (see graph below):

That means most who own multiple homes are people (not large investors) who’ve bought an extra home to rent out or hold onto for later.

That means most who own multiple homes are people (not large investors) who’ve bought an extra home to rent out or hold onto for later.

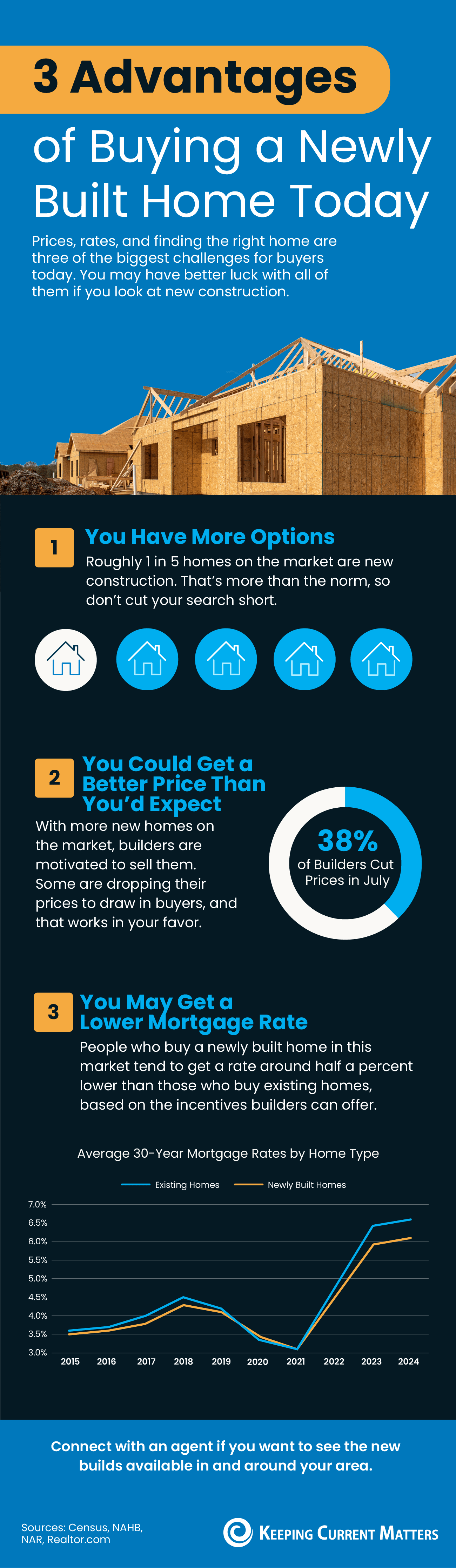

Why Now Might Be the Right Time

And right now, the door may be opening for buyers like you. According to Danielle Hale, Chief Economist at Realtor.com:

