The Biggest Mistakes Buyers Are Making Today

Buyers face challenges in any market – and today’s is no different. With higher mortgage rates and rising prices, plus the limited supply of homes for sale, there’s a lot to consider.

But, there’s one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice. An expert’s insights will help you avoid some of the most common mistakes homebuyers are making right now.

Putting Off Pre-approval

As part of the homebuying process, a lender will look at your finances to figure out what they’re willing to loan you for your mortgage. This gives you a good idea of what you can borrow so you can really wrap your head around the financial side of things before you start looking at homes. While house hunting can be a lot more fun than talking about finances, you don’t want to do this out of order. Make sure you get your pre-approval first. As CNET explains:

“If you wait to get preapproved until the last minute, you might be scrambling to contact a lender and miss the opportunity to put a bid on a home.”

Holding Out for Perfection

While you may have a long list of must-haves and nice-to-haves, you need to be realistic about your home search. Even though your ideal state is you find a home that checks every box, you may need to be willing to compromise – especially since inventory is still low. Plus, a home that has everything you want may be too pricey. As Investopedia puts it:

“When you expect to find the perfect home, you could prolong the homebuying process by holding out for something better. Or you could end up paying more for a home just because it meets all your needs.”

Instead, look for something that has most of your must-haves and good bones where you can add anything else you may need down the line.

Buying More House Than You Can Afford

With today’s mortgage rates and home prices, there’s no arguing it’s expensive to buy a home. And while it may be tempting to stretch your finances a bit further than you’re comfortable with to make sure you get the house, you want to avoid overextending your budget. Make sure you talk to your agent about how changing mortgage rates impact your monthly payment. Bankrate offers this advice:

“Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations. Every borrower’s case is different, so factor in your whole financial profile when determining how much house you can afford.”

Not Working with a Local Real Estate Agent

This last one may be the most important of all. Buying a home is a process that involves a lot of steps, paperwork, negotiation, and more. Rather than take all of this on yourself, it’s a good idea to have a pro working with you. The right agent will reduce your stress and help the process go smoothly. As CNET explains:

“Attempting to buy a home without a real estate agent makes the process more arduous than it needs to be. A real estate agent can give you professional legal guidance, market expertise and support, which will save you time, money and stress. They can also increase your chances of finding the right home so you don’t have to spend hours scouring the internet for listings.”

Bottom Line

Mistakes can cost you time, frustration, and money. If you want to buy a home in today’s market, connect with a local real estate agent so you have a pro on your side who can help you avoid these missteps.

How an Agent Helps Market Your House

You’re ready to sell your house. But what do you need most from your real estate agent? Well, the National Association of Realtors (NAR) asked that very question to recent sellers and found one of the top things they were looking for is help marketing their house to potential buyers. Maybe that’s what you need the most help with too.

You expect your real estate agent to write a great description of your house for the listing and pair it with some high-quality photos. But that’s not all you’re going to get when you partner with a great agent.

