What Credit Score Do You Really Need To Buy a Home?

According to Fannie Mae, 90% of buyers don’t actually know what credit score lenders are looking for, or they overestimate the minimum needed.

Let that sink in. That means most homebuyers think they need better credit than they actually do – and maybe you’re one of them. And that could make you think buying a home is out of reach for you right now, even if that’s not necessarily true. So, let’s look at what the data really says about credit scores and homebuying.

There’s No One Magic Number

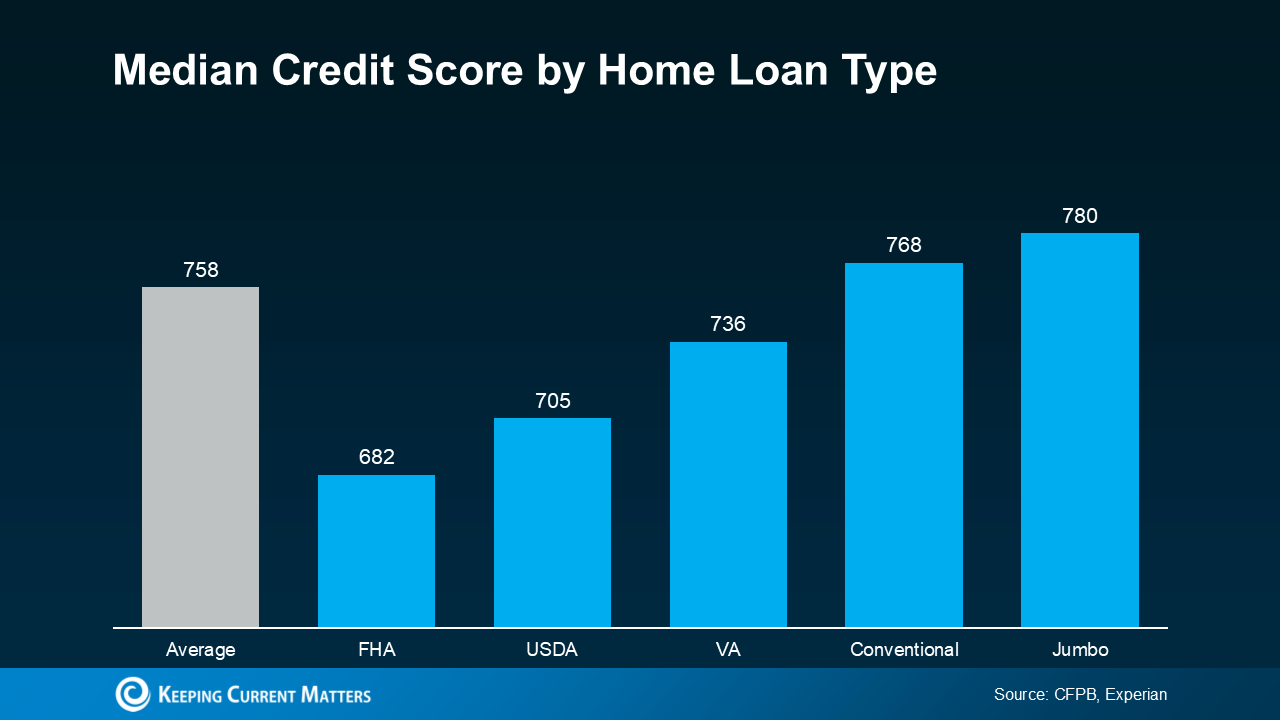

There’s no universal credit score you absolutely have to have when buying a home. And that means there’s more flexibility than most people realize. Check out this graph showing the median credit scores recent buyers had among different home loan types:

Here’s what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

Here’s what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

Why Your Score Still Matters

When you buy a home, lenders use your credit score to get a sense of how reliable you are with money. They want to see if you typically make payments on time, pay back debts, and more.

Your score can impact which loan types you may qualify for, the terms on those loans, and even your mortgage rate. And since mortgage rates are a big factor in how much house you’ll be able to afford, that may make your score feel even more important today. As Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

That still doesn’t mean your credit has to be perfect. Even if your credit score isn’t as high as you’d like, you may still be able to get a home loan.

Want To Boost Your Score? Start Here

And if you talk to a lender and decide you want to improve your score (and hopefully your loan type and terms too), here are a few smart moves according to the Federal Reserve Board:

- Pay Your Bills on Time: This is a big one. Lenders want to see you can reliably pay your bills on time. This includes everything from credit cards to utilities and cell phone bills. Consistent, on-time payments show you’re a responsible borrower.

- Pay Down Your Debt: When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible. That makes you a lower-risk borrower in the eyes of lenders – making them more likely to approve a loan with better terms.

- Review Your Credit Report: Get copies of your credit report and work to correct any errors you find. This can help improve your score.

- Don’t Open New Accounts: While it might be tempting to open more credit cards to build your score, it’s best to hold off. Too many new credit applications can lead to hard inquiries on your report, which can temporarily lower your score.

Bottom Line

Your credit score doesn’t have to be perfect to qualify for a home loan. But a better score can help you get better terms on your home loan. The best way to know where you stand and your options for a mortgage is to connect with a trusted lender.

Home Price Forecasts for the Second Half of 2025

Some Highlights

- With all the headlines circulating recently, you may be wondering what’s next for home prices? Here’s what the expert forecasts say.

- Home prices are still forecast to rise nationally this year, just at a much slower pace. But price trends are going to vary by area.

- To have a quick conversation about what’s happening in your local market, connect with a real estate agent.

Today’s Tale of Two Housing Markets

Depending on where you live, the housing market could feel red-hot or strangely quiet right now. The truth is, local markets are starting to move in different directions. In some places, buyers are calling the shots. In others, sellers still hold the power. It’s a tale of two markets.

What’s a Buyer’s Market vs. a Seller’s Market?

In a buyer’s market, there are more homes for sale and not as many buyers. That means homes sit longer, buyers have more negotiating power, and prices tend to soften as a result. It’s simple supply and demand.

On the flip side, a seller’s market happens when there aren’t enough homes available for the number of people looking to buy them. Because buyers have to compete with each other to get the house they want, that leads to faster sales, multiple offers, and rising prices.

Right now, both of these scenarios are playing out, depending on where you are. So, how do you know what kind of market you’re in? Lean on a local real estate agent. They’ll explain what’s really happening in your area based on these key drivers.

