Why We’re Not Heading Toward a Foreclosure Crisis

The real estate market in Greater Cincinnati, Northern Kentucky, and Southeast Indiana is thriving, with strong fundamentals that set it apart from the 2008 housing crisis. One major factor is the unprecedented level of equity homeowners have today. Unlike the last housing bubble, when many owed more on their homes than they were worth, today’s homeowners enjoy significantly more equity than debt.

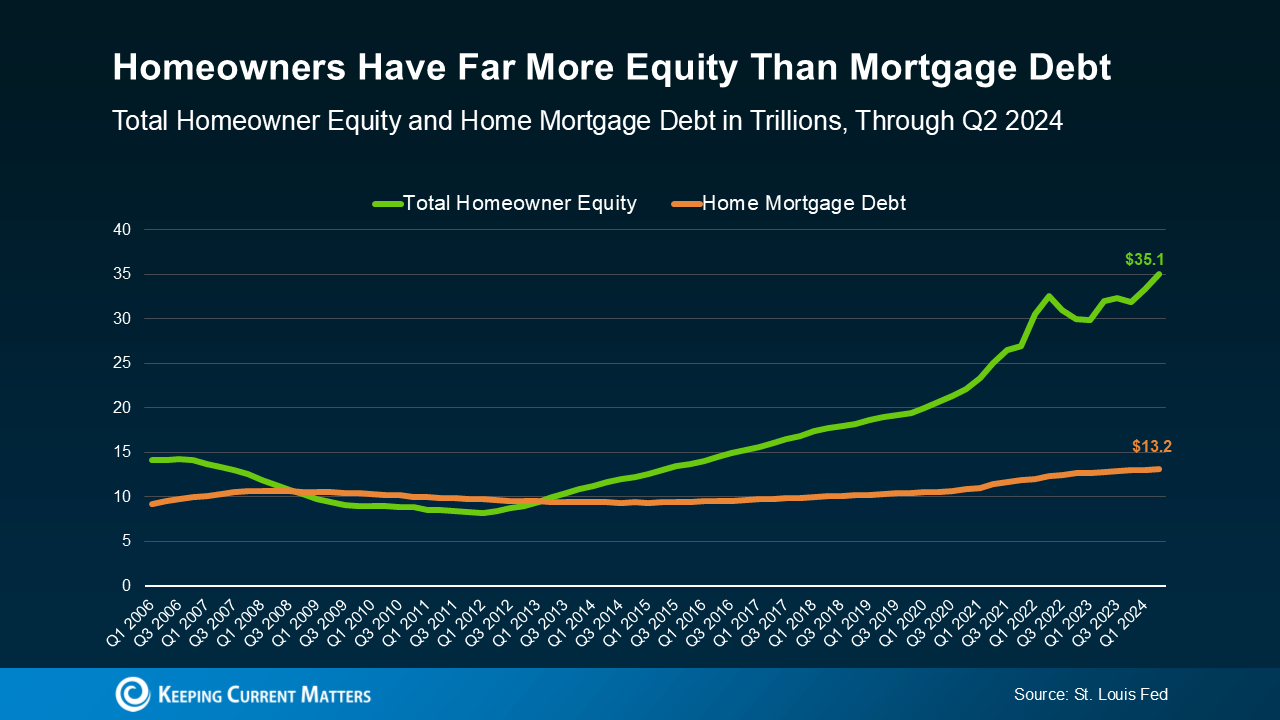

Equity Levels Are a Game-Changer

Even though mortgage debt is at an all-time high, it’s not a concern. As housing analyst Bill McBride of Calculated Risk explains:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Let’s dive deeper to see why today’s market is different and how this affects homes for sale and homeowners looking to sell their house.

More Equity, Less Foreclosure Risk

Data from the St. Louis Fed shows that homeowner equity today is nearly triple the total mortgage debt. (See graph below.)

This high equity reduces foreclosure risks. If a homeowner struggles to make payments, they often have the option to sell their house and still come out ahead, thanks to their accumulated equity. This is a stark contrast to 2008, when many homeowners were underwater with no options.

Even if home values were to dip, most homeowners would remain in a strong position due to their equity cushion.

