You May Have More Negotiation Power When You Buy a Home Today

You May Have More Negotiation Power When You Buy a Home Today

Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper competitive market has cooled this year as buyer demand has moderated and housing supply has grown. Those two factors combined mean you may see less competition from other buyers.

And with less competition comes more opportunity. Here are two trends that may be the news you need to reenter the market.

1. The Return of Contingencies

Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or the inspection, in hopes of gaining an advantage in a bidding war. But now, things are different.

The latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving their home inspection or appraisal is down. And a recent article from realtor.com points out more sellers are accepting contingencies:

“A year ago, sellers were calling all the shots and buyers were launching legendary bidding wars, waiving contingencies, and paying for homes in cash. But now, the shoe is on the other foot, and 92% of home sellers are accepting some buyer-friendly terms (frequently related to home inspections, financing, or appraisals), . . .”

This doesn’t mean we’re in a buyers’ market now, but it does mean you have a bit more leverage when it comes time to negotiate with a seller. The days of feeling like you may need to waive contingencies or pay drastically over asking price to get your offer considered may be coming to a close.

2. Sellers Are More Willing To Help with Closing Costs

Before the pandemic, it was a common negotiation tactic for sellers to cover some of the buyer’s closing costs to sweeten the deal. This didn’t happen as much during the peak buyer frenzy over the past two years.

Today, data suggests this is making a comeback. A realtor.com survey shows 32% of sellers paid some or all of their buyer’s closing costs. This may be a negotiation tool you’ll see as you go to purchase a home. Just keep in mind, limits on closing cost credits are set by your lender and can vary by state and loan type. Work closely with your loan advisor to understand how much a seller can contribute to closing costs in your area.

Bottom Line

Despite the extremely competitive housing market of the past several years, today’s data suggests negotiations are starting to come back to the table. To find out how the market is shifting in our area, let’s connect today.

Ready To Sell? Today’s Housing Supply Gives You Two Opportunities.

Ready To Sell? Today’s Housing Supply Gives You Two Opportunities.

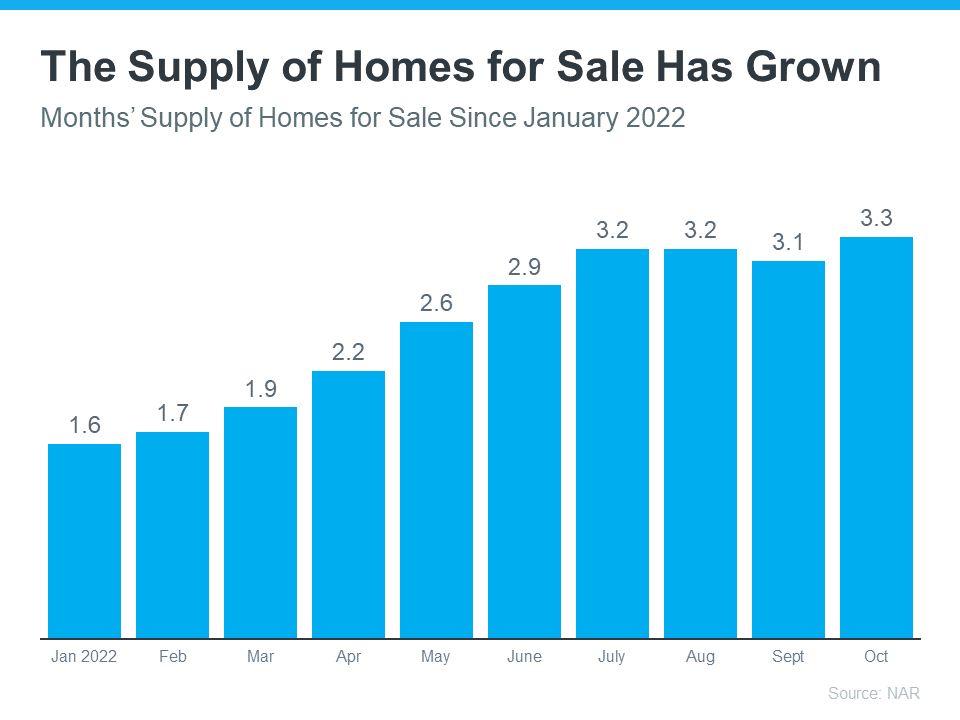

At first glance, the increase in housing supply compared to last year may not sound like good news for prospective sellers, but it actually gives you two key opportunities in today’s housing market.

