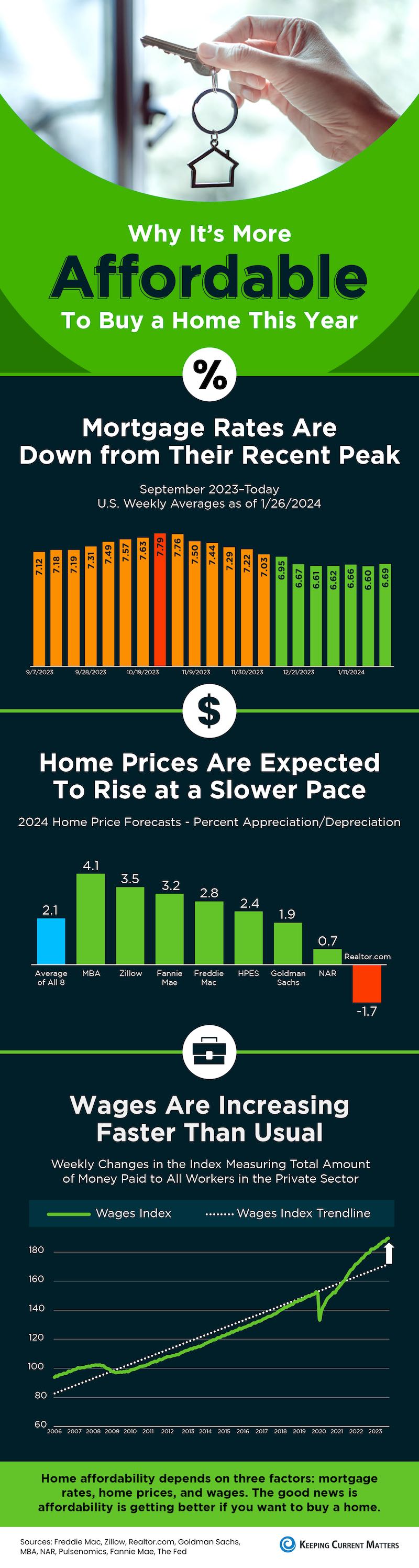

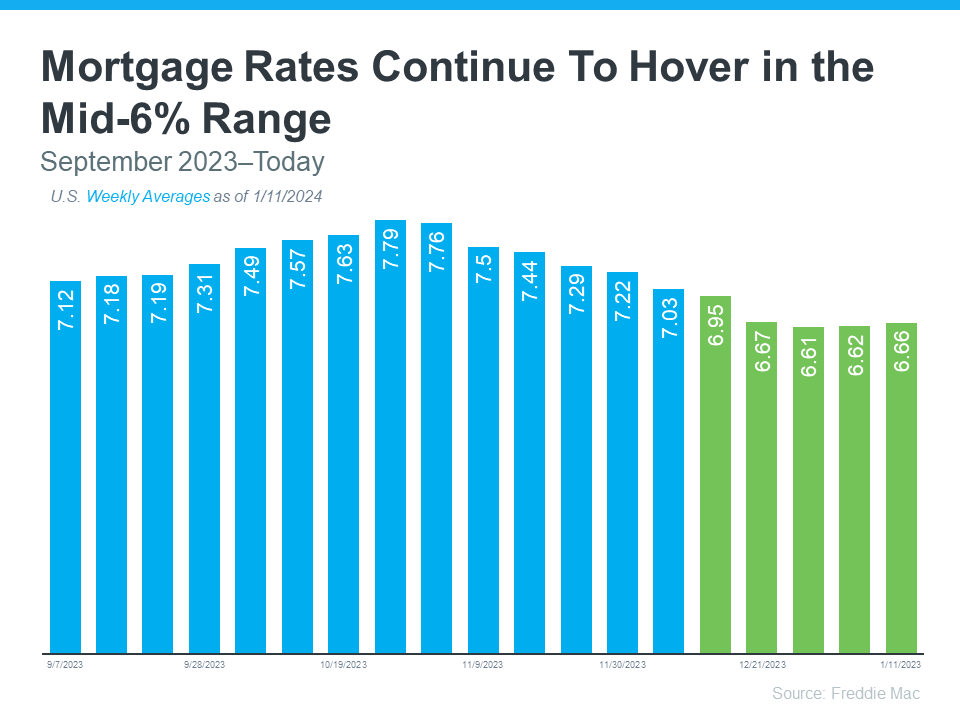

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why?

The answer is complicated because there’s a lot that can influence mortgage rates. Here are just a few of the most impactful factors at play.

Inflation and the Federal Reserve

The Federal Reserve (Fed) doesn’t directly determine mortgage rates. But the Fed does move the Federal Funds Rate up or down in response to what’s happening with inflation, the economy, employment rates, and more. As that happens, mortgage rates tend to respond. Business Insider explains:

“The Federal Reserve slows inflation by raising the federal funds rate, which can indirectly impact mortgages. High inflation and investor expectations of more Fed rate hikes can push mortgage rates up. If investors believe the Fed may cut rates and inflation is decelerating, mortgage rates will typically trend down.”

Over the last couple of years, the Fed raised the Federal Fund Rate to try to fight inflation and, as that happened, mortgage rates jumped up, too. Fortunately, the expert outlook for inflation and mortgage rates is that both should become more favorable over the course of the year. As Danielle Hale, Chief Economist at Realtor.com, says:

“[M]ortgage rates will continue to ease in 2024 as inflation improves . . .”

There’s even talk the Fed may actually cut the Fed Funds Rate this year because inflation is cooling, even though it’s not yet back to their ideal target.

The 10-Year Treasury Yield

Additionally, mortgage companies look at the 10-Year Treasury Yield to decide how much interest to charge on home loans. If the yield goes up, mortgage rates usually go up, too. The opposite is also true. According to Investopedia:

“One frequently used government bond benchmark to which mortgage lenders often peg their interest rates is the 10-year Treasury bond yield.”

Historically, the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has been fairly consistent, but that’s not the case recently. That means, there’s room for mortgage rates to come down. So, keeping an eye on which way the treasury yield is trending can give experts an idea of where mortgage rates may head next.

Bottom Line

With the Fed meeting later this week, experts in the industry will be keeping a close watch to see what they decide and what impact it’ll have on the economy. To navigate any mortgage rate changes and their impact on your moving plans, it’s best to have a team of professionals on your side.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link