The Number of Buyers and Sellers by Region

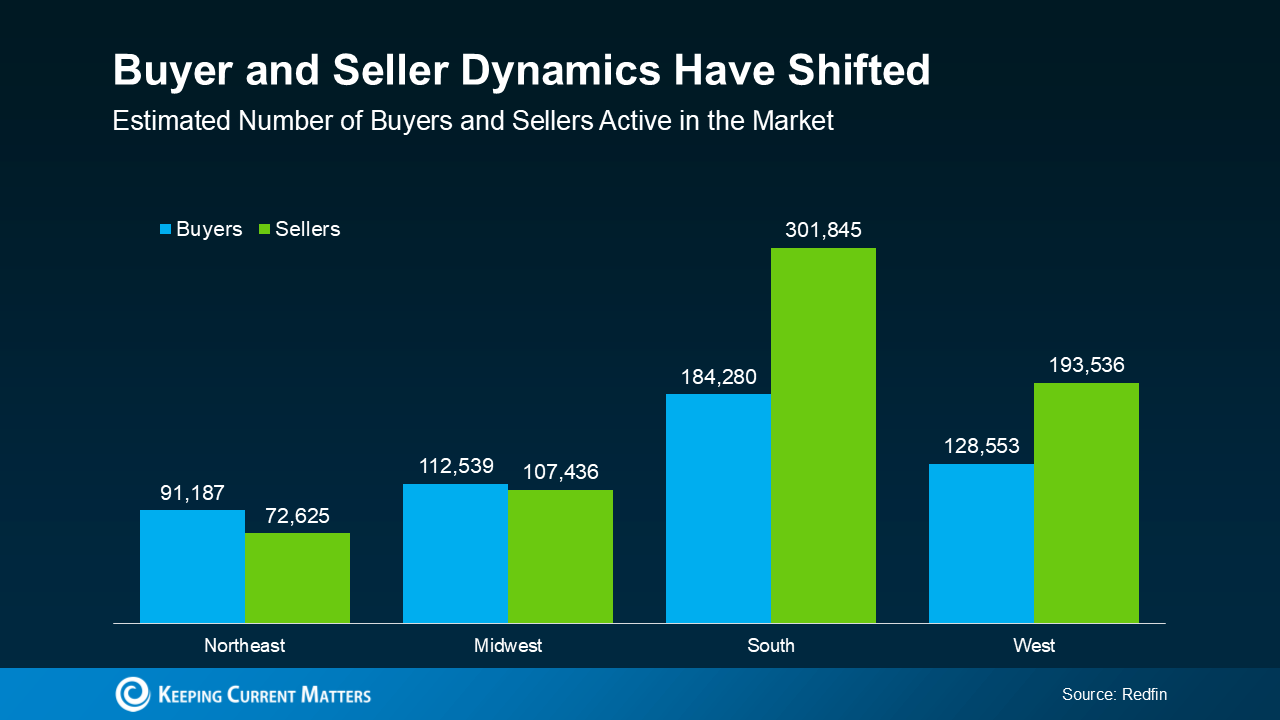

One of the biggest factors impacting each market is the number of active buyers and sellers. According to Redfin, here’s what that looks like by region (see graph below):

Today, the Northeast and Midwest are more likely to be seller’s markets. Buyers still outnumber sellers there, and that keeps things tilted in favor of homeowners. Generally speaking, homes are selling faster and prices are rising in those areas.

Today, the Northeast and Midwest are more likely to be seller’s markets. Buyers still outnumber sellers there, and that keeps things tilted in favor of homeowners. Generally speaking, homes are selling faster and prices are rising in those areas.

But the South and West are leaning more toward buyer’s markets. There are more sellers than buyers, which means more listings to choose from and less competition among buyers.

That’s a major shift from a few years ago when sellers had the advantage almost everywhere. Today, your local conditions matter more than ever – and they can vary even from one neighborhood to the next.

Price Trends Mirror the Buyer/Seller Divide

When inventory and buyer activity shift, so do prices. In places where demand still outpaces supply, like much of the Northeast and Midwest, prices are continuing to climb.

But in parts of the South and West where inventory is up and demand has cooled, prices are softening. And that’s a plus for buyers looking to negotiate in those areas.

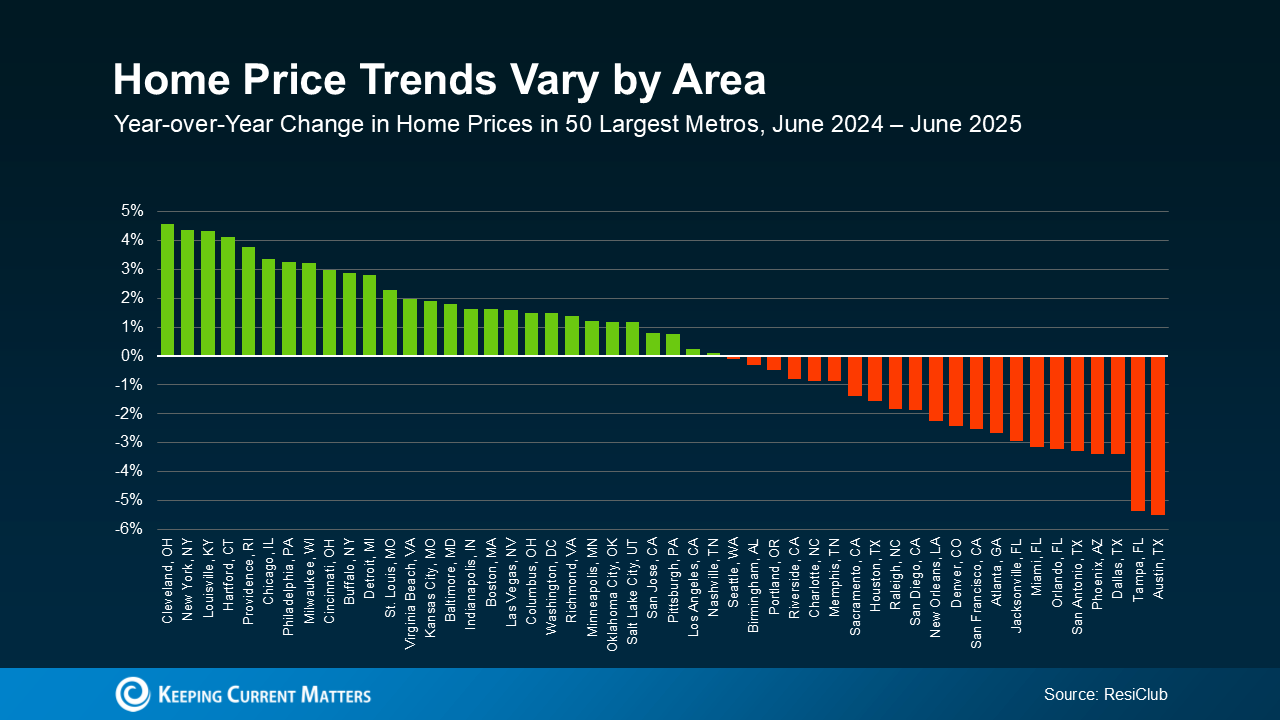

Here’s the latest price data from ResiClub to show how this divide is shaking out across the top metros in the country (see graph below):

This is why it’s the tale of two markets. Roughly half of the top 50 metros are up, and half are relatively flat or down.