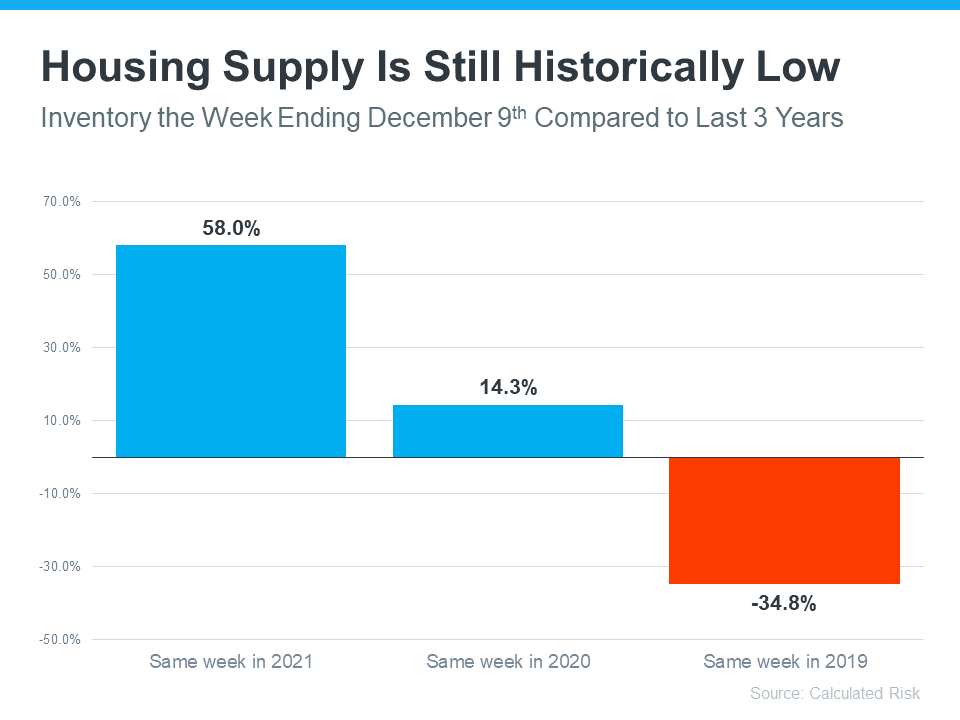

An article from Calculated Risk helps put the inventory gains the market has seen in 2022 into perspective by comparing it to recent years (see graph below). It shows supply has surpassed 2021 levels by 58%. But the further back you look, the more you’ll understand the bigger picture. And if you go all the way back to 2019, the last normal year in real estate, we’re roughly 35% below the housing supply we had at that time.

Opportunity #1: Take Advantage of More Options for Your Move

If your current house no longer meets your needs or lacks the space and features you want, this inventory growth gives you even more opportunity to sell and move into the home of your dreams. With more houses on the market, you’ll have more to choose from when you search for your next home.

Partnering with a local real estate professional can help you make sure you’re up to date on the homes available in your area. And when you do find the one, a professional can advise you on how to write a winning offer.

Opportunity #2: Sell While Inventory Is Still Low Overall

But again, despite the growth, inventory is still low compared to more normal years, and that isn’t going to change overnight. For you, that means your house should still be in demand among potential buyers if you price it right.

As an article from realtor.com says:

“Today’s shoppers generally have more homes to consider than last year’s shoppers did, but the market is still not back to pre-pandemic inventory levels.”

Bottom Line

If you’re a homeowner looking to sell, you have more homes to choose from and can still sell your house while inventory is low overall. Let’s connect to get started, so you can have the best of both worlds.