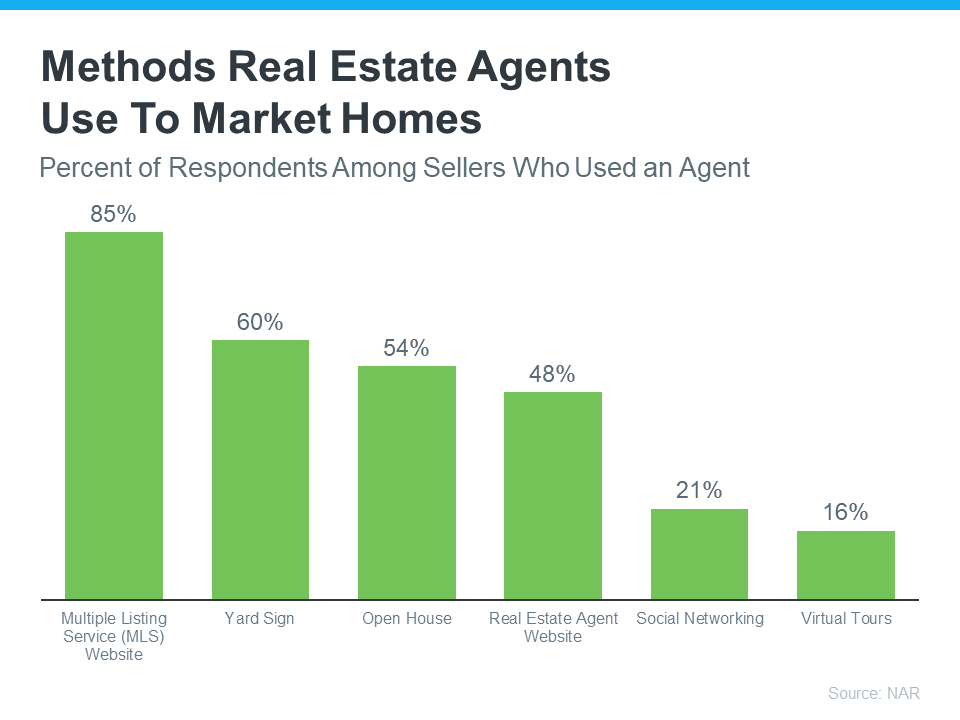

They’ll do a lot more to make sure your house stands out. Here are some of the most common methods real estate agents use to market homes according to that same report from NAR (see graph below):

So, how can you benefit from your agent using these methods?

- Listing on the MLS – By listing your house on the MLS, it will get more visibility from other real estate agents and buyers. This could lead to more traffic, which could ultimately help you see an increase in offers and ultimately a better price.

- Using a Yard Sign – A yard sign catches the eye of people driving or walking by. This method drums up local interest since people who live nearby might have friends or family looking to move into the area. It also prominently displays your agent’s contact information, so interested buyers can get in touch easily.

- Having an Open House – When your agent advertises and hosts your open house, buyers see others are interested in your house, too. This competition can lead to stronger offers. An open house is also easier for you since you only need to leave once for many buyers to visit. Plus, your agent may get useful feedback on what people like or don’t like, which can help you make improvements to attract more buyers later, if needed.

- Showcasing on Your Agent’s Website – Having your house visible on your agent’s website allows for a professional presentation of your property. Additionally, people visiting your agent’s website are more likely to be serious buyers who are ready to make a move.

- Social Networking – Your real estate agent works hard to have a wide-ranging social media presence. Marketing your house this way allows them to reach a large audience. It also makes it easy for people to share your listing with friends and loved ones who might be interested.

- Providing Virtual Tours – Virtual tours are extremely convenient for buyers, especially those who are relocating from out of town. This method allows them to tour anytime, day or night. It shows your agent is using the latest technology to market your house.

There are many tools that can be used to market your house. As NerdWallet sums up:

“A good real estate agent will have a robust plan to promote your listing in an effort to find the right pool of buyers. Adding your home to databases of available homes called multiple listing services (MLS), open houses, 3D virtual tours, professional photography and broker tours for buyers’ agents (particularly for luxury homes) are all factors that may go into a marketing plan.”

As a seller, it’s smart to work with a creative local real estate agent who can maximize them to make sure you get as many eyes on your house as possible.

Bottom Line

When it comes to marketing your house, working with a pro has tons of benefits. If you’re ready to sell, but don’t know where to start, connect with a local real estate agent.

How VA Loans Can Help You Buy a Home

For over 80 years, Veterans Affairs (VA) home loans have helped millions of veterans buy their own homes. If you or someone you know has served in the military, it’s important to learn about this program and its benefits.

Here are some key things to know about VA loans before buying a home.

Top Benefits of VA Home Loans

VA home loans make it easier for veterans to buy a home, and they’re a great perk for those who qualify. According to the Department of Veteran Affairs, some benefits include:

- Options for No Down Payment: Qualified borrowers can often purchase a home with no down payment. That’s a huge weight lifted when you’re trying to save for a home. The Associated Press says:

“. . . about 90% of VA loans are used to purchase a home with no money down.”

- Don’t Require Private Mortgage Insurance (PMI): Many other loans with down payments under 20% require PMI. VA loans do not, which means veterans can save on their monthly housing costs.

- Limited Closing Costs: There are limits on the types of closing costs you pay when you qualify for a VA home loan. So, more money stays in your pocket when it’s time to seal the deal.

An article from Veterans United sums up how remarkable this loan can be:

“For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

Bottom Line

Owning a home is the American Dream. Veterans give a lot to protect our country, and one way to honor them is by making sure they know about VA home loans.