This is why it’s the tale of two markets. Roughly half of the top 50 metros are up, and half are relatively flat or down.

That said, don’t panic if you own a home in a market where prices are dipping. Most homeowners have built up significant equity over the past few years, and chances are you have too. So, you’re likely still come out way ahead when you sell.

Why Local Insights Matter

Even in regions that lean more buyer-friendly right now, there will be cities, towns, and even neighborhoods that don’t follow the regional trends. That’s why an agent’s local market expertise is so important. They can help you understand what’s happening all the way down to a zip code level, including:

- Whether your area is favoring buyers or sellers

- How to set the right price or craft an offer strategy based on local trends

- The best way to make your move happen, no matter what’s happening in the market

Bottom Line

In a market where conditions vary this much from place to place, success starts with understanding every aspect of your local area. Connect with a local agent so you’ve got an expert in your corner who knows exactly how to guide you through your market, wherever you are.

Housing Market Forecasts for the Rest of 2025

If you’ve been watching the market, you’ve likely noticed a few changes already this year. But what’s next? From home prices to mortgage rates, here’s what the latest expert forecasts suggest for the rest of 2025 – and what these shifts could mean for you.

Will Home Prices Fall?

Many buyers are hoping home prices will come down soon. And recent headlines about prices dipping in some areas are making some people believe it’s just a matter of time before there’s a bigger drop. But here are the facts.

While home price growth is slowing down, that doesn’t mean we’re headed for a crash. As NAHB explains:

“House price growth slowed . . . partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices. These factors signaled a cooling market, following rapid gains seen in previous years.”

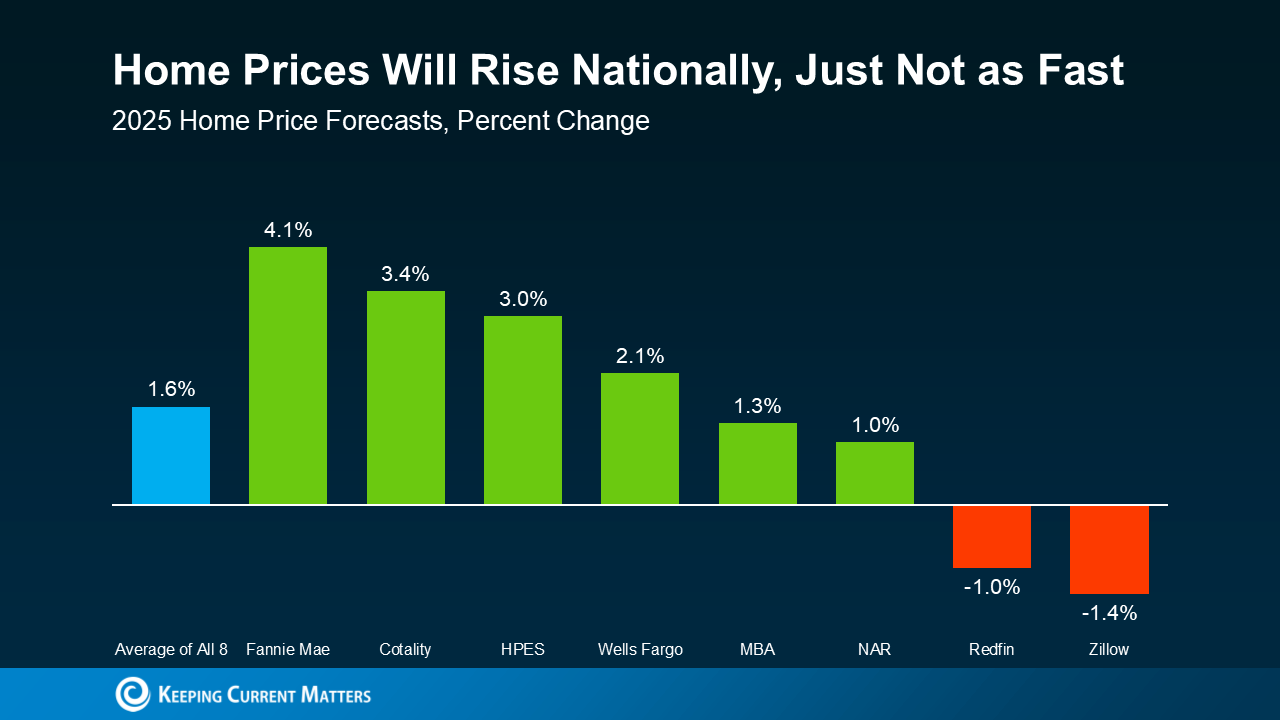

But experts say, even with that slowdown, prices will still rise this year at the national level. The average of 8 leading forecasters shows prices are expected to go up 1.5-2% in 2025 (see graph below):

That means, if you’re waiting for a major drop, experts agree that’s just not in the cards.

That means, if you’re waiting for a major drop, experts agree that’s just not in the cards.

Keep in mind, while some markets are already seeing prices come down slightly, the average dip is just -3.5%. That’s a far cry from the nearly 20% decline the market experienced during the 2008 crash.

Plus, those small changes are easily absorbed when you consider how much home prices have climbed over the past few years. Data from the Federal Housing Finance Agency (FHFA) shows prices are up 55% nationally compared to just 5 years ago.

The takeaway? Prices aren’t crashing. They’re expected to keep climbing – just not as quickly these days. And some may argue they’ll be closer to flat by the end of this year. But, again, this is going to vary by market, with some local ups and downs. So, lean on a pro to see the latest price trends for your area.

Will Mortgage Rates Come Down?