What Every Seller Should Know About Home Prices

What Every Seller Should Know About Home Prices

If you’re trying to decide whether or not to sell your house, recent headlines about home prices may be top of mind. And if those stories have you wondering what that means for your home’s value, here’s what you really need to know.

What’s Really Happening with Home Prices?

It’s possible you’ve seen news stories mentioning a drop in home values or home price depreciation, but it’s important to remember those headlines are designed to make a big impression in just a few words. But what headlines aren’t always great at is painting the full picture.

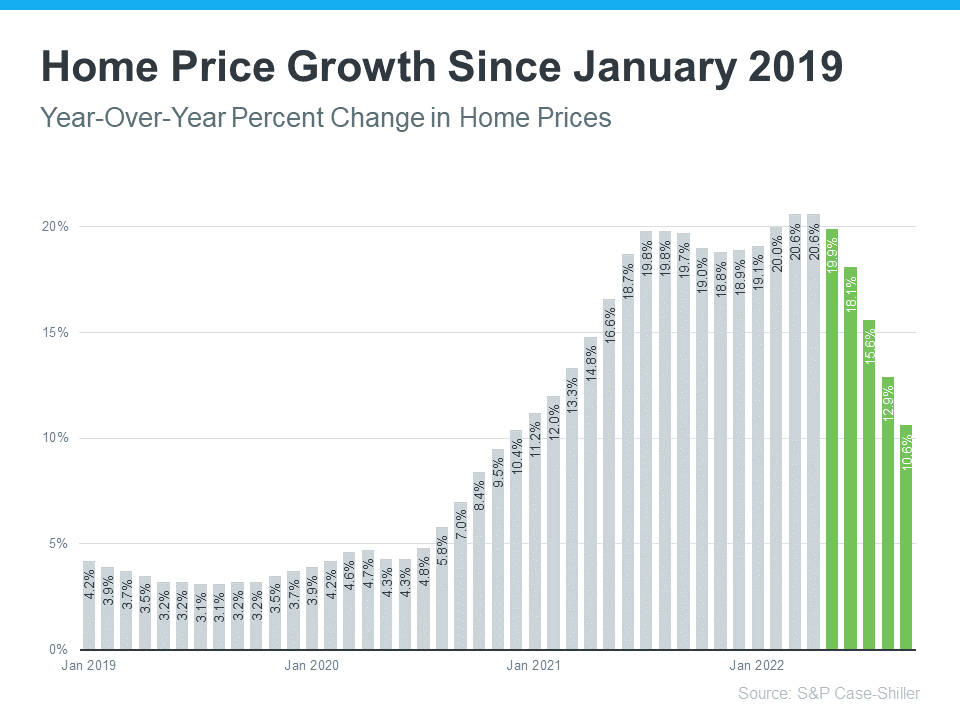

While home prices are down slightly month-over-month in some markets, it’s also true that home values are up nationally on a year-over-year basis. The graph below uses the latest data from S&P Case-Shiller to help tell the story of what’s actually happening in the housing market today:

As the graph shows, it’s true home price growth has moderated in recent months (shown in green) as buyer demand has pulled back in response to higher mortgage rates. This is what the headlines are drawing attention to today.

But what’s important to notice is the bigger, longer-term picture. While home price growth is moderating month-over-month, the percent of appreciation year-over-year is still well above the home price change we saw during more normal years in the market.

The bars for January 2019 through mid-2020 show home price appreciation around 3-4% a year was more typical (see bars for January 2019 through mid-2020). But even the latest data for this year shows prices have still climbed by roughly 10% over last year.

What Does This Mean for Your Home’s Equity?

While you may not be able to capitalize on the 20% appreciation we saw in early 2022, in most markets your home’s value, on average, is up 10% over last year – and a 10% gain is still dramatic compared to a more normal level of appreciation (3-4%).

The big takeaway? Don’t let the headlines get in the way of your plans to sell. Over the past two years alone, you’ve likely gained a substantial amount of equity in your home as home prices climbed. Even though home price moderation will vary by market moving forward, you can still use the boost your equity got to help power your move.