Your Agent Is the Key To Pricing Your House Right [INFOGRAPHIC]

Some Highlights

- The asking price for your house can impact your bottom line and how quickly it sells.

- Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your agent for their expertise.

- Don’t pick just any price for your listing. Trust your real estate professional to help you find the perfect price for your house.

Questions You May Have About Selling Your House

There’s no denying mortgage rates are having a big impact on today’s housing market. And that may leave you with some questions about whether it still makes sense to sell your house and make a move.

Here are three of the top questions you may be asking – and the data that helps answer them.

1. Should I Wait To Sell?

If you’re thinking about waiting to sell until after mortgage rates come down, here’s what you need to know. So are a ton of other people.

And while mortgage rates are still forecasted to come down later this year, if you wait for that to happen, you may be dealing with a lot more competition as other buyers and sellers jump back in too. As Bright MLS says:

“Even a modest drop in rates will bring both more buyers and more sellers into the market.”

That means if you wait it out, you’ll have to deal with things like prices rising faster and more multiple-offer scenarios when you buy your next home.

2. Are Buyers Still Out There?

But that doesn’t mean no one is moving right now. While some people are holding off, there are still plenty of buyers active today. And here’s the data to prove it.

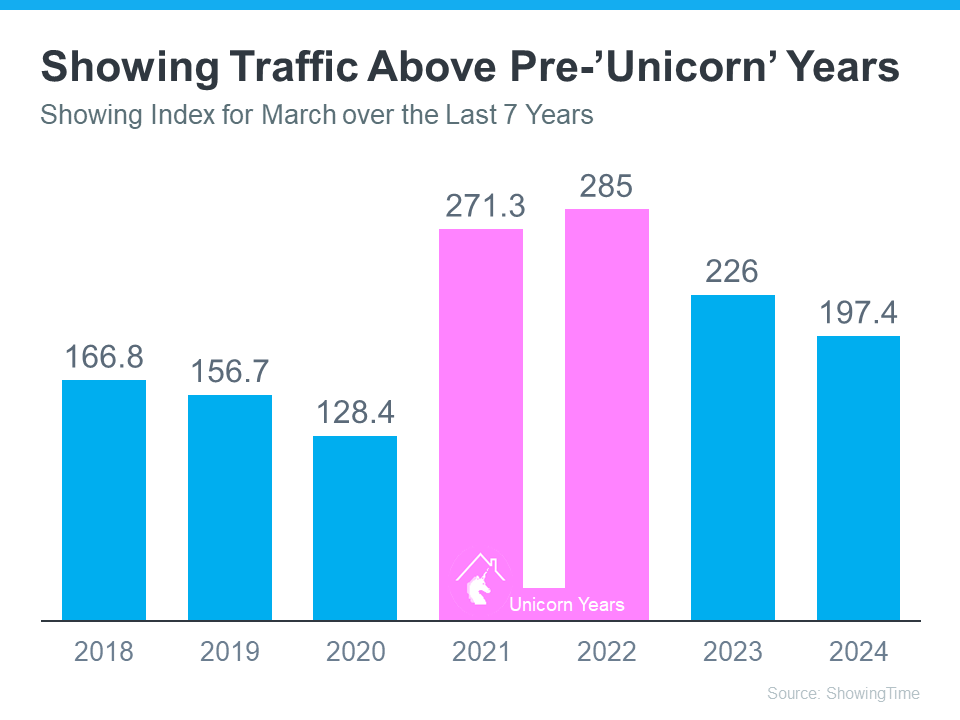

The ShowingTime Showing Index is a measure of how frequently buyers are touring homes. The graph below uses that index to show buyer activity for March (the latest data available) over the past seven years:

You can see demand has dipped some since the ‘unicorn’ years (shown in pink). That’s in response to a lot of market factors, like higher mortgage rates, rising prices, and limited inventory. But, to really understand today’s demand, you have to compare where we are now with the last normal years in the market (2018-2019) – not the abnormal ‘unicorn’ years.

When you focus on just the blue bars, you can get an idea of how 2024 stacks up. And that gives you a whole new perspective.

Nationally, demand is still high compared to the last normal years in the housing market (2018-2019). And that means there’s still a market for your house to sell.

3. Can I Afford To Buy My Next Home?

And if you’re worried about how you’ll afford your next move with today’s rates and prices, consider this: you probably have more equity in your current home than you realize.