Another common thought among today’s buyers is: I’m just going to wait for rates to come down. But is that a smart strategy? According to Yahoo Finance:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting. The latest news from the Federal Reserve and other key economic data point toward steady mortgage rates on par with what we see today.”

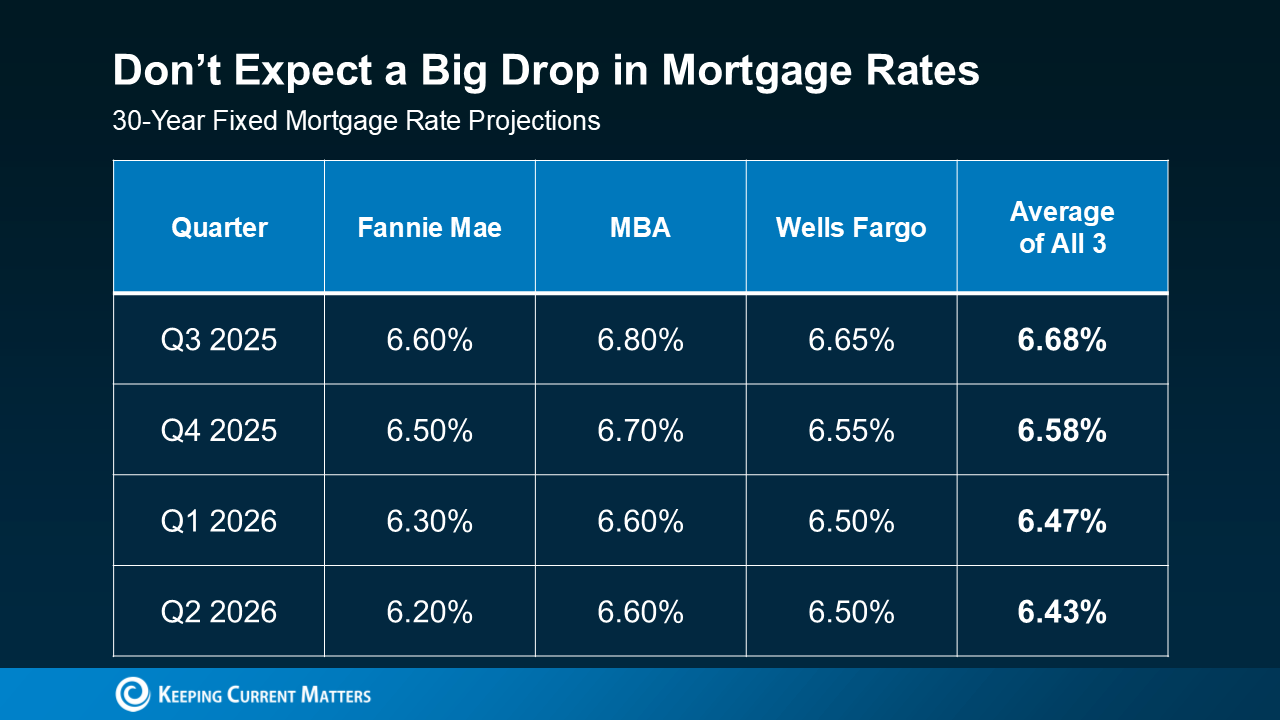

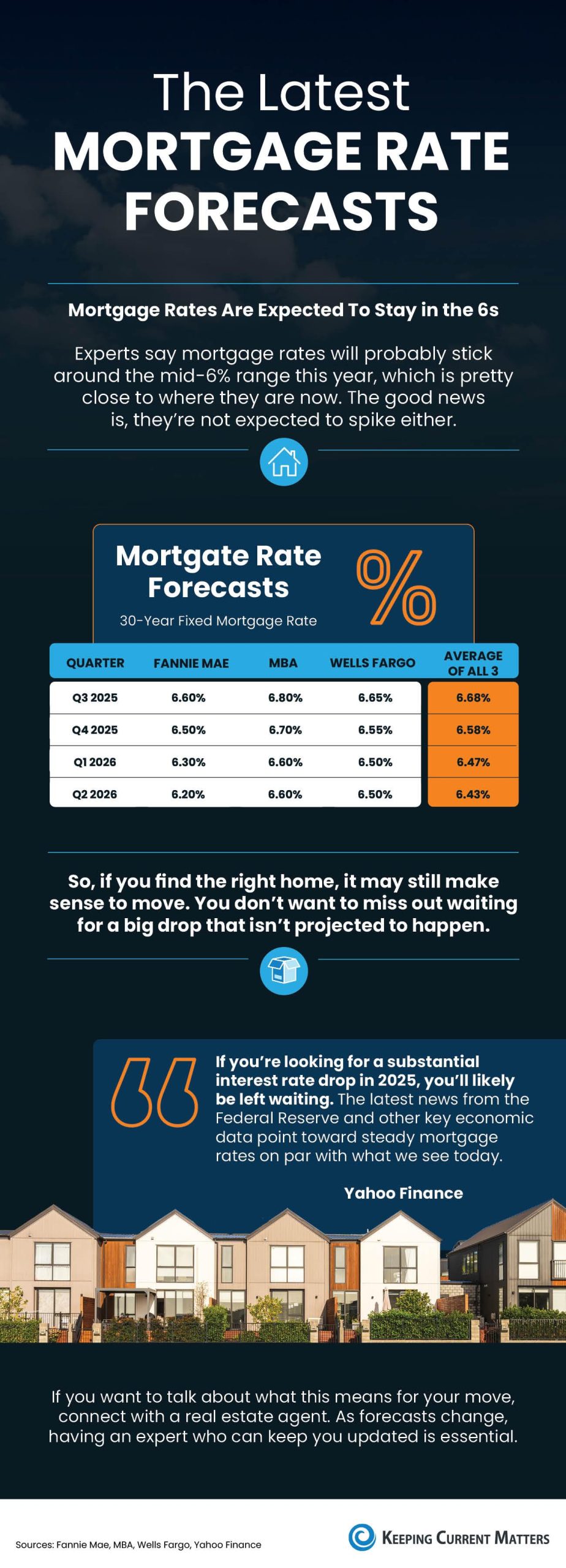

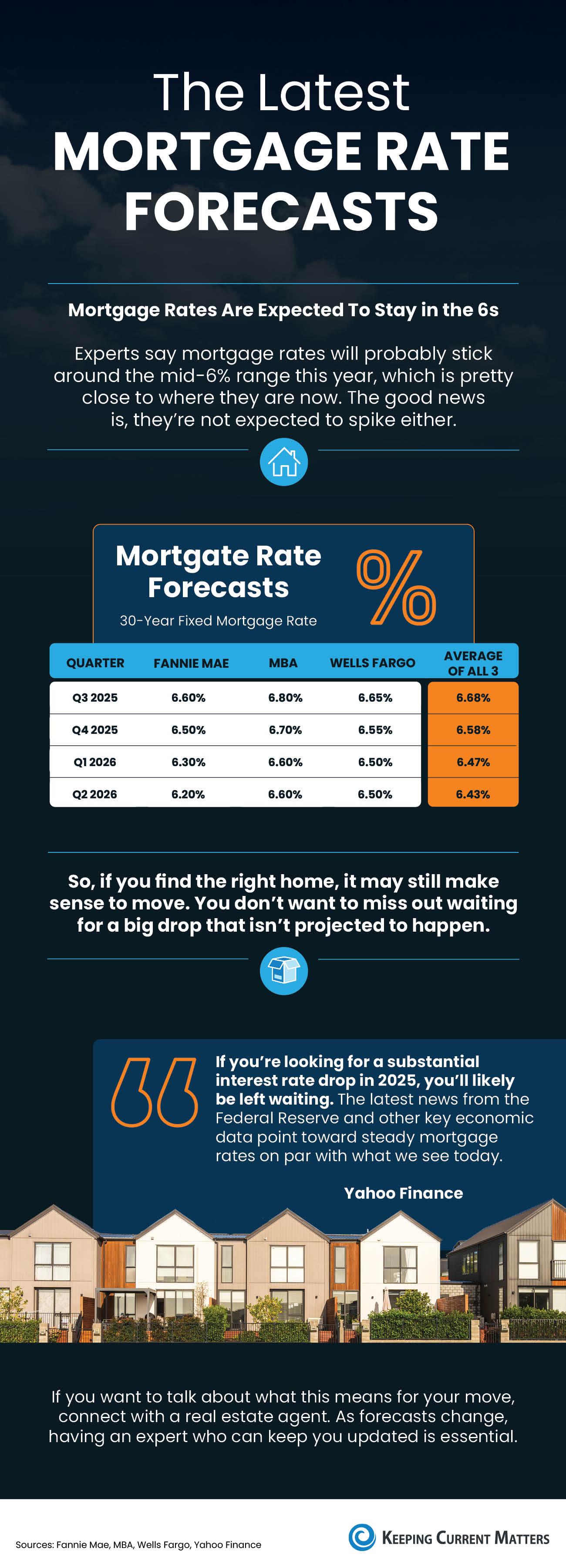

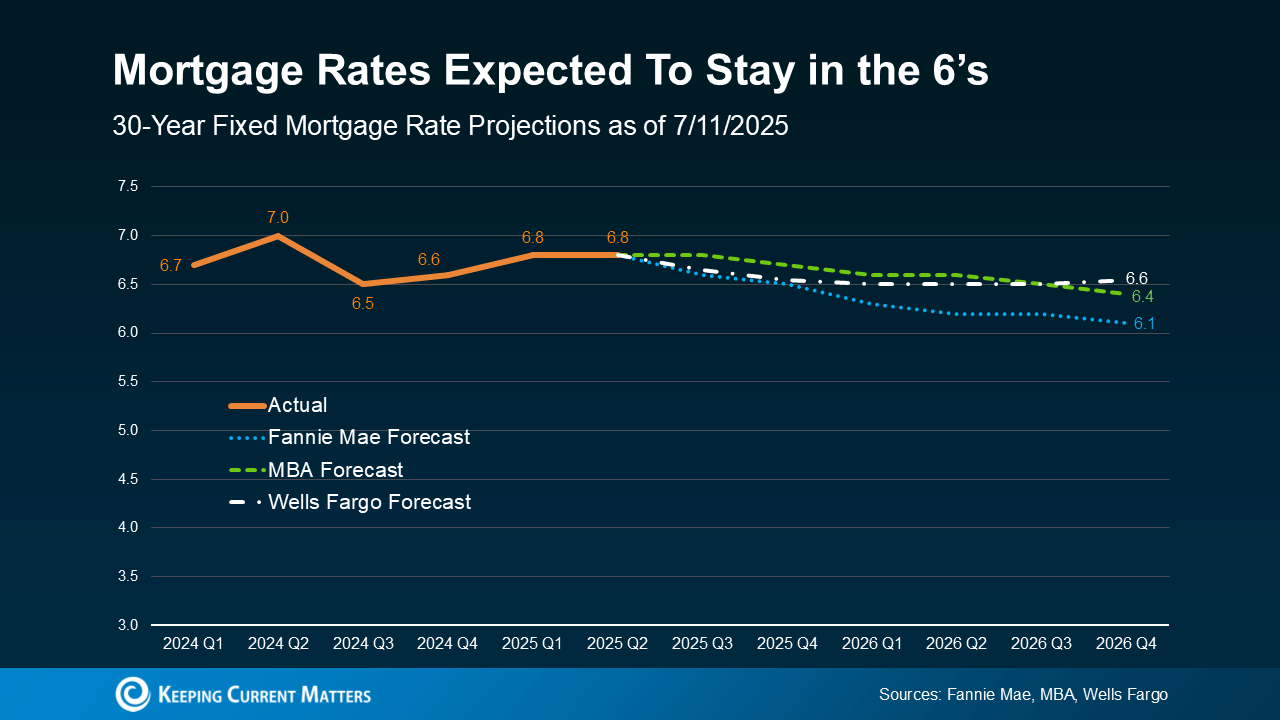

In other words, don’t try to time the market or wait for a drop that may not be coming. Most experts say rates will remain in the 6s, and current projections have them settling in the mid-6% range by the end of this year (see chart below):

And that’s not a big change from where they are right now. So, if you need to move, let’s talk about how to make it happen and what you should watch for. Because while rates may not be as low as you want them to be, you don’t want to put your needs on the back burner, hoping for something the data shows isn’t likely to happen.

And that’s not a big change from where they are right now. So, if you need to move, let’s talk about how to make it happen and what you should watch for. Because while rates may not be as low as you want them to be, you don’t want to put your needs on the back burner, hoping for something the data shows isn’t likely to happen.

Working with an expert who is keeping an eye on all the economic factors that can influence mortgage rates is going to be essential this year. That’s because changes in things like inflation and other key drivers could impact how rates move going forward.