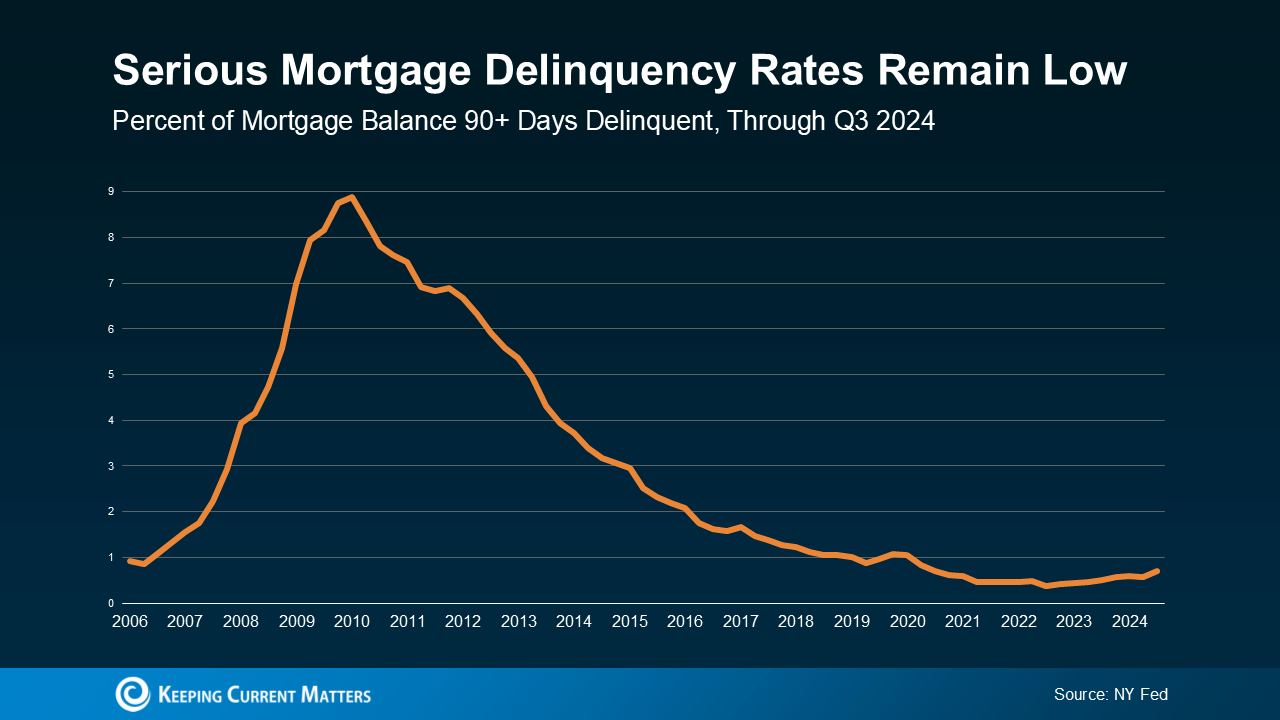

Delinquency Rates Are Historically Low

Mortgage delinquency rates are another sign of market health. According to the NY Fed, mortgage payments that are over 90 days late remain near historic lows.

This trend is supported by programs that assist homeowners during financial hardships. Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association, emphasizes:

“. . . servicers are helping at-risk homeowners avoid foreclosures through loan workout options that can mitigate temporary distress.”

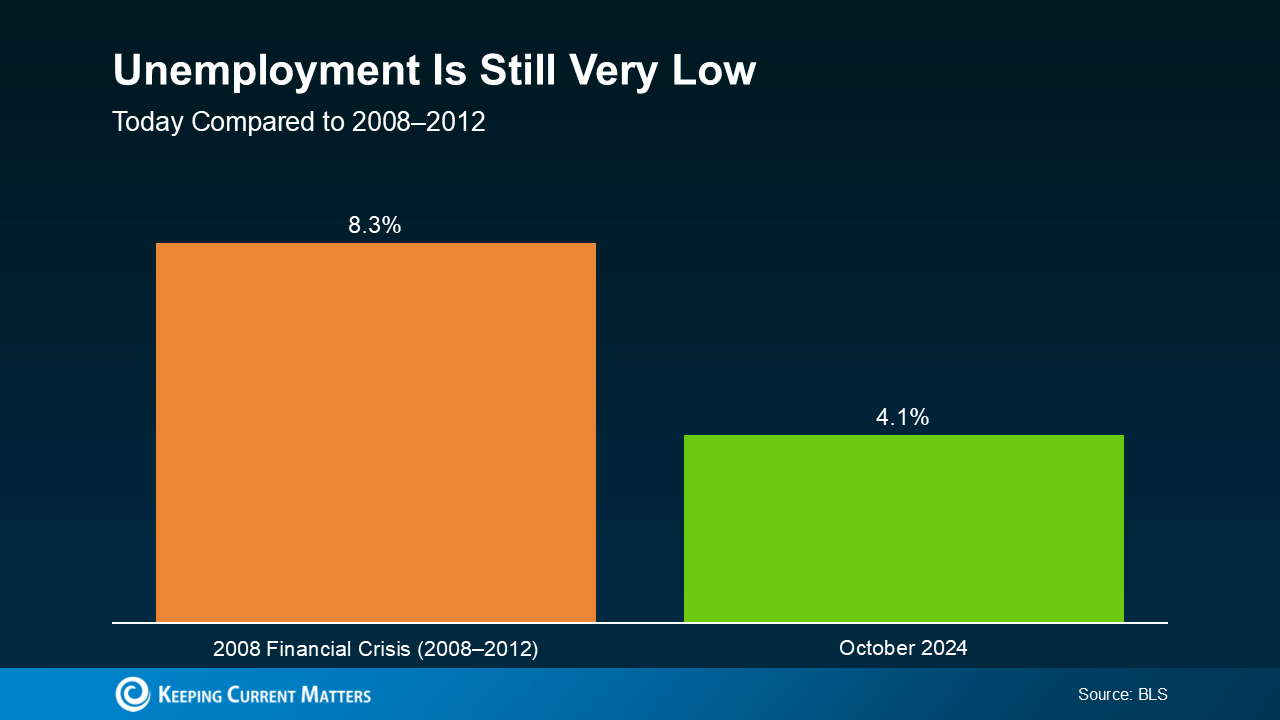

Stable Employment Supports Housing Market

Low unemployment is another critical factor keeping the real estate market in Greater Cincinnati, Northern Kentucky, and Southeast Indiana stable. More people with steady jobs mean fewer missed mortgage payments. Archana Pradhan, Principal Economist at CoreLogic, explains:

“Low unemployment numbers have helped reduce the overall delinquency rate . . .”

During the last housing crisis, high unemployment drove a wave of foreclosures. Today, low unemployment and affordable, low-interest mortgages are helping homeowners stay current on payments.

Bottom Line

The housing market isn’t heading toward a foreclosure crisis. With strong equity, historically low delinquency rates, and a stable employment environment, today’s market is fundamentally different from 2008.

If you’re thinking of selling your house or exploring homes for sale in Greater Cincinnati, Northern Kentucky, or Southeast Indiana, now is the time. Connect with a local real estate expert to discuss your options and stay ahead of the market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link