Homeowners have gained record amounts of equity over the past few years. And that equity can make a big difference when you buy your next home. You may even have enough to be an all-cash buyer and avoid taking out a mortgage altogether. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today’s housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

Bottom Line

If you’ve had these three questions on your mind and they’ve been holding you back from selling, hopefully, it helps to have this information now. A recent survey from Realtor.com found more than 85% of potential sellers have been considering selling for over a year. That means there are a number of sellers like you who are on the fence.

But that same survey also talked to sellers who recently decided to take the plunge and list. And 79% of those recent sellers wish they’d sold sooner.

If you want to talk more about any of these questions or need more information, contact a real estate agent.

Worried About Home Maintenance Costs? Consider This

If one of the main reasons you’re hesitant to buy a home is because you’re worried about the upkeep, here’s some information you may find interesting on both new home construction and existing homes (a home that’s been lived in by a previous owner).

Newly Built Homes Need Less Upfront Maintenance

If you can afford it, you may find a newly built home could help ease your worries about maintenance costs. Think about it, if everything in the house is brand new, it won’t have the wear and tear you may see in an existing home – and that means it’s less likely to need repairs. As LendingTree says:

“Since the systems, appliances, roof and foundation are new, you’re less likely to pay for major or minor repairs within the first few years of homeownership. That can make a big difference for first-time homebuyers who are adjusting to owning rather than renting.”

Plus, many builders also have warranties on their homes that would cover some of the more major expenses that could pop up. As First American explains:

“The new systems in your home, like plumbing, electrical, and HVAC, are typically covered for one to two years by your builder’s warranty. When something happens to these systems, you contact the builder or their warranty company.”

Existing Homes Can Still Have Great Perks

But it’s worth mentioning, that it’s not just newly built homes that can have warranties. It’s an option for existing homes too.

Your agent may be able to help you negotiate with the seller to add one as a concession on your contract. But you should know that not all sellers will be willing to do that. If they won’t, you could purchase one yourself, if you’d like to. An article from Forbes explains:

“During a real estate transaction, a home warranty policy can be purchased by the buyer or the seller.”

And there are benefits for both parties when it comes to a home warranty. According to MarketWatch:

“A buyer’s home warranty benefits both buyers and sellers, as it helps the seller close the deal while providing the future homeowner with peace of mind that they’ll be covered if a system or appliance breaks down . . . Sometimes, a seller will pay for the first year of the home buyer’s warranty to sweeten the deal, but it depends on the real estate market.”

If you’re interested in a home warranty for peace of mind, lean on your agent. They’ll negotiate on your behalf to see if a seller would be willing to cover one for you. Just remember, the likelihood of a seller throwing one in depends on conditions in your local market.

So, Should I Buy New or Existing?

While the need for less upfront maintenance is a great perk for new construction, there are some things a newly built home can’t provide that an existing home can.

For example, existing homes have a lot of character and charm that’s difficult to reproduce. The quirks that come with an older home may make it feel more homey. And, existing homes usually have more developed landscaping and a well-established sense of community. So, it can feel more inviting than something that’s a blank slate, like new construction often is. Not to mention, if you go with new construction, you may have to wait for the home to finish being built based on where it is in the process. It all depends on what’s most important to you.

Bottom Line

Whether you choose a newly built or an existing home, you may be able to ease some of your concerns over maintenance with a home warranty. To weigh your options and go over what’s the top priority for you, talk to the professionals.

Should I Rent or Buy a Home? [INFOGRAPHIC]