The Takeaway for Buyers and Sellers

Whether you’re buying, selling, or thinking about doing both, this market requires strategy, not guesswork. Prices are still rising nationally (just more slowly), and rates are projected to stay pretty much where they are, so the bigger picture is one of moderation – not a meltdown.

Bottom Line

If you want to make a move, your best bet is to focus on your personal situation – not what the headlines say – and work with a real estate pro who knows how to navigate the shifting conditions in your local market.

The U.S. Foreclosure Map You Need To See

Foreclosure headlines are making noise again – and they’re designed to stir up fear to get you to read them. But what the data shows is actually happening in the market tells a very different story than what you might be led to believe. So, before you jump to conclusions, it’s important to look at the full picture.

Yes, foreclosure starts are up 7% in the first six months of the year. But zooming out shows that’s nowhere near crisis levels. Here’s why.

Filings Are Still Far Below Crash Levels

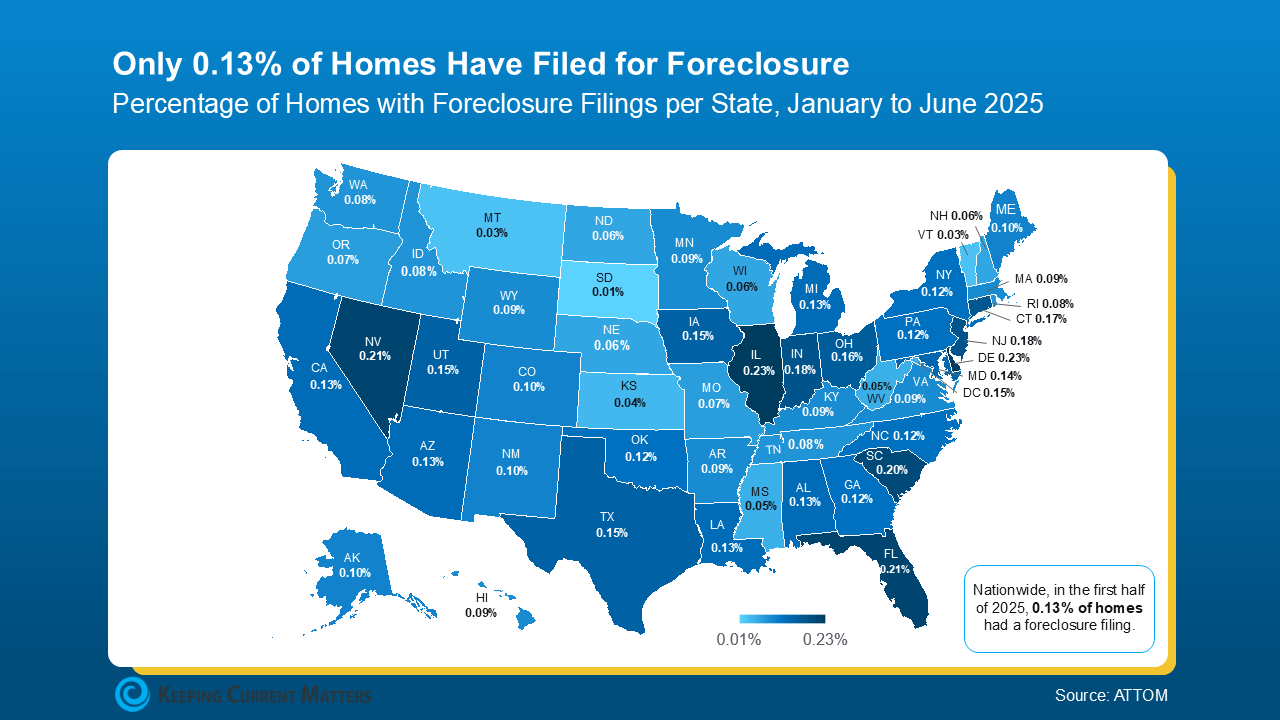

Even with the recent uptick, overall foreclosure filings are still very low. In the first half of 2025, just 0.13% of homes had filed for foreclosure. That’s less than 1% of homes in this country. In fact, it’s even far less than that at under a quarter of a percent. That’s a very small fraction of all the homes out there. But like with anything else in real estate, the numbers vary by market.

Here’s the map you need to see that shows how foreclosure rates are lower than you might think, and how they differ by local area:

For context, data from ATTOM shows in the first half of 2025, 1 in every 758 homes nationwide had a foreclosure filing. Thats the 0.13% you can see in the map above. But in 2010, back during the crash? Mortgage News Daily says it was 1 in every 45 homes.

For context, data from ATTOM shows in the first half of 2025, 1 in every 758 homes nationwide had a foreclosure filing. Thats the 0.13% you can see in the map above. But in 2010, back during the crash? Mortgage News Daily says it was 1 in every 45 homes.

Today’s Numbers Don’t Indicate a Market in Trouble

But here’s what everyone remembers…

Leading up to the crash, risky lending practices left homeowners with payments they eventually couldn’t afford. That led to a situation where many homeowners were underwater on their mortgages. When they couldn’t make their payments, they had no choice but to walk away. Foreclosures surged, and the market ultimately crashed.

Today’s housing market is very different. Lending standards are stronger. Homeowners have near record levels of equity. And when someone hits financial trouble, that equity means many people can sell their home rather than face foreclosure. As Rick Sharga, Founder of CJ Patrick Company, explains:

“. . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

No one wants to see a homeowner struggle. But if you’re a homeowner facing hardship, talk to your mortgage provider. You may have more options than you think.

Bottom Line

Recent headlines may not tell the whole story, but the data does. Foreclosure activity remains low by historical standards and is not a sign of another crash.

If you’re simply watching the market and want to understand what’s really going on, or how this impacts the value of your home, connect with an agent. They’ll help you separate fact from fear by showing you what the data really says.

The Latest Mortgage Rate Forecasts

Some Highlights

- If you’re tempted to delay your move in hope that mortgage rates will come down, you may want to rethink that strategy based on the latest forecast.

- Experts say mortgage rates are projected to stay in the 6s this year. So don’t expect a big drop.

- If you want to talk about what this means for your move, connect with a real estate agent. As forecasts change, having an expert who can keep you updated is essential.

Don’t Make These Mistakes When Selling Your House

Are you thinking about selling your house? Some common mistakes today can make the process more stressful or even cost you money.

Fortunately, they’re easy to avoid, as long as you know what to watch for. Let’s break down the biggest seller slip-ups, and how an agent helps you steer clear of them.

