With everything feeling more expensive these days, it’s natural to worry about how rising costs might impact the housing market. Many homeowners and potential buyers are concerned that high prices and tighter budgets could lead to more people falling behind on their mortgage payments, causing a wave of foreclosures. For those looking to buy homes for sale or wondering, “Should I sell my house?”, this concern is understandable.

Before jumping to conclusions about a potential housing market crash in Greater Cincinnati, Northern Kentucky, or Southeast Indiana, let’s take a closer look at what’s actually happening. The good news is: the latest foreclosure data shows there’s no major wave on the horizon, and the real estate market remains stable.

### How Today’s Market Is Different from 2008

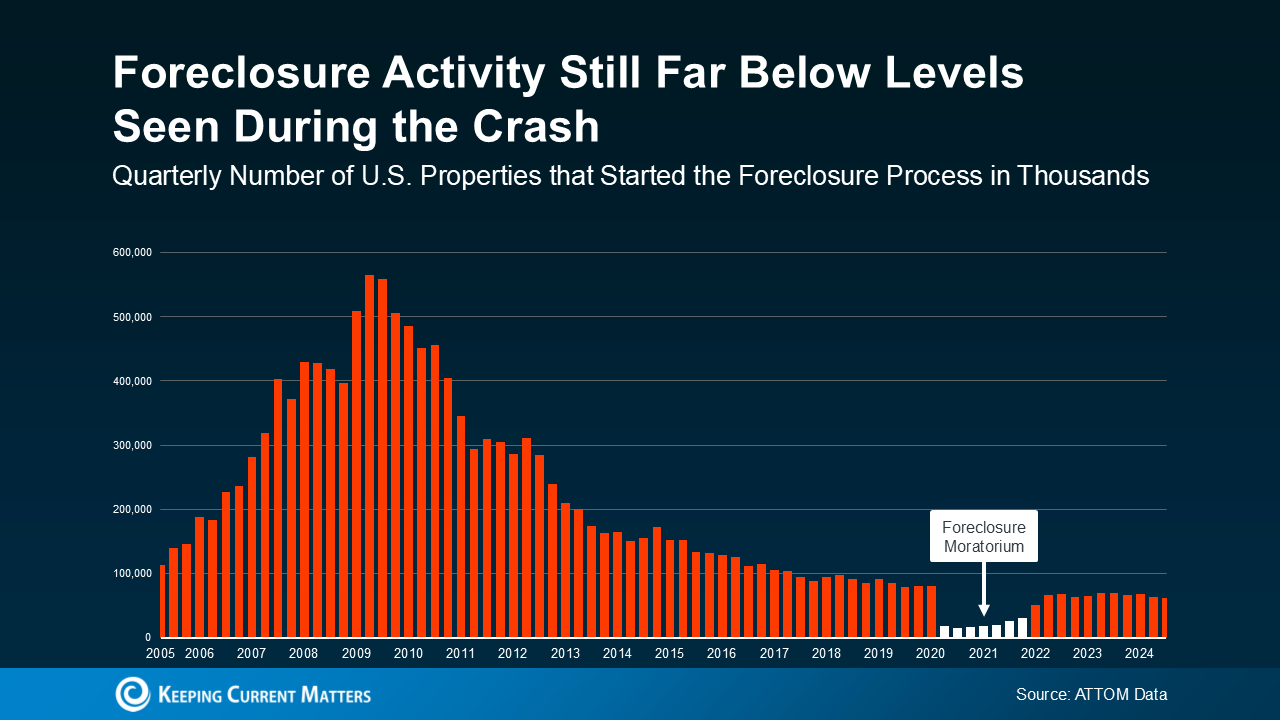

To ease any fears, it’s essential to understand the bigger picture. The graph below, based on research from ATTOM (a leading property data provider), shows that the number of homeowners starting the foreclosure process is nowhere near what we saw in the aftermath of the 2008 housing crisis. Back then, the real estate market experienced a significant spike in foreclosures, but today, the numbers are much lower—and even show a slight decline in recent reports. What’s happening now is vastly different from what occurred during the crash (see the graph below):

*

Just in case you’re wondering why foreclosure filings have slightly increased since 2020 and 2021, here’s what you need to know. During those years, there was a foreclosure moratorium (represented in white on the graph), which helped millions of homeowners avoid foreclosure during a challenging time. As a result, the numbers during those years were incredibly low. When you look at the long-term trends, however, it’s clear that overall foreclosure filings are significantly down.

### Why Are There Fewer Foreclosures Despite Rising Costs?

You may be wondering how foreclosure numbers remain low even as the cost of living has risen. One key factor is that homeowners today have more equity built up in their homes compared to 2008. As Bankrate explains:

*”In the years following the housing crash, millions of foreclosures flooded the market, depressing home prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes.”*

This equity acts as a financial safety net, allowing homeowners to avoid foreclosure even when facing financial hardships. Even if someone is struggling to make their monthly payments, they may be able to sell their home—potentially in a thriving market like Greater Cincinnati, Northern Kentucky, or Southeast Indiana—and avoid foreclosure altogether. This is a stark contrast to the 2008 crisis when many homeowners owed more on their mortgages than their homes were worth.

### What’s Ahead for the Real Estate Market?

It’s true that today’s higher cost of living—whether for gas, groceries, or other essentials—presents a challenge for many. However, this doesn’t signal a coming surge in foreclosures. The strong equity cushion that homeowners currently enjoy is helping to keep foreclosure filings at bay. Those who are facing financial difficulty have more options today, whether it’s selling their home or refinancing, making it easier to avoid the foreclosure process.

### Bottom Line

While everyday expenses may be rising, this doesn’t mean the housing market in Greater Cincinnati, Northern Kentucky, and Southeast Indiana is heading for another foreclosure crisis. The data shows that the market is far from a foreclosure wave, and homeowners are in a much stronger financial position today compared to the 2008 crash, largely thanks to the significant equity they’ve built up. Whether you’re looking to buy homes for sale or considering selling your house, the real estate market remains resilient and offers plenty of opportunities.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link