As Mark Fleming, Chief Economist at First American, says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

Bottom Line

If you have questions about home prices or how much equity you have in your current home, let’s connect so you have an expert’s advice.

Reasons To Sell Your House This Season

Reasons To Sell Your House This Season [INFOGRAPHIC]

![Reasons To Sell Your House This Season [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/12/08121045/Reasons-To-Sell-Your-House-This-Season-MEM-1046x2601.png)

Some Highlights

- If you’re planning to make a move but aren’t sure if now’s the right time, here are a few reasons why you shouldn’t wait to sell your house.

- The supply of homes for sale, while growing, is still low today. Plus, serious buyers are out looking right now, and many are hoping to avoid falling into the rental trap for another year.

- Let’s connect to determine if selling your house before the new year is the right move for you.

Homeownership Is an Investment in Your Future

Homeownership Is an Investment in Your Future

There are many people thinking about buying a home, but with everything affecting the economy, some are wondering if it’s a smart decision to buy now or if it makes more sense to wait it out. As Bob Broeksmit, President and CEO of the Mortgage Bankers Association (MBA), explains:

“The desire for homeownership is strong. Many prospective buyers are waiting for the volatility in mortgage rates to subside, as well as for a clearer picture of the economic outlook.”

If you’re in that position, remember that it’s important to consider not just what’s happening today but also what benefits you may gain in the long run.

There’s a lot of information out there about how homeownership helps build a homeowner’s net worth over time. But even today, many people think first about things like 401(k)s before they think of owning a home as a wealth-building tool. It’s especially important if you’re a young prospective homebuyer to understand how homeownership is another key way to invest in your future. An article from Bloomberg notes:

“Millennials have higher average 401(k) balances than Generation X did when they were the same age, but they’re not any better off financially. . . . A lot of that has to do with being less likely to own a home.”

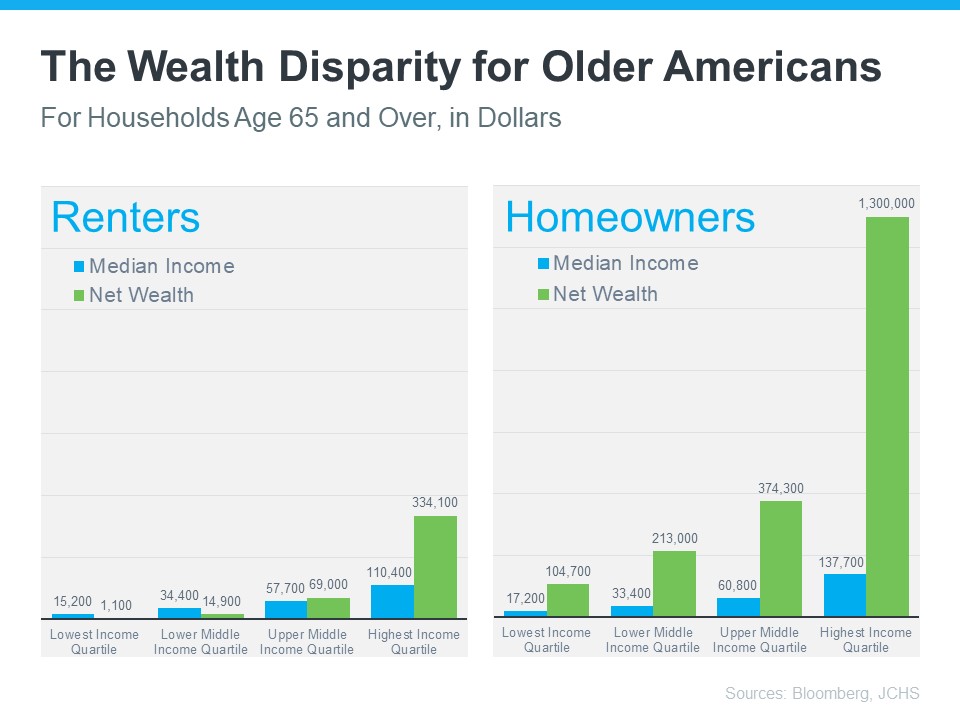

To help you understand just how much owning a home can have a positive impact on your life over the years, take a look at what the data shows. The same Bloomberg article helps show the gap in wealth between renters and homeowners who are 65 years and older (see graph below). The difference is substantial, even when incomes are similar.