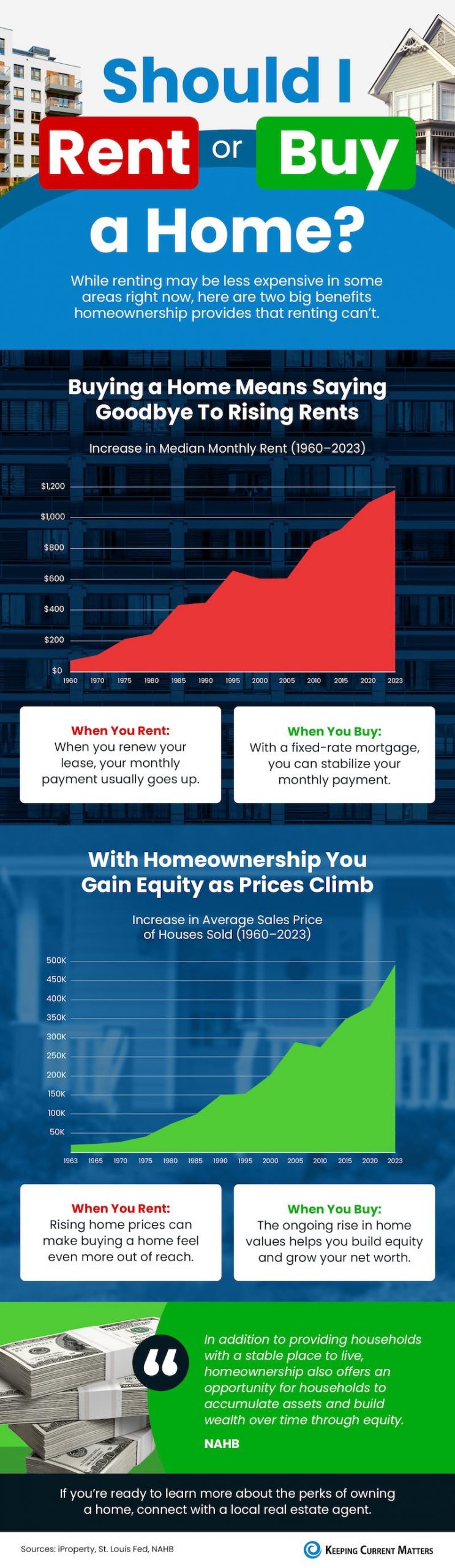

Some Highlights

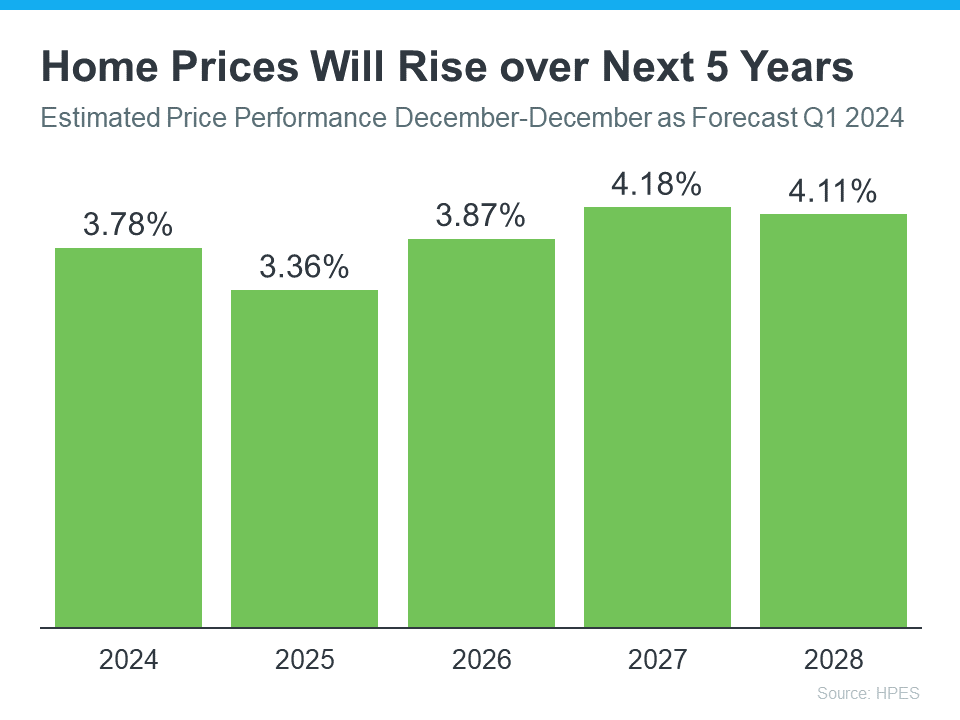

- While renting may be less expensive in some areas right now, there are two big benefits homeownership provides that renting can’t.

- Owning a home means you get to say goodbye to rising rents and hello to stability. It also gives you the chance to gain equity as home values rise over time.

- If you’re ready to learn more about the perks of owning a home, connect with a local real estate agent.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link