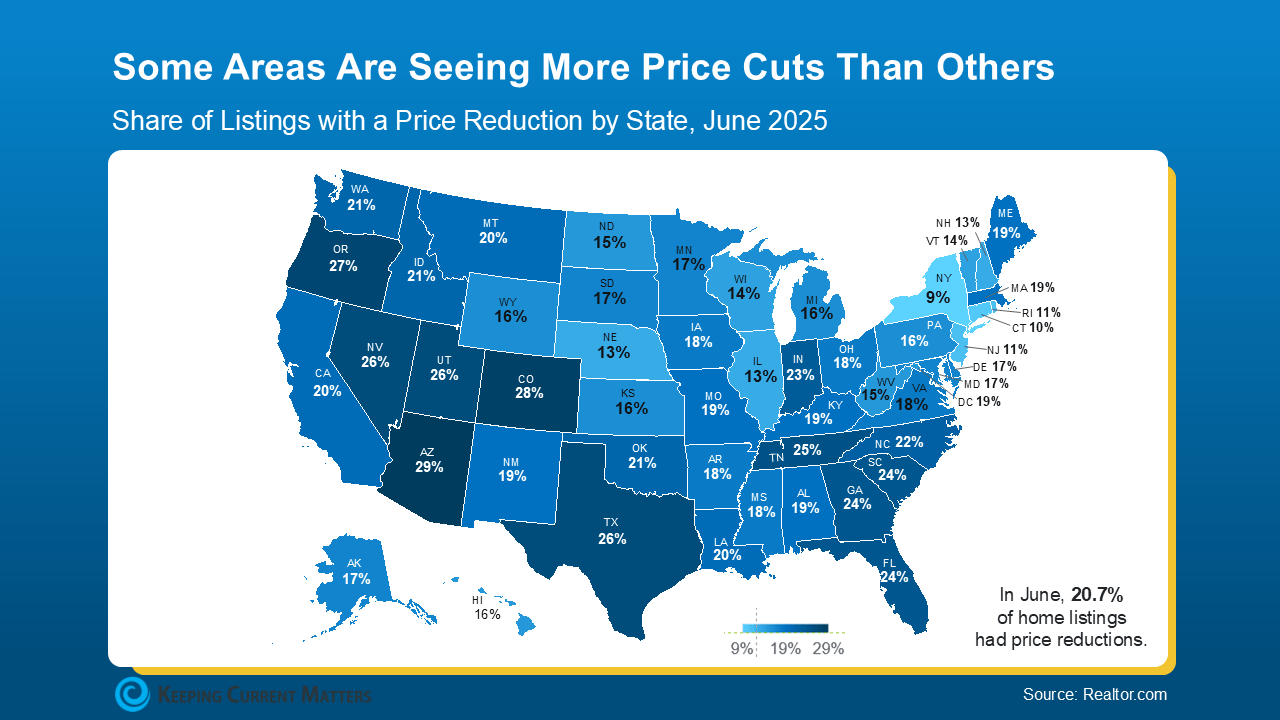

“. . . the balance of power in the housing market keeps shifting in favor of homebuyers. . . A confluence of factors—including more homes for sale, rising price cuts, and slower-moving inventory—is giving buyers more leverage than they’ve had in years . . .”

If you live in an area where home prices are expected to rise, buying another property now and selling it later could help fund your future. Or you could rent it out and earn income now.

Start with Just a Few Trusted Pros

If this idea sounds interesting, the most important first step is to connect with a few key people who can guide you through the process:

- A local real estate agent who understands the market

- A lender who specializes in second home or investment loans

Surrounding yourself with the right pros can help you make confident decisions from day one.

Bottom Line

Talk with a local real estate agent about what’s possible. They’d love to help you explore whether owning a second home could bring you more security and peace of mind for the road ahead.

If a second home could help you retire earlier or with more freedom, would you want to take a closer look?