So, if you want to create wealth to help set you up for success later on, it may be time to prioritize homeownership. That’s because, whether you decide to rent or buy a home, you’ll have a monthly housing expense either way. The question is: are you going to invest in yourself and your future, or will you help someone else (your landlord) increase their wealth?

Bottom Line

Before putting your homeownership plans on hold, let’s connect to go over your options. That way, you’ll have expert advice on how to make the best decision right now and the best investment in your future.

Real Estate Should ALWAYS Be Listed with PROFESSIONAL Photography, NOT Cell Snaps!

American Dream purchases professional photography for every listing, at no cost to you!

While cellphone cameras are pretty good, they do not come close to the quality of a professional camera ran by a professional photographer and editor. Your house deserves better than cellphone snaps!! Make sure your agent hires professionals for you, or better yet, PAYS for them, like American Dream!!

In today’s world, it’s wise to invest in professional photography to serve as the foundation of your property marketing, rather than selecting the DIY approach with smartphone cameras. Professional photographers, REALTORS®, and even clients with a discerning eye can easily distinguish a professional photograph from a phone one. To illustrate this difference, we’re providing you with an outline of key differences between professional HDR photos vs. smartphone photos and visual examples. Read on below!

1. LENSES AND ACCESSORIES

Professional photography gear allows you to swap various lenses to achieve the exact composition you require. Different lenses are required for portraits, landscape images, macro shots, and yes – real estate properties. A true professional knows that it’s best to use a lens that will capture the subject matter in a way that will entice prospective buyers to visit the property. For smartphones, lens options are limited as they are clip-ons, and most images taken on smartphones are shot with the camera that’s already built in. Phones are also not set up to fit with the essential accessories professionals use day-to-day – tripods, settings and filters, for instance – and anyone who has tried to take phone pictures in poor light knows that results are often lackluster.

Cellphone vs Professional Photography

2. PROFESSIONAL EDITING CAPABILITIES

Professional cameras capture images in larger files sizes. Larger file sizes are far more convenient for the editing process since there are more pixels per square inch. Trying to edit a smartphone photograph in professional editing software often results in a disastrous final product that lacks clarity. Professional photographers have the tools and knowledge to shoot in RAW format, which means that an image is full of information regarding the scene’s colors and tones. This information makes it much easier for a media professional to make final touches to the photograph without reducing its quality.

Cellphone vs Professional Photography

3. HIGH RESOLUTION PRINT QUALITY AVAILABLE

The majority of the real estate business can be conducted digitally – and thank goodness for that! Meetings can be held through Zoom, contracts can be sent via email, and homes can be toured from anywhere with the power of 3D virtual tours. That being said, there’s something very real and tangible about print brochures and feature sheets. When prospective buyers visit a property, it’s always a good idea to leave them with something they can hold on to that outlines the special features of a home, which require professionally shot photographs that translate well on print material. Unfortunately, phone images lack the resolution to display well on print, unless you’re fine with pixelated, blurry images.

Cellphone vs Professional Photography

4. COLOR AND TONE ACCURACY

Have you ever taken a photo with your smartphone and thought the colors looked nothing like those in front of you? Maybe it was way too orange or a bit too blue. Professional photographers understand that lighting sources can vary. Even “white” light sources can be warmer or cooler depending on the material. This is referred to as the “temperature” of lighting. In the Smartphone example below, you can see that the kitchen cabinets look yellowish and dingy, thanks to the surrounding warm light source in the kitchen, even though the cabinets are actually bright and white. Thanks to post-processing softwares and white balancing tools, not to mention professional camera gear, temperatures in real estate photos can be corrected and look more like the Professional example below. No matter what light sources are available within a property, your professional property photographer should be able to display the much more accurate color of cabinets, floors, and walls of space.