1. Overpricing Your House

It’s completely natural to want top dollar for your house, especially if you’ve put a lot of work into it. But in today’s shifting market, pricing it too high can backfire. Investopedia explains:

“Setting a list price too high could mean your home struggles to attract buyers and stays on the market for longer.”

And your house sitting on the market for a long time could lead to price cuts that raise red flags. That’s why pricing your house right from the start matters.

A great real estate agent will look at what other homes nearby have sold for, the condition of your house, and what’s happening in your market right now. That helps them find a price that’s more likely to bring in buyers, and maybe even more than one offer.

2. Spending Money on the Wrong Upgrades

The housing market has nearly a half million more sellers than buyers according to Redfin. That means you have more competition as a seller and may have to do a bit more to get your house ready to sell. But not all projects are going to be worth it. If you spend money on the wrong projects, it could really cut into your profit.

A local real estate pro knows what buyers in your area are really looking for, and they can help you figure out which projects are worth it, and which ones to skip. Even better, they’ll know how to highlight any upgrades you make in your listing, so your house stands out online and gets more attention.

3. Refusing To Negotiate

Now that inventory has grown, it’s important to stay flexible. Buyers have more options – and with it comes more negotiating power. U.S. News explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

That’s where your agent comes in. They’ll help you understand what buyers are asking for, what’s normal in today’s market, and how to find a win-win solution. Sometimes making a small compromise can keep the deal moving and help you move on to your next chapter faster.

4. Skipping Research When Hiring an Agent

All of these mistakes are avoidable with the help of a skilled agent. So, you want to be sure you’re working with the right partner. Still, according to the National Association of Realtors (NAR), 81% of sellers pick the first agent they talk to.

Many homeowners may skip basic steps like reading reviews, checking sales history, and interviewing a few agents. But that’s a mistake. You want someone you know you can rely on – someone with a good track record. The right agent can help you price your house right, market it well, and sell it quickly (and maybe for more money).

Bottom Line

Selling a house doesn’t have to be stressful, especially if you have an experienced agent by your side. Connect with a local agent so you have an expert to help you avoid these common mistakes and make the most of your sale.

Why a Newly Built Home Might Be the Move Right Now

Are you looking for better home prices, or even a lower mortgage rate? You might find both in one place: a newly built home. While many buyers are overlooking new construction, it could be your best opportunity in today’s market. Here’s why.

There are more brand-new homes available right now than there were even just a few months ago. According to the most recent data from the Census and the National Association of Realtors (NAR), roughly 1 in 5 homes for sale right now is new construction. So, if you’re not looking at newly built homes, you’re missing out on a big portion of what’s available.

And with more new homes on the market, builders are motivated to sell their current inventory. As a result, many are taking steps to draw in buyers.

Builders Are Cutting Prices

According to Buddy Hughes, Chairman of the National Association of Home Builders (NAHB):

“Almost 40% of home builders reduced sales prices in the last month . . .”

That means builders are being realistic about today’s market and adjusting to what buyers can afford. It’s their way to keep their inventory moving.

So, builders may be more willing to negotiate price than you’d expect – and that means your dollar may go further if you buy a newly built home. Lean on your agent to see what’s available and what incentives builders are offering in and around your area.

Builders Are Offering Lower Mortgage Rates

Here’s something most people don’t know. Right now, buyers of brand-new homes often get better mortgage rates than buyers of existing homes.

That’s because many builders are also offering rate buydowns to make their homes more attractive and keep sales moving. Basically, they’re willing to chip in to lower your rate, so you’re more likely to buy one of their homes.

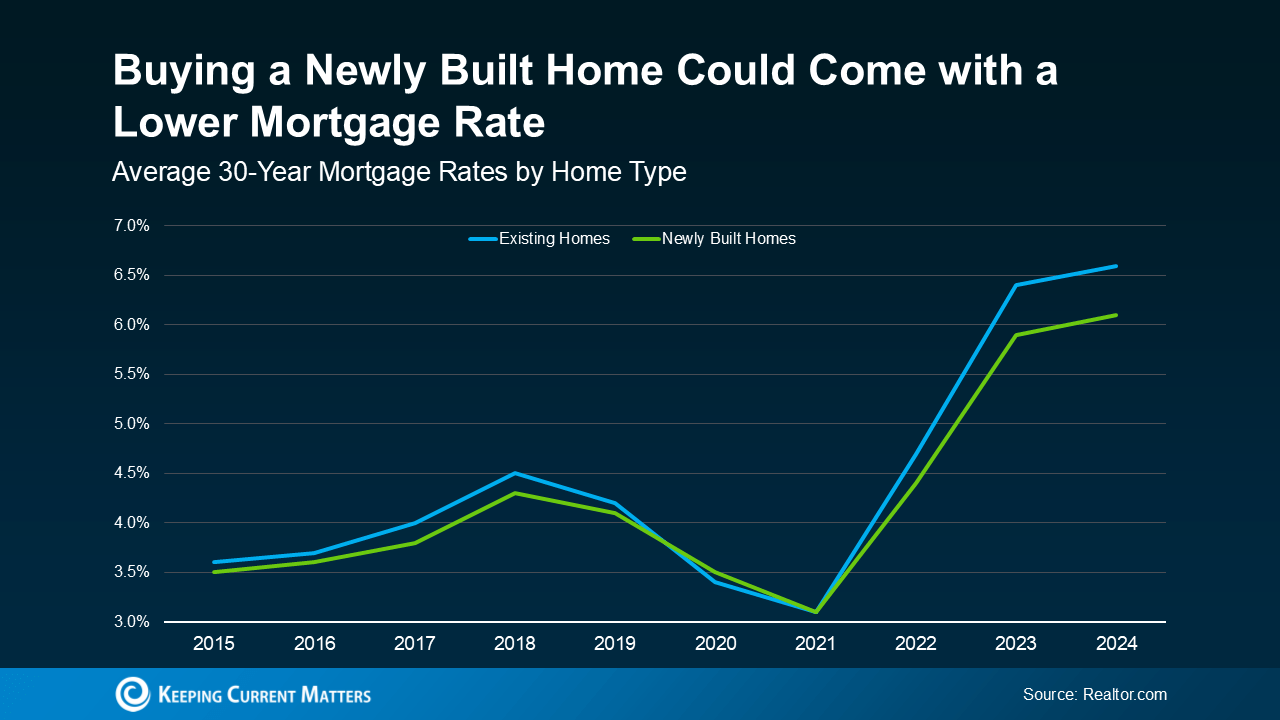

Data from Realtor.com shows, in 2023 and 2024, buyers of newly built homes got a mortgage rate around half a percent lower compared to those who bought existing homes (see graph below):

That kind of savings adds up and makes a big difference when you’re figuring out your monthly budget.