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

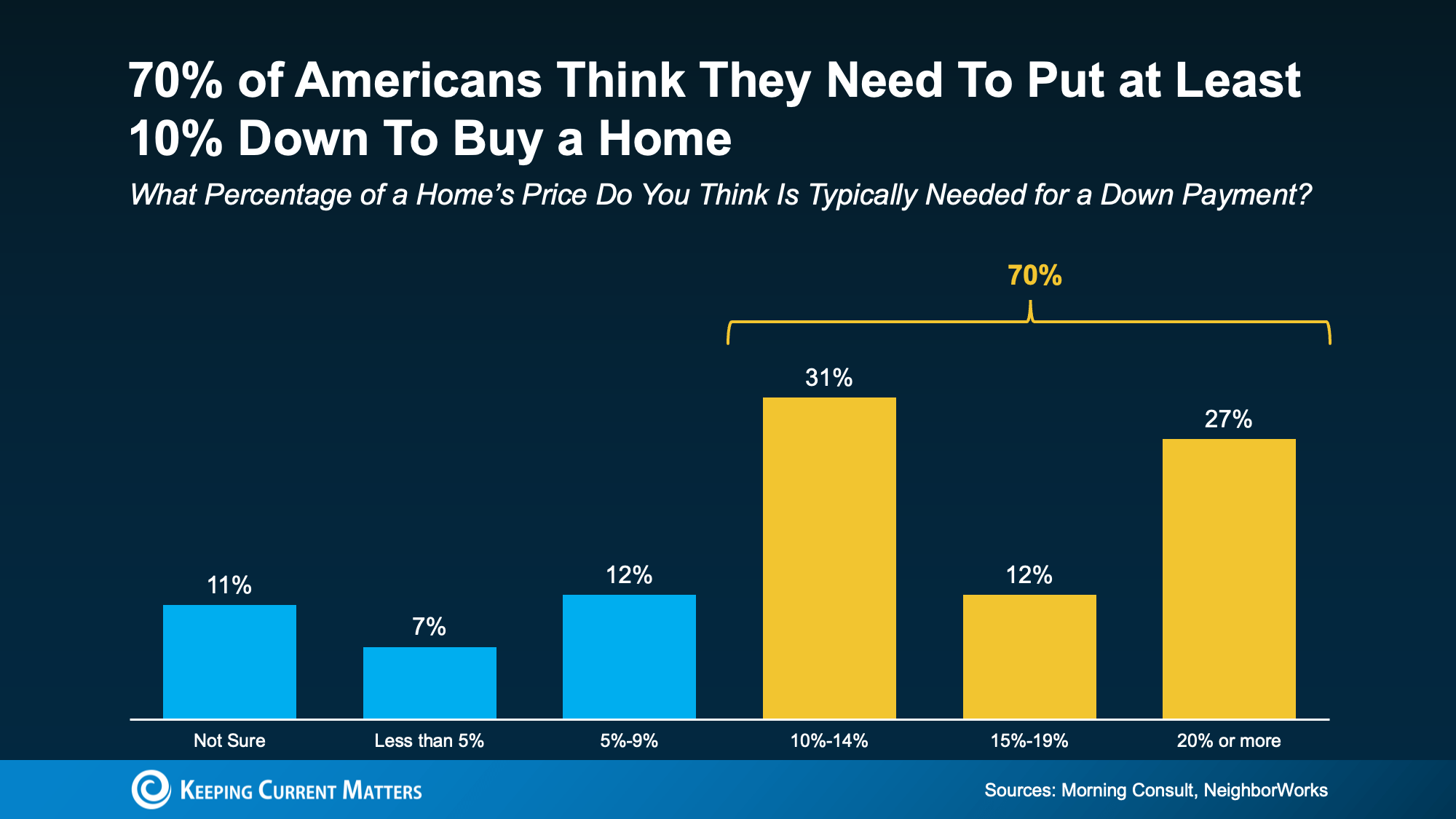

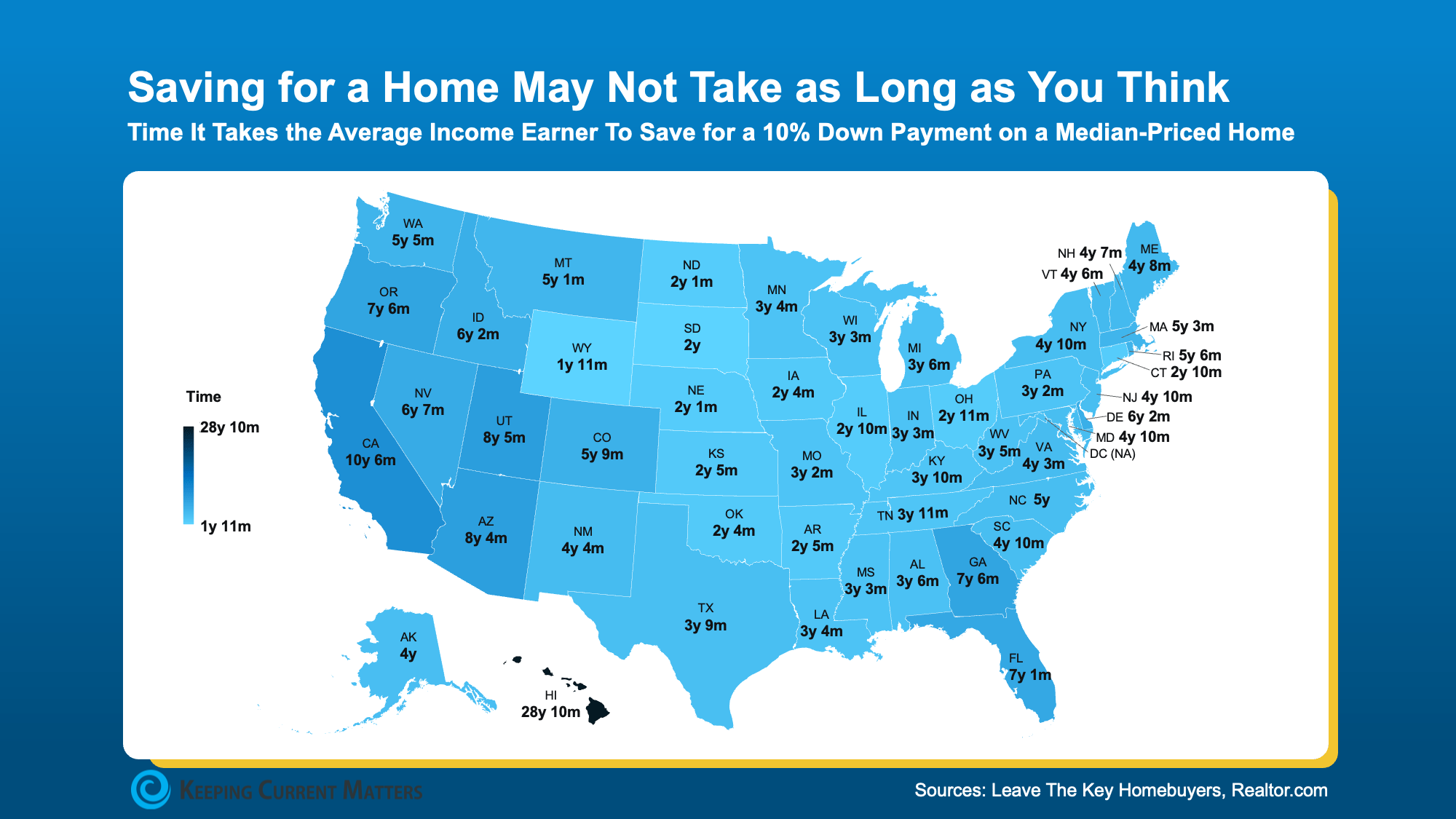

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.