Cellphone vs Professional Photography

5. EXPOSURE ISSUES

“Crushed shadows” and “blown highlights” are both common exposure problems in real estate photography. They’re two sides of the same coin. When you crush your shadows, you underexpose your image so much that there are large areas of pure black in your image. When your highlights are blown out, your image is overexposed so much that there are large areas of white in the image. In either case, you’re losing valuable detail, like street views from windows or property features in darker basements. Unfortunately, you cannot recover these details in post-production so the camera gear itself is key here. When you shoot with a smartphone camera, there are limited exposure settings you can use to prevent exposure issues in the final image. In professional cameras, there are many more settings available including histograms, highlight alerts, filters, metering that a photographer can use to ensure that the optimum amount of detail is captured.

Cellphone vs Professional Photography

6. LINES AND COMPOSITION

As you can see in the numerous examples provided in this article, lines and composition make a huge difference in presenting a property. Real estate images should accurately display a property, while making a space feel expansive. The vertical lines in a space should be just that – vertical. When scanning a photo our eyes move from left to right, rather than up and down, so vertical lines work to lead a viewer’s eyes upwards, making a space feel taller. When we think of growth, we think of an upwards direction. Using vertical lines to lead the eye upwards emphasizes growth and expansiveness. Similarly, a property photograph should feel horizontally expansive, too. Using wide-angle lenses to capture an extra wall or even more features like doorways (as in the example above) work well to see a room in its entirety. Don’t be threatened though, about the accuracy of a space, this is much closer to what your eyes would see when in the space.

Again, American Dream purchases professional photography for every listing, at no cost to you!

Call me today to list your home –

Michael Cummiskey – 859-208-6139

What’s Going on with Home Prices? Ask a Professional.

What’s Going on with Home Prices? Ask a Professional.

If you’re thinking about buying or selling a home this year, you may have questions about what’s happening with home prices today as the market cools. In the simplest sense, nationally, experts don’t expect prices to come crashing down, but the level of home price moderation will depend on factors like supply and demand in each local market.