That kind of savings adds up and makes a big difference when you’re figuring out your monthly budget.

So, if you haven’t found something you love yet, it’s time to add newly built homes to your search. You may find that what you’ve been looking for is already out there, it’s just in a new home community.

Bottom Line

More choices, the potential to negotiate on the price, and maybe even better mortgage rates make these options a bright spot in today’s housing market.

If you haven’t considered a newly built home yet, what’s holding you back?

Talk to a local real estate agent about what’s available and if a newly built home makes sense for you.

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates, many have felt stuck between a rock and a hard place.

But, something pretty encouraging is happening. While affordability is still tight, mortgage rates have shown signs of stabilizing in recent months. And that may finally make it a bit easier to plan your move.

Mortgage Rates Have Stabilized – For Now

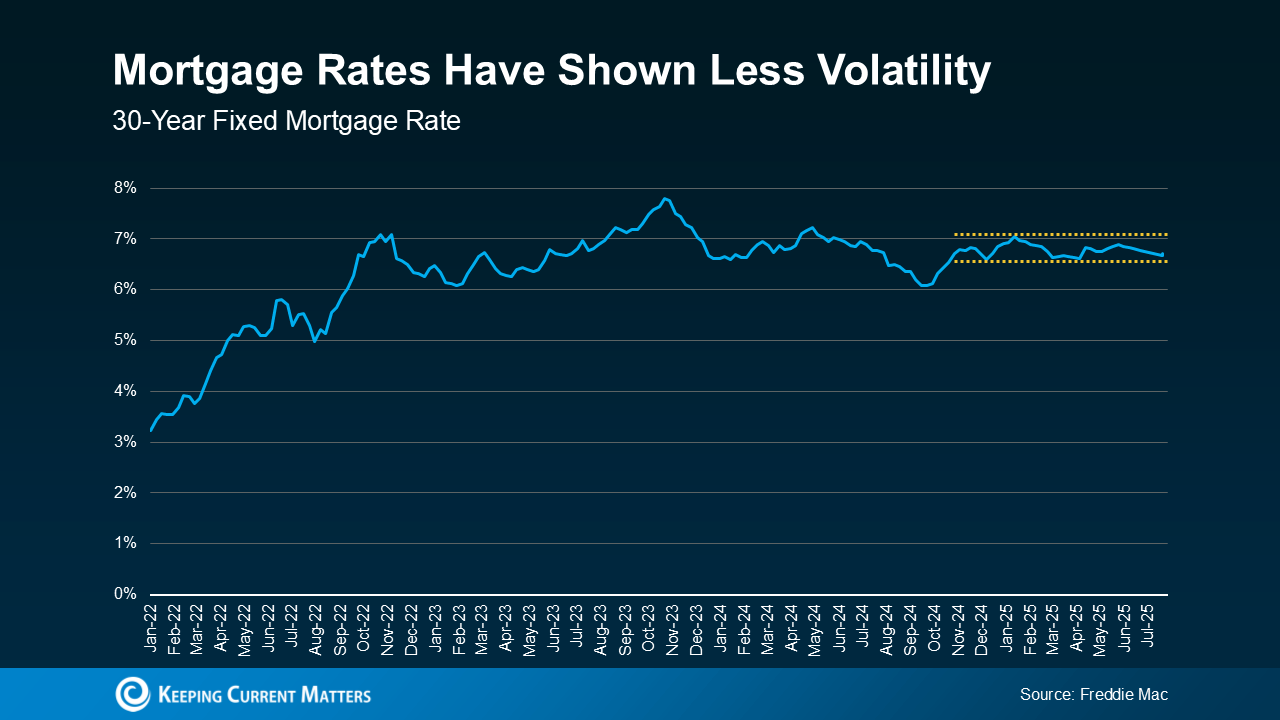

Over the past year, mortgage rates have had their share of ups and downs, making it tough for buyers to know what to expect. But recently, rates have started to level out and have settled into a more narrow range (see graph below):

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately. And that’s a bigger deal than you may realize. As HousingWire explains:

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately. And that’s a bigger deal than you may realize. As HousingWire explains:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most “calm” periods for mortgage rates in recent memory.”

How This Helps Today’s Buyers

Let’s be real. Unpredictability makes it tough to plan ahead. When rates are bouncing around and making big jumps week to week, it’s easy to be intimidated. But with rates staying in a pretty steady range over the past several months, you have a clearer picture of what your potential monthly payment could look like. That makes moving feel less uncertain – and more doable.

So, stop waiting. And start planning. Even though rates may not be where you want them to be right now, they have been much less volatile for quite some time.

Will This Stability Last?

According to the experts, it looks like that stability might hang around for a bit. Rates may come down ever so slightly in the months ahead, but it’ll likely be a slow and mild change. As Danielle Hale, Chief Economist at Realtor.com, says:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

So, if you’ve been holding out for the perfect mortgage rate, the best advice is to avoid trying to time the market. It may not look terribly different than the opportunity you already have in front of you. As Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

And if we look at the latest expert forecasts that go out a bit further, even those tell much of the same story. Two out of the three projections say rates will still likely be in the mid-6% range by the end of 2026 (see graph below):

This puts today’s buyers in a much better spot. As Sam Khater, Chief Economist at Freddie Mac, explains:

This puts today’s buyers in a much better spot. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have moved within a narrow range for the past few months . . . Rate stability, improving inventory and slower house price growth are an encouraging combination . . .”

Just remember, mortgage rates are still going to react to changing economic conditions, inflation, and more – and that means they could shift again. But right now, you’ve got more predictability, and that means more opportunity, too.

Bottom Line

While affordability is still a challenge, the market may be offering a bit more stability – and that makes planning your next move a lot easier.

Connect with an agent or a lender if you want to run the numbers and see what a monthly payment would look like in today’s market. That way you can stop waiting and start planning.

The 5-Year Rule for Home Prices

Some Highlights

- If recent home price headlines have you feeling worried, here’s some perspective.

- Home values almost always go up in the long run. And the long-term gains offset any short-term dips. Basically, if you plan to live there for 5 or more years, you should be able to buffer yourself against any short-term declines.

- Connect with an agent to have a conversation about what’s happening with prices in your market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link