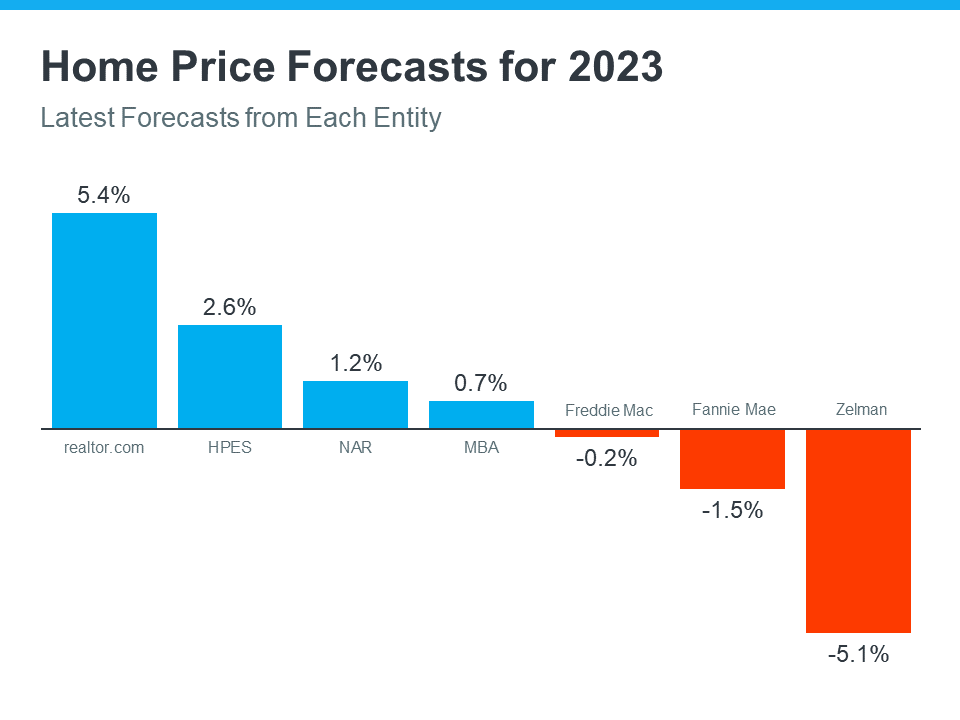

That means, moving forward, home price appreciation will continue to vary by location, with more significant changes happening in overheated areas. Here’s a quick snapshot of what the experts are saying:

Danielle Hale, Chief Economist at realtor.com, says:

“The major question on the minds of homeowners and aspiring buyers alike is what will happen to home prices. . . Soaring prices were propelled by all-time low mortgage rates which are a thing of the past. As a result, home price growth is expected to continue slowing, dipping below its pre-pandemic average to 5.4% for 2023, as a whole.”

Mark Fleming, Chief Economist at First American, says:

“House price appreciation has slowed in all 50 markets we track, but the deceleration is generally more dramatic in areas that experienced the strongest peak appreciation rates.”

Taylor Marr, Deputy Chief Economist at Redfin, says:

“For those bearish folks eagerly awaiting the home price crash, you’ll have to keep waiting. As much as demand is pulling back supply is as well reducing downward pressure on prices in the short run.”

John Paulson, Founder of Paulson & Co., says:

“It’s true – housing may be a little frothy. So housing prices may come down or they may plateau . . .”

What Does This Mean for You?

The best way to get the answers you need is to lean on a local real estate advisor. They’ll be able to explain the latest trends in your specific market so you can make a confident and informed decision on your next step toward buying or selling a home.

Bottom Line

If you have questions about what’s happening with home prices today, let’s connect so you have the latest on our local market.

Prioritizing Your Wants and Needs as a Homebuyer in Today’s Market

Prioritizing Your Wants and Needs as a Homebuyer in Today’s Market

There’s no denying mortgage rates are higher now than they were last year. And if you’re thinking about buying a home, this may be top of mind for you. That’s because those higher rates impact how much it costs to borrow money for your home loan. As you set out to make a purchase this winter, you’ll need to be strategic so you can find a home that meets your needs and budget.

Danielle Hale, Chief Economist at realtor.com, explains:

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, . . . Another key point is to avoid stretching your budget, as tempting as it may be given the diminished purchasing power.”

In other words, it’s important to be mindful of what’s a necessity and what’s a nice-to-have when searching for a home. And the best way to understand this is to put together a list of desired features for your home search.

The first step? Get pre-approved for a mortgage. Pre-approval helps you better understand what you can borrow for your home loan, and that plays an important role in how you’ll craft your list. After all, you don’t want to fall in love with a home that’s out of reach. Once you have a good grasp of your budget, you can begin to list (and prioritize) all the features of a home you would like.

Here’s a great way to think about them before you begin:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle (examples: distance from work or loved ones, number of bedrooms/bathrooms, etc.).

- Nice-To-Haves – These are features that you’d love to have but can live without. Nice-To-Haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of the these, it’s a contender (examples: a second home office, a garage, etc.).

- Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner (examples: farmhouse sink, multiple walk-in closets, etc.).

Finally, once you’ve created your list and categorized it in a way that works for you, discuss it with your real estate advisor. They’ll be able to help you refine the list further, coach you through the best way to stick to it, and find a home in your area that meets your needs.

Bottom Line

Putting together your list of necessary features for your next home might seem like a small task, but it’s a crucial first step on your homebuying journey today. If you’re ready to find a home that fits your needs, let’s connect.

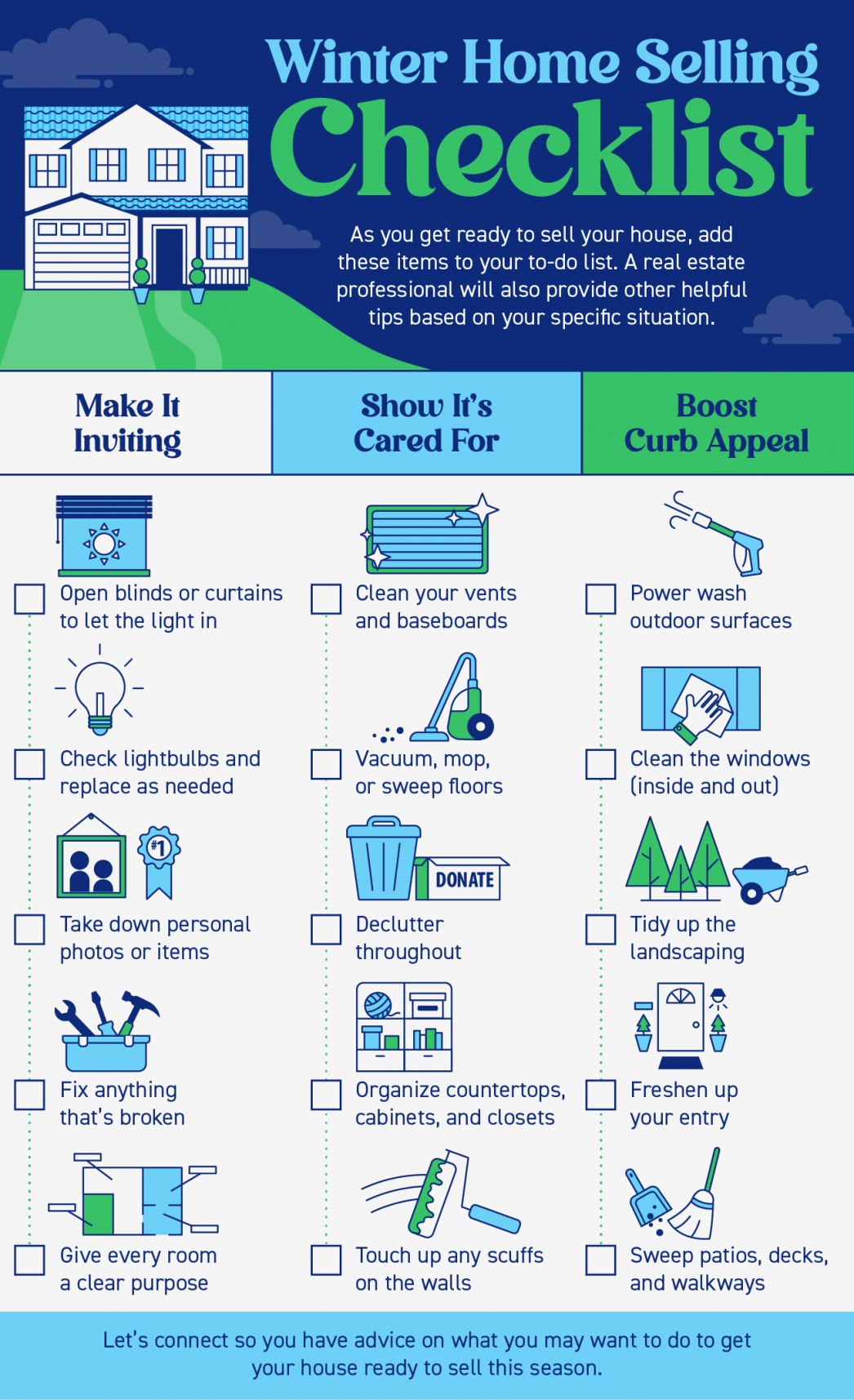

Winter Home Selling Checklist

Winter Home Selling Checklist [INFOGRAPHIC]

![Winter Home Selling Checklist [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/11/17130959/Winter-Checklist-MEM-1046x1715.png)

Some Highlights

- As you get ready to sell your house, focus on tasks that make it inviting, show it’s cared for, and boost your curb appeal.

- This list will help you get started, but don’t forget, a real estate professional will provide other helpful tips based on your specific situation.

- Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link